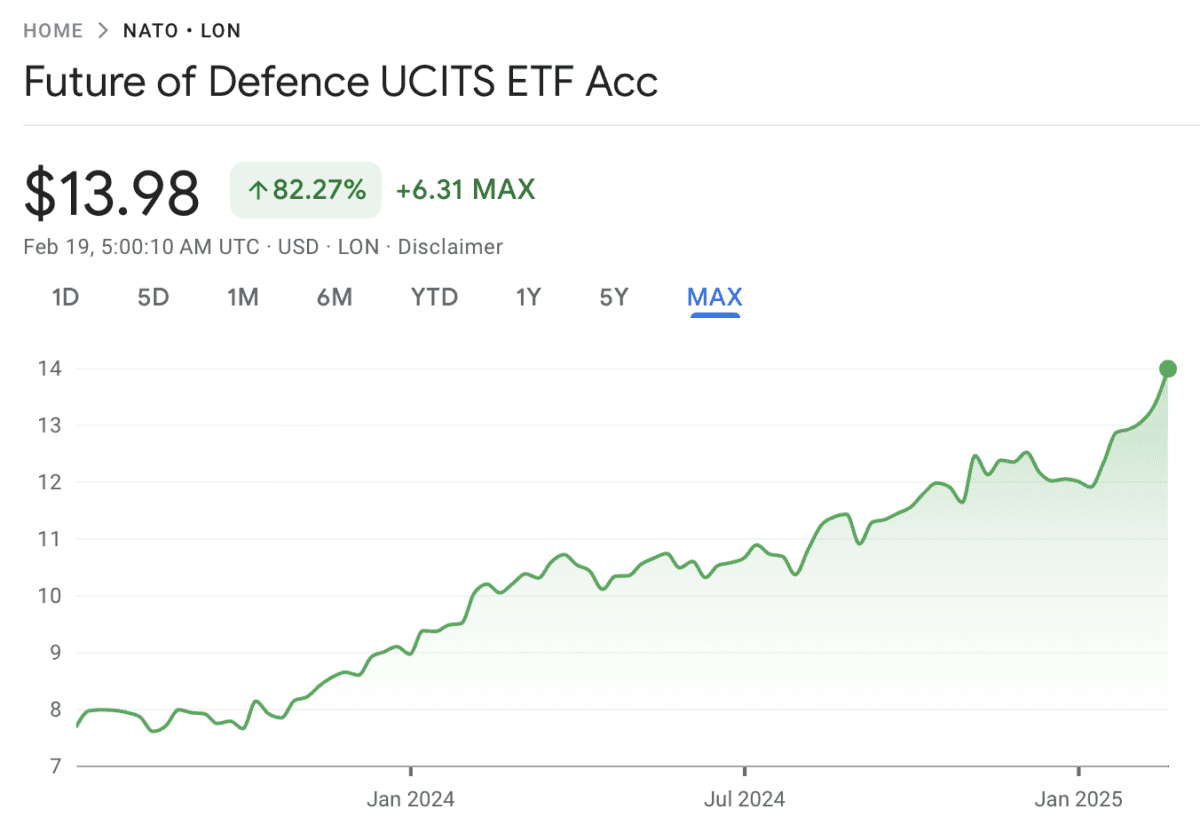

Defence stocks are hot right now. It’s easy to see why – currently geopolitical uncertainty is sky-high. Looking for stocks to buy in this area of the market? I think it’s worth considering the HANetf Future of Defence ETF (LSE: NATO) – which provides exposure to a range of different companies.

Outperforming BAE Systems shares

I bought this ETF for my own portfolio back in November, shortly after Donald Trump won the US election. And I’m not regretting it. Already, I’m sitting on a gain of 16.5% (after trading fees). That’s a great return in a little over two months. For reference, shares in UK defence contractor BAE Systems have only risen about 1% over the same timeframe. So, I’ve outperformed them by a wide margin.

Diversified exposure to the sector

This performance gap is exactly why I chose to go with a defence ETF instead of buying shares in BAE Systems or another individual company. Back in November, I was pretty confident that the defence sector, as a whole, would — sadly from a human suffering perspective — do well in the months and years ahead. However, when you invest in an individual company, there’s always the risk that it won’t fully participate in an industry rally. With this ETF, I was able to get exposure to nearly 60 different stocks – including the likes of Safran, Rheinmetall, and L3 Harris – and that has worked out well as many defence stocks have risen in recent months.

Should you invest £1,000 in Scottish Mortgage right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Scottish Mortgage made the list?

A modern take on an old industry

One reason I chose to invest in this particular ETF, instead of other similar products, was that it takes a futuristic view of defence, providing exposure to cybersecurity and artificial intelligence (AI) companies alongside traditional defence companies. Some examples here include CrowdStrike, Palantir, and Palo Alto Networks (which are all doing really well this year). Today, the nature of defence is rapidly evolving. And these kinds of companies give me exposure to cutting-edge technologies that are shaping the future of the industry.

Low fees

I was also attracted to the fee structure. Ongoing fees for this ETF are just 0.49% per year, which to my mind are reasonable (although I also need to pay trading commissions to buy and sell).

Favourable outlook

Looking ahead, there are no guarantees that this ETF will continue to do well. If geopolitical uncertainty eases (as we hope it will) and there’s a sentiment shift away from defence and cybersecurity stocks, the product could underperform.

Another risk is US defence budgets. With the Department of Government Efficiency (DOGE) – led by Elon Musk – looking to cut US government costs, there’s a chance that US defence contractors could see lower revenues in the years ahead.

However, with European leaders having just met to discuss the ramp up of defence spending across Europe, I think the outlook for the defence sector, as a whole, looks favourable. So, I believe this ETF is worth considering for a diversified portfolio today.