Nvidia (NASDAQ: NVDA) stock took a bit of a bruising in January, falling 13% at one point. However, it’s bounced back and is now 3.4% higher in 2025. Over five years, it’s up by a scarcely believable 1,817%!

The AI chip king is due to release its Q4 2025 earnings on 26 February. Here, I’ll take a look at the latest forecasts heading into the results report.

Incredible growth

Since ChatGPT was released in late 2022, Nvidia’s quarterly results have blown away Wall Street’s estimates.

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

The table below shows the revenue and earnings per share (EPS) figures, along with the surprise outstripping of EPS expectations.

| Quarter* | Revenue | Revenue surprise | EPS | EPS surprise |

|---|---|---|---|---|

| Q1 24 | $7.2bn | 10.1% | $0.11 | 18% |

| Q2 24 | $13.5bn | 20.7% | $0.27 | 29.7% |

| Q3 24 | $18.1bn | 11.2% | $0.40 | 18.5% |

| Q4 24 | $22.1bn | 8.4% | $0.52 | 12.3% |

| Q1 25 | $26bn | 5.8% | $0.61 | 9.2% |

| Q2 25 | $30bn | 4.4% | $0.68 | 5.4% |

| Q3 25 | $35.1bn | 5.8% | $0.81 | 8.3% |

As we can see, Nvidia was crushing estimates by double digits around a year ago. However, as the AI revolution has matured and analysts have a better grip on demand for chips, these surprises have understandably fallen into the single digits.

Of course, that’s still impressive, and it means Nvidia has beaten estimates on both the top and bottom lines every single quarter since the start of 2023. And over the period, it has added a mind-boggling $2.8trn in market capitalisation!

For Q4 25, Wall Street expects revenue of $38bn and EPS of $0.84. That would represent exceptional respective growth of 72% and 64%.

These are the headline figures that investors should look out for. Though the thing that will probably decide the direction of the share price afterwards is forward guidance for Q1 26. Investors will want to know that AI chip demand is going to remain strong this year.

Right now, analysts are forecasting revenue of $41.7bn and EPS of $0.91 for the current quarter (Q1). If the company revises this upwards, the stock could jump higher, and vice versa.

Price target

Broker share price targets should always be taken with a pinch of salt, especially when it comes to a volatile stock like Nvidia. Having said that, they can provide valuable insight into potential market disparities.

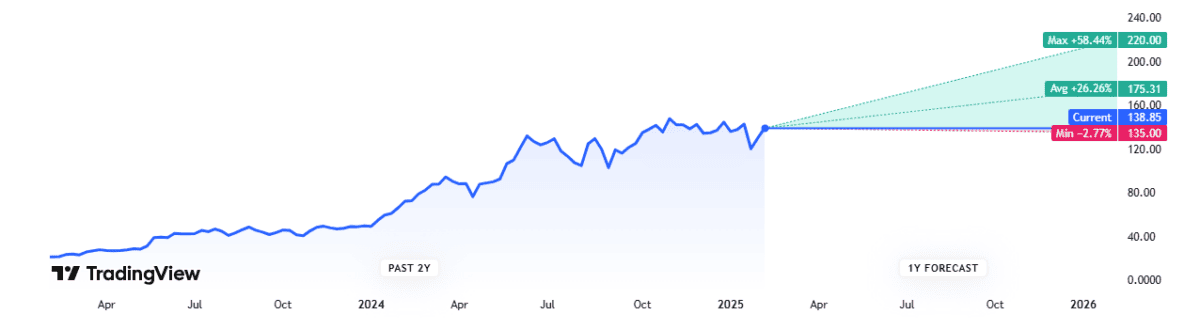

So, what’s the latest on this front for Nvidia? Based on 52 analysts covering the stock, the average 12-month price target is $175. That’s around 26% higher than the current share price of $138.

Valuation

Finally, we have the valuation. Based on current FY26 estimates, the stock is trading at roughly 31 times forward earnings. That doesn’t look too demanding to me, given the company’s rapid growth.

Combining this with the $175 price target, a convincing case could be made that this is a growth stock to consider buying.

What could go wrong?

However, as Stanford computer scientist Roy Amara once said: “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”

In other words, transformative new technologies have rarely avoided early speculative bubbles throughout history. The internet was the most famous example, though there have been others.

Moreover, around 36% of Nvidia’s sales came from just three customers in the last quarter. If these customers scale back their AI infrastructure spending after initial build-outs, the chipmaker could experience an immediate slowdown in revenue growth.

Given this medium-term uncertainty, I’m not going to buy the stock at today’s price.