Making predictions about the BP (LSE:BP.) share price isn’t easy. That’s because the group’s financial performance is closely linked to the price of oil. Although it’s not obvious how much of its revenue comes from the sale of the black stuff, its oil production and customer & products divisions contributed 84% of revenue in 2024.

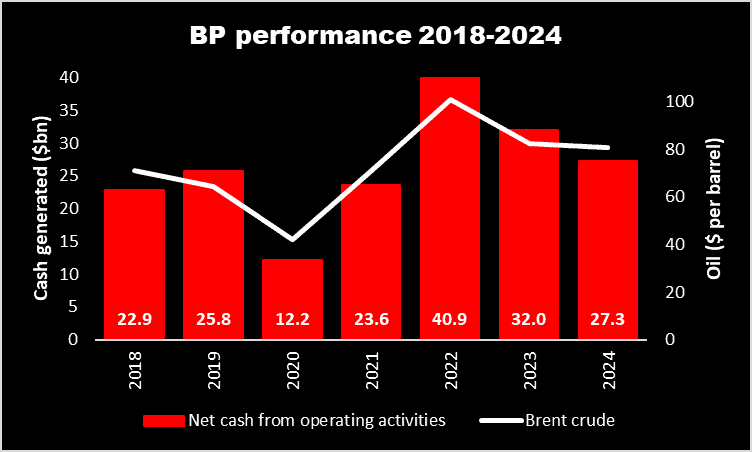

Therefore, it stands to reason, that it does better when energy prices are high. This can be seen in the chart below, which shows the cash generated from its operations from 2019-2024, alongside the average price of a barrel of Brent crude.

From a statistical point of view, the two variables are 96% correlated. This means they have a near-perfect relationship.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

A crystal ball

However, it’s impossible to accurately predict oil prices. They’re influenced by numerous factors, including production decisions by OPEC+ members, regional conflicts and global demand.

Over the past decade, I’ve seen headlines suggesting Brent crude could reach anything from $100 to $1,000 a barrel. It’s currently (14 February) around $75.

The United States Energy Information Administration’s predicting an average price of $74 (2025) and $66 (2026). A survey of economists by The Wall Street Journal is forecasting $73 this year.

If any of these estimates prove to be correct, BP will — in 2025 — probably have its most disappointing year since 2021. As for 2026, it could be worse than its 2019 performance. And this could put pressure on its share price.

But then again, if a barrel of Brent crude hits $1,000 …

However, the prediction of a four-figure oil price was a little tongue-in-cheek. The article appeared in Fortune magazine, in 2008, with the author writing: “I say this with absolutely as much information at hand as the pundits who are now making headlines for themselves by their soggy $200 predictions. Nobody knows what’s going to happen. So I’m going to not know what’s happening at an even more dramatic level.”

With so much uncertainty surrounding commodity prices, I think it’s fair to say that predicting the BP share price is a mug’s game.

A healthy income stream

However, the energy giant pays a generous dividend. For the past three quarters it’s paid $0.08 a share. If this is repeated one more time, its annual payout of $0.32 (25.7p at current exchange rates) implies a yield of 5.6%.

This is comfortably above the FTSE 100 average of 3.6%.

But it’s important to remember that dividends are never guaranteed, particularly in the energy sector where earnings can be volatile. BP cut its payout in 2020 and even though it’s steadily been increased since, in cash terms it remains 23% lower.

But the yield’s not high enough to make me want to invest, although others appear to disagree.

Shareholders got excited on 10 February when reports emerged that Elliott Investment Management had taken a position in the company. Its share price jumped 8% on hopes that the ‘activist investor’ will force changes to the business that’ll see it valued more highly. With the demand for hydrocarbons continuing to climb, now could be a good time to consider investing.

However, I’m not going to take a stake. Its reliance on the price of oil — which is so unpredictable — makes it too risky for me.