Investors often try calculating their passive income potential when investing in the stock market. This is a key part of formulating an income-based strategy, as the outcome relies on meeting certain criteria. Notably, it’s important to know how much to invest when aiming to achieve a specific return

For example, an investor wants to earn an extra £250 a week to supplement their current income. That equates to a return of approximately £1,000 a month (or £12,000 a year). How much would they need to invest to return £12,000 of income per year?

Formulating a strategy

An investment provides returns through both capital appreciation and dividends. Income investors typically prefer dividends due to the regular payments they deliver.

Should you invest £1,000 in Berkshire Hathaway right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Berkshire Hathaway made the list?

The best dividend stocks for passive income are those with a long track record of growth. This reduces the risk of a dividend cut in the near future.

A high yield is also important — but not so high that it’s unsustainable. Risk tolerance and diversification are also key criteria to consider. A less-diversified portfolio may provide higher returns at the risk of greater losses.

For example, diversifying into volatile US tech stocks can be risky. However, the opportunity for growth is good. Alternatively, low-volatility consumer goods or healthcare stocks are less risky but slow-growing.

How much to invest

Imagine a portfolio with a 7% average yield and 3% annualised growth. With £120,000 invested, that could return approximately £12k per year.

That amount could be reached by investing £200 a month for 20 years. It would require reinvesting the dividends to compound the returns so the investment grows exponentially.

By upping the monthly contribution to £300, the time could be reduced to 15 years. And an investor with already £20,000 in savings could further reduce it to only 11 years. Of course none of those returns are guaranteed.

What kind of stock meets those criteria?

Ideally, the portfolio should have 10 to 20 stocks with yields between 5% and 9%. They should span a range of different industries and geographical regions.

One example I think is worth considering is the FTSE 250 stock Investec (LSE: INVP). The international wealth management group is one of the largest companies on the index, with a market cap of £4.66bn. Larger-cap stocks tend to be less volatile.

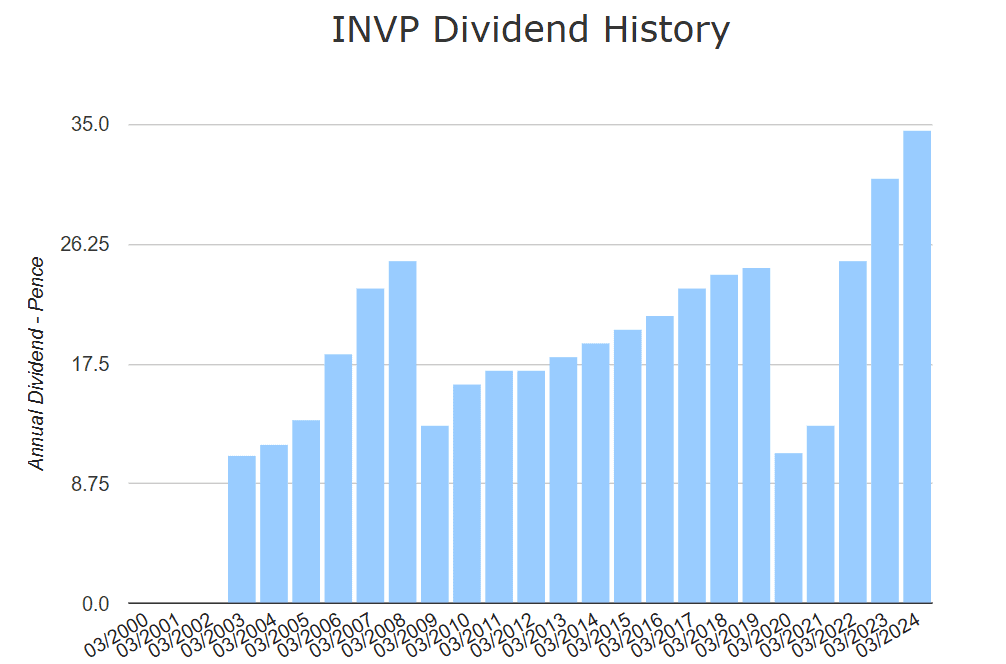

It maintains a fairly stable yield between 5% and 7%, which is higher than average. Although it has made two cuts in the past 20 years, dividends have grown at a rate of 6.9%.

As an investment firm, Investec is at higher risk from macroeconomic factors that lead to market volatility. These include interest rate changes, geopolitical conflicts and supply and demand issues. Profits may also suffer if a company it invests in defaults on its debt or falls into administration.

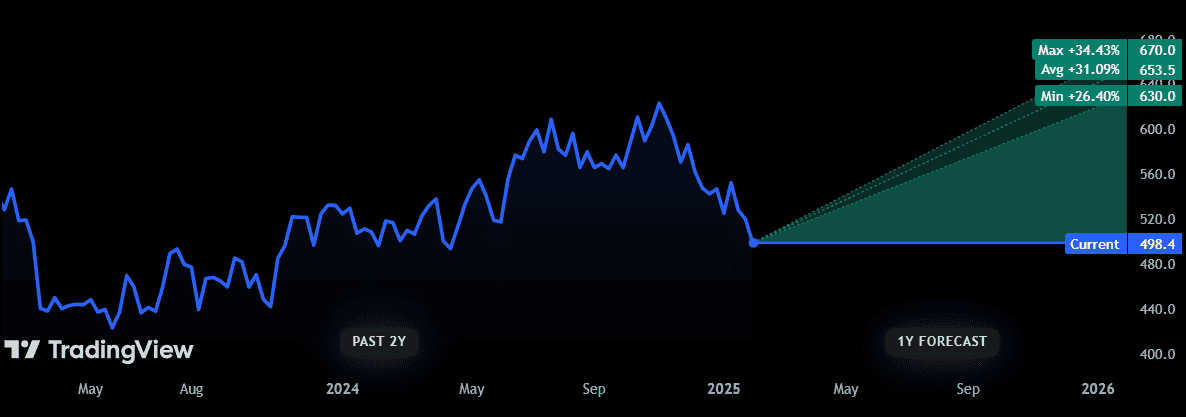

So far, it appears to have made good investment decisions. Analysts on average expect a 12-month price of 653p, 31% higher than today.

The share price has increased at an annualised rate of 7.3% over the past decade. That makes it an attractive addition to an income portfolio, as dividend stocks typically have lower price growth.

It also has good ratios, with a price of only 6.7 times earnings and a price-to-sales (P/S) ratio of 0.87.