Demand for cheap UK shares is heating up as investors seek refuge from volatile US tech stocks and tension over President Trump’s tariff plans.

Since 1 January, the FTSE All-Share Index has risen 4.4% as investors have rotated into undervalued London Stock Exchange companies. The FTSE 100, meanwhile, has sprinted to new record highs near 8,680 points.

Price drivers

Predicting the near-term direction of stock markets is extremely challenging. Share prices are influenced by a wide range of interconnected economic factors. As we saw during the Covid-19 pandemic, crises can also appear out the blue that drive share prices through the floor in a matter of days.

Should you invest £1,000 in Hurricane Energy Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Hurricane Energy Plc made the list?

Yet there are good reasons to believe the upturn in British stocks that begun last year could continue. These include:

- Economic and geopolitical turbulence in the US that drives demand for overseas equities.

- Sustained US dollar weakness that boosts earnings of companies with US exposure that report in sterling.

- A rise in merger and acquisition activity (like Aviva‘s takeover of Direct Line Insurance, and Hargreaves Lansdown‘s private equity buyout) that pushes valuations higher.

- Growing confidence in the UK’s political landscape following last year’s general election.

- Sustained demand from global investors for value shares.

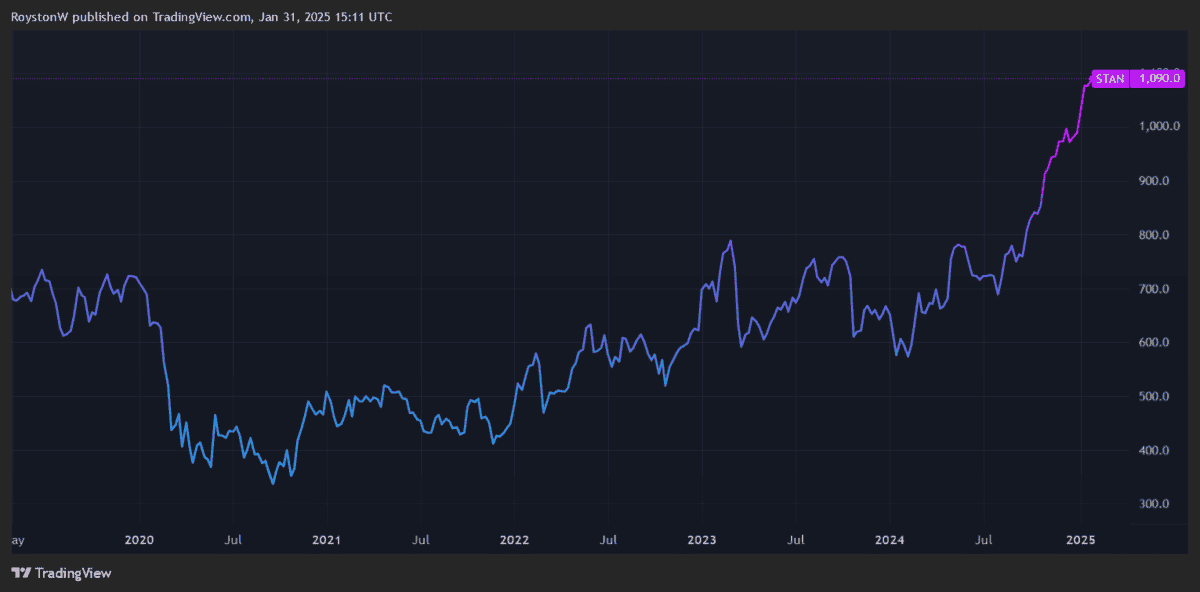

FTSE 100-listed Standard Chartered (LSE:STAN) is one UK share that’s continued rocketing in value since the start of 2025. Here’s why I think investors should consider buying it today while it’s still dirt cheap.

Brilliant bank

At £10.90 per share, the emerging markets bank looks like a bargain based on a variety of value metrics.

The bank’s price-to-earnings (P/E) ratio for 2025 is 7.6 times, while its price-to-earnings growth (P/B) ratio is just 0.6. Any reading below one suggests a share is undervalued.

On top of this, Standard Chartered’s price-to-book (P/B) ratio is also below one, indicating the bank trades at a discount to the value of its assets.

Banks are highly cyclical, and during economic downturns revenues can slump and loan impairments rocket. In the case of Standard Chartered, investors need to be aware of the risks posed by China’s economic slump, and especially weakness in the property market. The bank has already had to heavily write-down the value of some of its Chinese assets.

But I believe these risks are baked into the banking giant’s valuation. Also, from a long-term perspective, the earnings outlook here remains extremely bright.

In Asia and Africa — regions from which Standard Chartered sources 70% and 16% of profits respectively — financial services demand is soaring, driven by a mix of personal income growth and population increases. This is a growth opportunity the bank could mine for decades.

What’s more, Standard Chartered’s strong balance sheet gives it firepower to pursue further investment in fast-growing areas like wealth management. The group’s common equity tier 1 (CET1) capital ratio was 14.2% as of September.

It also means investors can expect healthy dividend growth along with further share buybacks. The bank launched another share repurchase programme worth $1.5bn last summer.