The FTSE 100 is home to a vast array of high-quality dividend shares.

The UK’s leading share index may lack the razamatazz of the tech-led S&P 500. However, its large weighting of ‘boring’ stocks — those that operate in traditional, mature industries rather than high-growth sectors — makes profits and cash flows far less volatile.

This brilliant blend is critical for investors seeking a strong, sustained, and growing passive income over time.

Should you invest £1,000 in Legal & General right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General made the list?

But dividends are never, ever guaranteed. So whats the best tactic for someone with a £20,000 lump sum to invest today?

Targeting stability

An increasingly popular option is to consider a FTSE 100-tracking exchange-traded fund (ETF), which can provide both capital gains and dividend income.

By holding the entire index, an ETF can help investors significantly reduce risk. If one or two companies experience trouble, the overall impact on an income stream can be smoothed out.

That said, there are several important caveats with this approach.

However…

Firstly, the price investors pay for this security is a pretty low yield.

At 3.5%, the FTSE 100’s forward dividend yield is lower than the current interest rate on most Cash ISAs. Someone who invested £20k in a Footsie ETF today would (if forecasts are correct) make a middling £700 passive income this year.

Secondly, while funds like this reduce risk the risk of poor dividend income, they don’t eliminate it entirely. This was apparent in 2020, when scores of blue-chip shares cut, cancelled or postponed dividends when the pandemic hit.

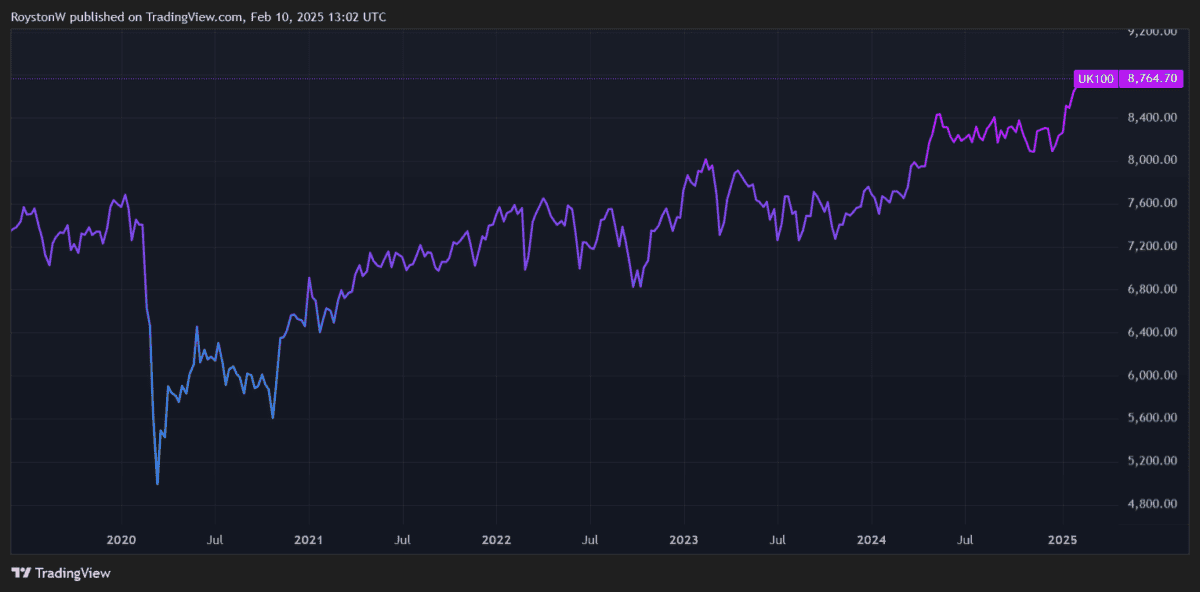

Finally, poor share price growth means the overall returns on FTSE-tracking ETFs have been disappointing in recent years. Since 2015, the index has delivered an average annual return of 6.5%.

A large dividend income is highly attractive. However, weak share price performance can erode passive income benefits over the long haul.

A £2,040 passive income

For this reason, purchasing individual shares might be a better way for investors to target passive income.

There’s no right and wrong answer in the ETF vs stock-picking argument. This depends on anyone’s risk tolerance and financial goals, along with one’s level of investing experience.

However, those seeking a large passive income today and market-beating returns should also consider buying specific shares as part of a diversified portfolio.

Let’s take Legal & General (LSE:LGEN) for instance. Considering a £20k investment here today would — if broker forecasts prove correct — provide a £2,040 passive income in 2025. That’s based on a 10.2% forward dividend yield.

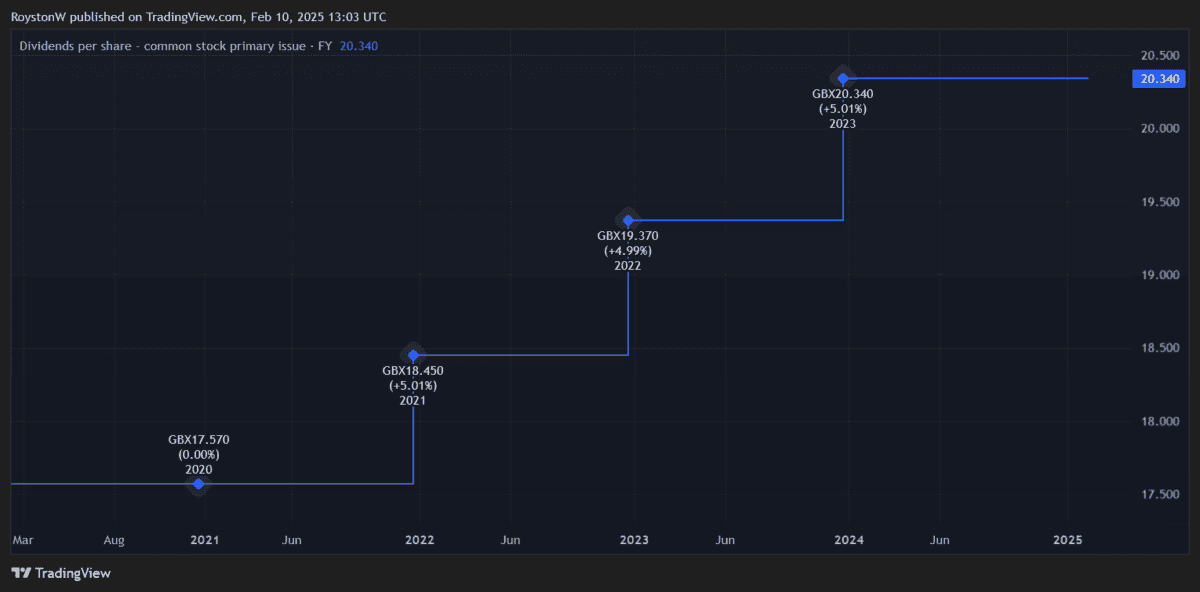

On top of this, investors can realistically expect dividends on Legal & General shares to keep rising over the short-to-medium term at least. The business, which has raised annual payouts in 12 of the last 13 years, is cash rich and had a Solvency II ratio of 223% as of June, more than double regulatory requirements.

Since 2015, Legal & General shares have provided an average annual return of 4%. That’s 2.5% below the return an FTSE 100 ETF could have delivered.

But I’m optimistic that overall returns, along with dividends, will beat the Footsie average looking ahead. Despite competitive pressures, I think profits could soar as financial services demand — and especially sales of retirement and wealth products –rapidly grows.