The Coca-Cola HBC (LSE: CCH) share price was on the move today (13 February), surging 9.3% to an all-time high of 3,246p. This made it the top riser in the FTSE 100 by some distance.

I’m relieved that I finally added this stock to my portfolio late last year. For months beforehand, I intended to invest but never got round to it.

Why is the stock up today?

For those unfamiliar, the company is one of the major bottlers for The Coca-Cola Company.

Should you invest £1,000 in Coca-Cola HBC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Coca-Cola HBC made the list?

Based in Switzerland, it produces, sells and distributes beverages like Coca-Cola, Fanta, Schweppes, Sprite, and Monster across 28 markets in Europe, Africa, and Eurasia. Coca-Cola still owns more than 20% of the FTSE 100 firm.

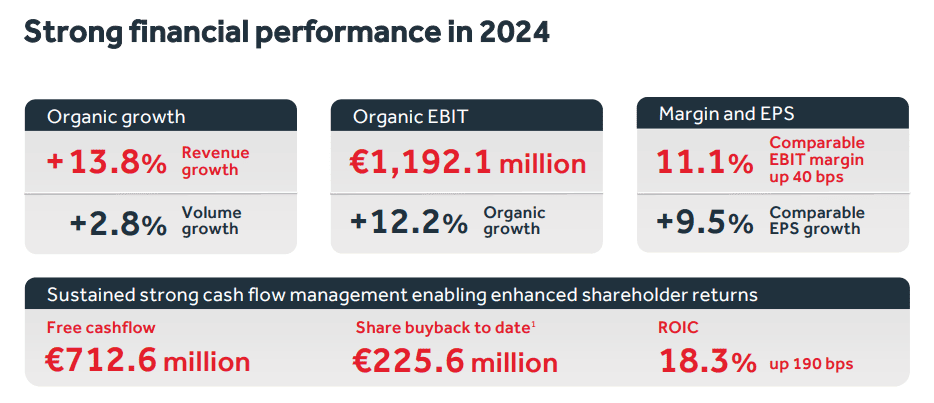

Today, it released a strong annual earnings report for 2024, which is why the stock is up. Organic net sales rose 13.8% year on year to €10.7bn, which slightly beat the consensus estimate for 13% growth.

However, reported revenue growth was 5.6%, as this strong organic performance was partially offset by currency headwinds in emerging markets.

Volumes increased by 2.8% on an organic basis, led by energy and coffee categories. Indeed, energy drink volumes grew by 30.2%, marking the ninth year of consecutive double-digit growth. Monster led the way, while Predator is growing strongly in Africa. Costa Coffee drinks are also doing really well.

Meanwhile, organic operating profit was up 12.2% to €1.2bn, while adjusted earnings per share increased 9.5% to €2.28. The dividend was hiked 11% to €1.03 per share, giving a forward yield of about 2.9%.

Looking ahead to this year, Coca-Cola HBC forecasts organic revenue growth of 6%-8%, compared to market expectations of 7.3%. And it sees operating profit increasing 7%-11%, versus analysts’ prior anticipation for a 10.7% rise.

While the company is forecasting slower growth, many consumer-facing firms would snap your hand off if you offered them this level of anticipated growth in 2025.

A good mix

One thing to bear in mind here is that foreign currency changes can hit reported earnings. In 2024, the business saw a negative currency impact from the depreciation of the Nigerian Naira, Russian Rouble and Egyptian Pound.

So this is a risk, while there is an ongoing pushback against some Western brands in Egypt (considered a growth market, with a youthful population above 110m).

On the other hand, this diverse geographical footprint can be a strength, as weakness in one market (developed Europe, for example) can be offset by strength in another (most of Eastern Europe is growing strongly).

This applies to drinks too. For example, Coke Zero grew mid-single digits last year while Monster is growing much faster.

Overall, I really like the strong mix of markets and brands here.

What about valuation?

The stock is trading at around 15.5 times forecast earnings for 2025. I don’t think that’s particularly demanding for a high-quality company like this.

Also, an end to the Russia/Ukraine conflict would be a positive for Coca-Cola HBC. It still sells products in Ukraine while also operating in Russia, where it focuses on local brands. An end to the war might also boost consumer sentiment in neighbouring countries like Poland and Romania.

Despite the rise today, I still think the stock is worth considering for a diversified portfolio.