Lloyds (LSE:LLOY) shares are up 11.3% over six months. So a £10,000 investment then is now worth £11,130 today. Sadly, an investment made exactly six months ago would miss out of the dividend cut-off. Nonetheless, it’s not a bad return.

More broadly, we can see long-term investors are being rewarded for their loyalty after the stock’s underperformance during the Bank of England’s rate hiking cycle. Shares are up 8% over five years, but 45% over 12 months, highlighting the volatility we’ve seen in recent years.

Long-term underperformance

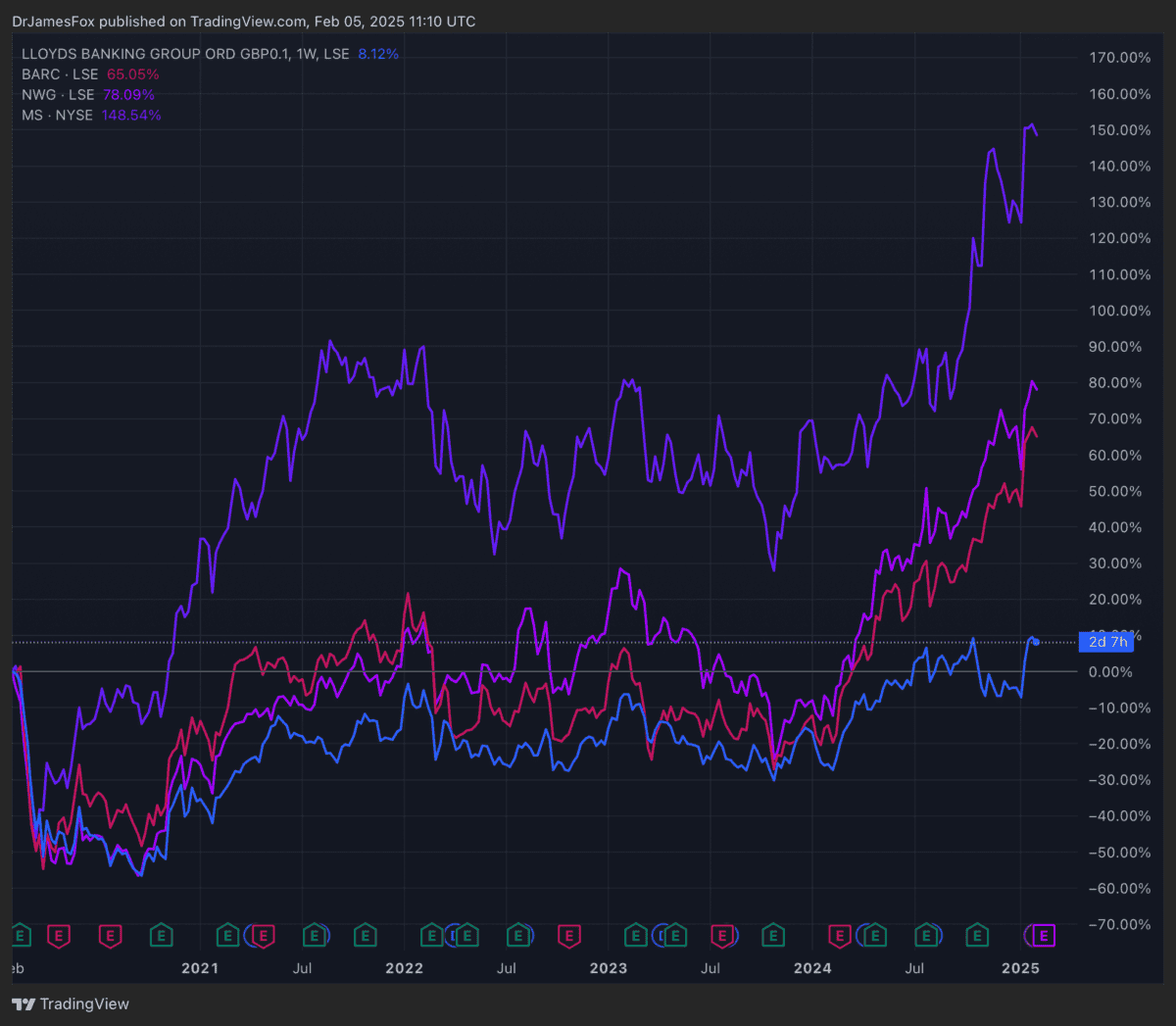

The graph below shows us how Lloyds has underperformed its major UK and US peers (such as JP Morgan) over the past five years. Once the darling of the FTSE 100 — albeit nearly 30 years ago — this bank no longer appears to have the same pulling power as its competitors.

So why is Lloyds not as popular as its peers? Primarily UK-focused, the bank lacks the global diversification and investment banking prowess of its competitors. Its heavy reliance on the domestic mortgage market makes it vulnerable to economic fluctuations, limiting growth potential. While stability’s a strength, investors often seek more dynamic financial institutions with broader revenue streams.

The absence of a significant international or investment banking arm can constrain Lloyds’ ability to generate higher returns. This conservative approach, though prudent, means the bank often appears less attractive to investors seeking more aggressive growth strategies in an increasingly complex and competitive financial landscape.

A risk worth taking?

The FCA’s investigation into Lloyds’ car finance practices presents a significant risk and opportunity for investors. The bank’s £450m provision may be insufficient if the Supreme Court rules against it, potentially leading to charges up to £3.9bn. This uncertainty has created a volatile situation for Lloyds shares.

However, a favorable outcome could trigger a relief rally. The chancellor’s intervention, citing potential “considerable economic harm,” may influence the ruling. If Lloyds prevails, investors will be keen to point out supportive trends emanating from falling interest rates.

In fact, Lloyds is already benefitting from falling interest rates, as evidenced by lower impairment charges in its most recent financial report. The bank’s structural hedges are set to provide a meaningful support to its income from 2025 onwards, which will lift its revenue and earnings.

Despite a slight decline in net interest margin, Lloyds’ loan book growth and stabilising consumer behaviour regarding savings accounts are positive indicators. Moreover, the bank’s ability to beat profit expectations amid softer economic conditions demonstrates its resilience and adaptability to changing market dynamics.

Some valuation uncertainty

Looking at the data, there appears to be some uncertainty among analysts around earnings. This, I assume, is because analysts are trying to forecast in which year the possible fine could fall. The result is an unclear price-to-earnings trajectory. The bank’s currently trading at 9.5 times forward earnings, this rises to 10.7 times for 2025 and then falls to 7.4 times for 2026.

Nonetheless, I’m here for the long run. I’m bullish on Lloyds and may consider buying more.