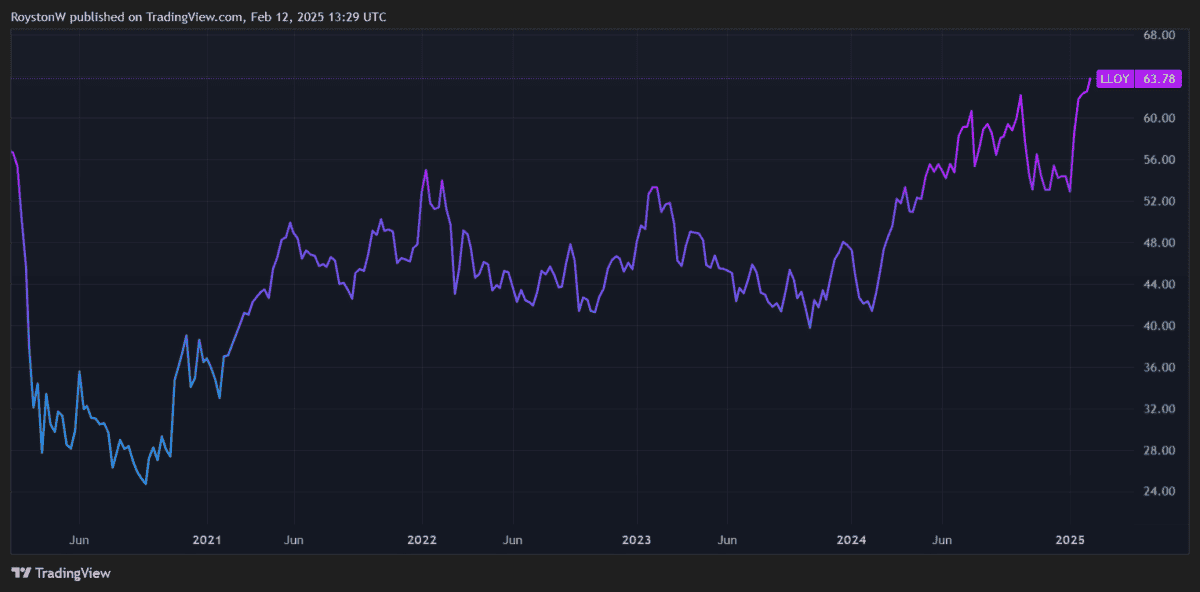

There’s no doubt that Lloyds Banking Group (LSE:LLOY) shares offer tremendous value on paper.

It looks like a bargain based on predicted profits — its price-to-earnings (P/E) ratio is 9.3 times. The bank also offers decent value in view of predicted dividends, with its yield at a FTSE 100-beating 5.2%.

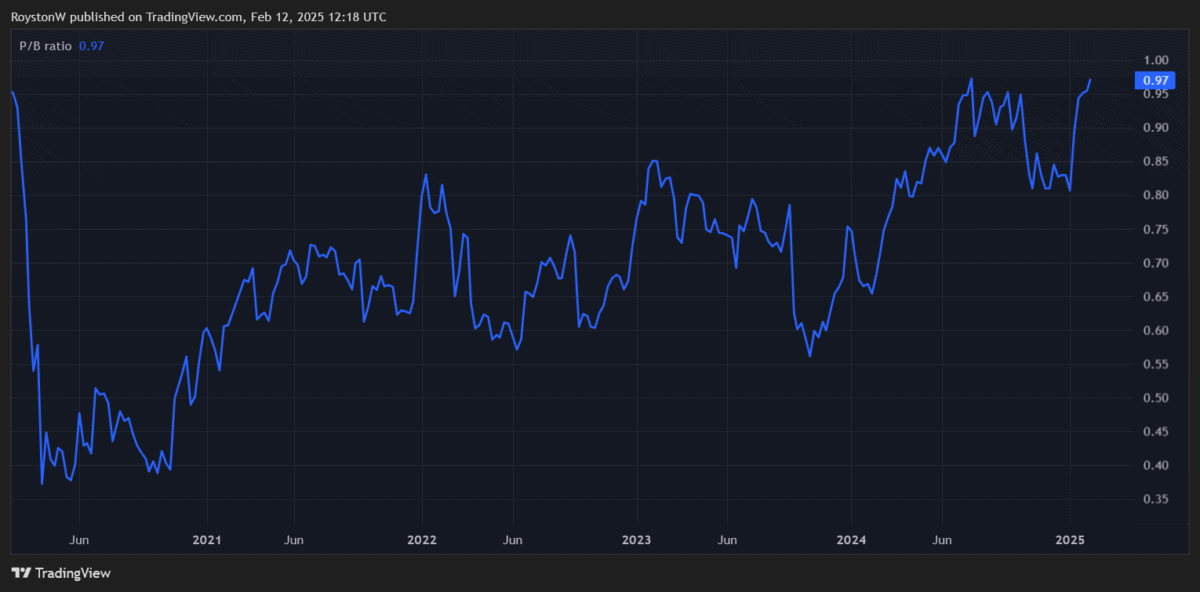

Finally, with a price-to-book (P/B) ratio below one, Lloyds also trades at a slight discount to the value of its assets.

Should you invest £1,000 in Lloyds Banking Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group Plc made the list?

But I don’t see Lloyds’ share price as a brilliant bargain. Rather, my view is that the bank’s cheap valuation reflects the high risk it poses to investors and its poor growth prospects looking ahead.

Here are four reasons I’m avoiding the Black Horse Bank today.

1. Growing mortgage competition

Signs of recovery in the housing market are great news for the UK’s largest mortgage provider. Home loan demand is recovering strongly as buyer confidence improves.

Mortgage approvals for home purchases leapt 28% year on year in December, government data shows.

However, margins in this key product segment are crumbling as competition intensifies. Santander and Barclays have sliced some fixed mortgage rates to below 4% this week, while others are also chopping amid a race to the bottom.

Lloyds will have no choice but to follow the herd, lest it loses new buyers and re-mortgagers to its rivals.

2. Margin pressures

The outlook for Lloyds’ margins is already pretty gloomy as the Bank of England (BoE) ramps up interest rate cuts.

Net interest margins (NIMs) at group level were wafer thin in the third quarter of 2024, at 2.94%. They dropped 21 basis points year on year, and could plummet more sharply if BoE rate reductions heat up as the market expects. This would leave little-to-no room for profits growth.

Experts suggest interest rates will decline to at least 4% by the end of December, down from 4.5% today.

3. Struggling economy

On the bright side, rate reductions will likely boost Lloyds by supporting credit demand and spending on other financial products. They could also reduce the level of credit impairments the bank endures.

Yet a gloomy outlook for the UK economy suggests it could still face issues on both these fronts. The BoE’s decision to cut its 2025 growth forecasts by half (to 0.75%) is a worrying omen.

With the central bank also tipping inflation to rise again, Lloyds faces a ‘stagflationary’ quagmire that may damage profits beyond this year. Major long-term structural issues for the UK economy include labour shortages, falling productivity, and trade tariffs.

4. Financial penalties

The final — and perhaps largest threat — to Lloyds’ share price in 2025 is the possibility of crushing misconduct charges.

To recap, the motor finance industry is subject to a Financial Conduct Authority (FCA) probe into potential mis-selling. Following a court case last September, analysts think lenders could be on the hook for tens of billions of pounds.

As the industry’s leading player, Lloyds — which made £15.6bn worth of car loans in the first nine months of 2024 — could be accountable for a large chunk of this. RBC Capital thinks the cost to the bank could be an eye-watering £3.9bn, though be aware that estimates have been moving higher in recent months.