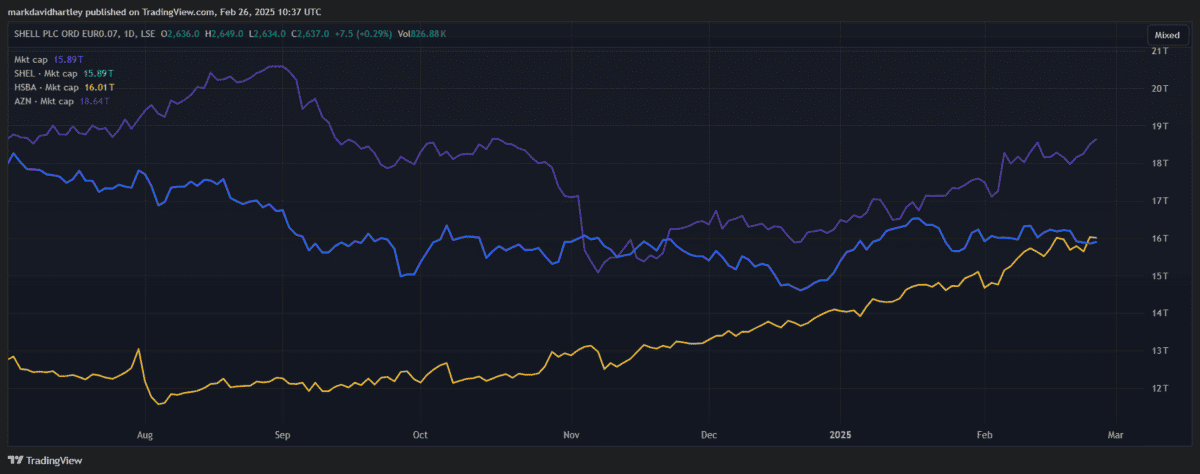

For years, Shell (LSE: SHEL) has been one of the largest and most influential energy stocks on the FTSE 100. But in a surprising turn, the leading UK oil stock has slipped to third place in the index, overtaken by HSBC in terms of market capitalisation.

Since August last year, it’s doubled from £80bn to £160bn, while Shell’s market cap has dropped from £175bn to below £160bn.

So, what’s behind this shift and should investors be concerned about Shell’s future?

Should you invest £1,000 in Trifast Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Trifast Plc made the list?

Let’s take a closer look at the key factors driving its share price, from global oil prices to the company’s latest strategic moves.

Why did Shell drop?

Shell’s fall in the rankings has far more to do with HSBC’s growth than its own weaknesses. But why hasn’t Shell’s market cap grown in a rising Footsie too? Could there be underlying issues worth examining?

For example, falling crude oil prices could be affecting revenue and earnings expectations. Shell’s profitability is directly tied to crude oil prices. When oil prices are high, the company enjoys soaring revenues, but when they fall, profits can take a hit.

Recently, Brent crude has hovered between $75 to $85 a barrel, down from highs above $100 in 2022.

OPEC+ production cuts have attempted to stabilise prices while demand concerns in China have weighed on market sentiment.

There are many reasons why Shell remains a good stock to consider but first, let’s look at the risks.

An industry in flux

Unlike some sectors, energy stocks are highly cyclical and susceptible to global market swings. This adds a degree of volatility to stocks that are dependent on oil prices. If the world economy weakens, energy consumption could decline, further pressuring Shell’s revenue and profit margins.

In recent years, this problem has been compounded by a growing desire to shift away from fossil fuel consumption. Governments worldwide are tightening climate policies, leading to higher costs and reduced demand for fossil fuels.

A full transition to renewable energy, while necessary, is proving to be costly and drawn out. This has become a key risk affecting its bottom line.

Prioritising profits

Shell may be suffering short-term losses but it remains a solid stock with a history of strong shareholder returns. With a dividend yield of around 4% and a dedicated share buyback programme, it offers good value for investors.

Despite oil price fluctuations, its diverse operations in refining, chemicals and renewables help maintain a steady cash flow.

But to continue turning a profit, it may need to rebalance its priorities.

While some renewable energy and carbon capture efforts remain, there’s been a notable weakening of emission reduction targets.

The high costs of these efforts threaten shareholder returns, pressuring it to prioritise fossil fuel profits over climate needs. While this could help revitalise short-term growth, it comes at a high cost for the environment.

Hopefully, a more beneficial long-term solution can be achieved.

For those bullish on oil prices rebounding, Shell may be a stock to consider. But for investors worried about long-term energy transition risks, it may be worth considering more diversified FTSE 100 stocks.