The US stock market has been hit with a triple-whammy of trade tariffs, AI threats and inflation fears, leading to prices dropping across the board.

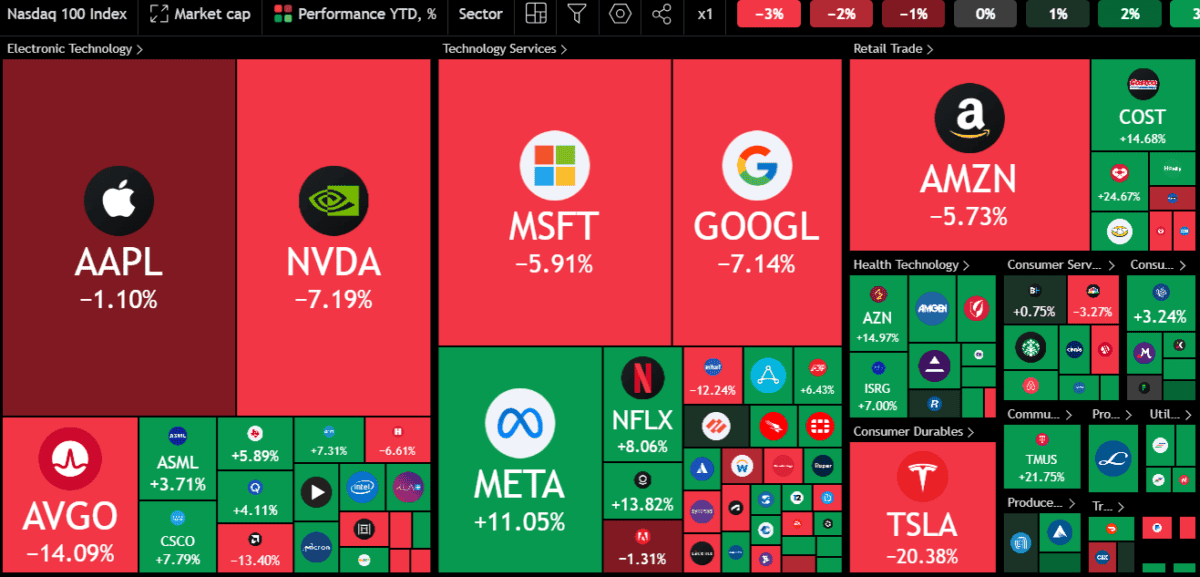

Popular indices like the S&P 500 and Nasdaq 100 are down 3% to 4% since last week. While there’s been some growth in healthcare and retail, major tech and finance stocks have suffered the most.

So far this year, Microsoft and Amazon are down by around 5.7%. Meanwhile, Google and Nvidia (NASDAQ: NVDA) have seen losses closer to 7% each.

Should you invest £1,000 in Nvidia right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Nvidia made the list?

Some of the worst hit include Tesla and Axon, both down by around 20%. Overall, approximately 40% of Nasdaq 100 stocks are suffering losses this year. This is despite the vast majority of stocks finishing last year up.

With Nvidia set to report Q4 earnings today (26 February), all eyes are on the semiconductor manufacturer. Can it deliver market-beating results and save the day?

High expectations

Analysts have high expectations for Nvidia, with revenue forecast to grow 72% and earnings per share (EPS) 63% year on year.

Despite recent losses attributed to the launch of AI competitor DeepSeek, the price is up over 60% in the past year. The past two months, however, have been a marked difference from the gains it made in 2023 and 2024.

The loss of momentum has many questioning where Nvidia stock may be headed in 2025. The $3.17trn company has been losing ground to Apple this year after briefly securing the top spot as the largest global company by market cap.

Other major tech stocks with AI links have followed suit while Apple has bucked the trend. Meta briefly tracked its growth only to suffer a sharp correction in the past week.

Maybe Apple alone keep the AI dream alive in the US?

US market outlook in 2025

A failure to impress in today’s earnings could extend Nvidia’s losses and further compound the US stock market’s rout.

Already there are signals from leading investors that troubles are brewing. Warren Buffett, for instance, seems to be leaning toward substantial cash reserves, possibly anticipating a market downturn. Similarly, Howard Marks of Oaktree Capital has raised concerns about potential market corrections following recent strong performances.

Economist Julia Coronado has highlighted risks such as slowing economic growth, stubborn inflation and geopolitical uncertainties. All these factors could impact market stability in 2025 and beyond.

But it’s not all doom and gloom.

BlackRock’s Fundamental Equities CIO Tony DeSpirito remains optimistic about market gains this year, albeit at a more subdued pace than in 2024.

Goldman Sachs recently raised its GDP growth forecast for 2025, citing strong consumer spending, a resilient job market and improving corporate earnings. Morgan Stanley analysts expect the S&P 500 to grow although at a more moderate pace than last year, driven by AI-driven productivity gains and strong performance from the tech sector.

For now, the US market stands at a sensitive juncture, one that could be tipped by today’s results. If Nvidia fails to impress, the knock-on effects could drag the rest of the market down. Alternatively, a solid set of results could reassure investors that DeepSeek isn’t a serious threat.

Will that alone be enough to turn US markets around? I doubt it — but it might just be enough stop the current slide.