It has been an excellent couple of months for investors in Lloyds (LSE: LLOY). The Lloyds share price has surged 24% since the turn of the year and twice that much over the past 12 months.

An investor who put £1,000 into the black horse bank at its September 2020 nadir would now be sitting on a holding worth £2,763.

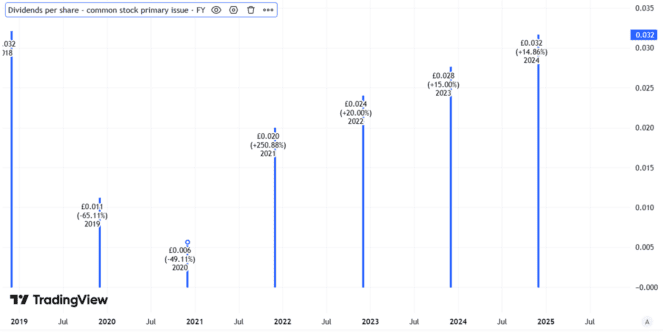

Short-term dividend growth, but still 88% below 2007 levels

They would also be earning a dividend yield of 12.8%. For buyers today the yield would be 4.7%.

Should you invest £1,000 in Reckitt Benckiser Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Reckitt Benckiser Group Plc made the list?

The prospective yield is even higher as Lloyds has been growing its dividend handily.

Last week it announced a full-year dividend per share increase of 15%. What is known as a progressive dividend policy means that the FTSE 100 bank aims to keep growing its dividend, although in practice no dividend is ever guaranteed to last.

Created using TradingView

Long-term Lloyds shareholders know that only too well.

Even after last week’s increase, the dividend per share is not yet back to where it stood in 2018. It is 88% below where it stood in 2007, before Lloyds ran into trouble in the financial crisis.

The shares could still move up from here

When it comes to the Lloyds share price, I see room for it to keep moving upwards from here.

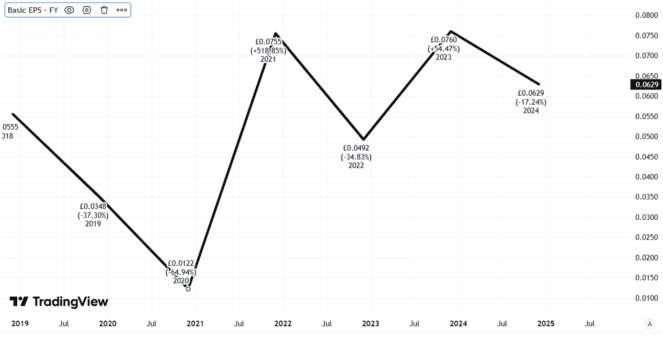

At the moment, the bank’s shares trade on a price-to-earnings (P/E) ratio of 11.

Moving up to a £1 share price would imply a prospective P/E ratio of 16. That is high compared to its peer group of major UK banks, although smaller lenders like Metro Bank have a much higher P/E ratio (64 in its case).

But if Lloyds’ earnings grow, the share price could hit £1 even if the P/E ratio remains broadly unchanged. They would have to grow by close to 50%. Is that likely given that last year, earnings per share fell 17%?

Created using TradingView

With its strong brands, £312bn mortgage book and massive customer base, Lloyds has the potential to perform well. However, I do not see any reason to expect earnings per share to jump dramatically. The recent trend has been downwards.

The bank faces ongoing pressures, such as mounting costs for historical car finance practices (it set aside a £700m provision for that in its most recent earnings).

Meanwhile, a medium-term risk that concerns me is higher loan defaults eating into profits. The bank said in its results that asset quality remains strong and last year saw lower default rates though, which helps partly explain why the Lloyds share price has been moving up.

Given the reassurance on asset quality and relatively cheap-looking valuation, I think that momentum could continue. However, I do not think the prospective business performance is strong enough to justify a move up to £1.

I’m steering clear

The last time the Lloyds share price was that high was back in 2008.

For now, business remains strong. The bank’s upbeat note about default rates in its results was music to my ears as an investor.

But it is not enough for me to want to invest.

Lloyds has been a long-term disaster over the past 20 years. I am not confident enough in the economic outlook to want to buy bank shares right now – including this one.