I’m partial to the odd small-cap share, if it floats my boat. Unfortunately, these two penny stocks don’t, leaving me keen to avoid them.

Beleaguered luxury brand

The first stock’s Mulberry Group (LSE: MUL). Shares of the luxury accessories maker have fallen 76% in just under four years!

This has seen the company’s market-cap slump to just £63m. Part of me thinks that’s too low for a company that posted £153m in FY24 sales (which ended in March). On the other hand, Mulberry’s being hammered by the global slowdown in demand for luxury goods.

In November, the company reported that revenue dropped 19% to £69.7m in the six months to the end of September. Sales fell in every region, with particular weakness in Asia. Gross margin contracted to 66.5% from 70.4% and the loss widened by 23% to £15.7m. Grim stuff.

The company doesn’t see things picking up anytime soon, saying the “wider macro-economic environment, including ongoing inflationary pressures, continues to present uncertainty and challenges“.

Now, Mulberry’s the UK’s largest designer and manufacturer of luxury leather goods. I don’t like to see the British brand suffering like this. So I hope new CEO Andrea Baldo is successful in cutting costs, renewing the brand, and restoring profits.

Perhaps he’ll succeed, or maybe the firm will be acquired at a higher price (though it rejected two bids from Frasers Group last year). Truth is, I haven’t the foggiest what’s going to happen. With the firm posting losses, there’s just far too much uncertainty for me to invest here.

Not ready for lift-off

The next penny stock I’m not touching with a bargepole in February is Virgin Galactic (NYSE: SPCE). This is the space tourism business founded by Sir Richard Branson.

The share price has suffered a supernova collapse, plummeting 99.5% in four years!

The company’s listed in the US, where there’s a slightly different definition of a penny stock. It’s typically defined as one that trades for less than $5 and has a low market-cap. That certainly describes Virgin Galactic, with its share price at $4.50 and a meagre $130m market cap.

What’s gone wrong? Well, the company conducted its final spaceflight last summer before announcing a two-year pause in commercial operations to focus on building its next-generation spacecraft. So there’s almost zero revenue coming in until at least 2026.

In Q3, it burnt through $118m of cash, leaving $744m in cash and equivalents. While that sounds a lot, cash burn’s expected to have risen to between $115m and $125m in Q4. At that rate, it probably won’t have enough to fund itself through to mid-2026.

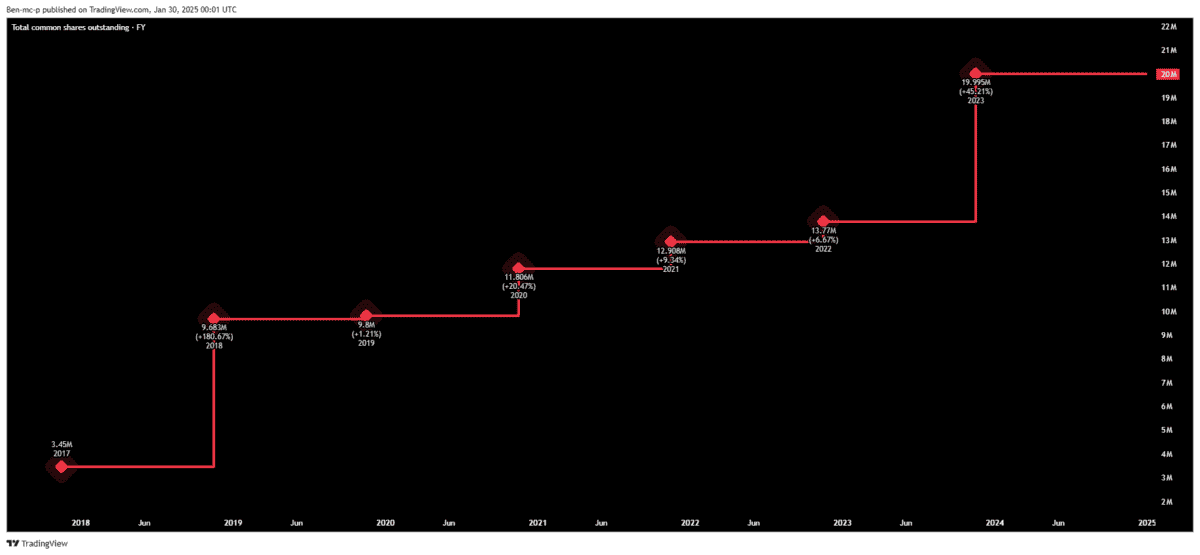

The solution? Keep selling more stock, massively diluting shareholders in the process. This isn’t new, as the share count history shows.

Now, I do support Virgin Galactic’s mission to fly thousands of private astronauts to space. Seeing our planet from above famously changes perspectives in a profound way (known as the ‘Overview Effect’). If space travel can bring humanity together, then I’m all for that (its retired spacecraft was called ‘VSS Unity’ for this reason).

However, I doubt such idealism will do much for my portfolio down here on Earth. So I’m sitting this one out.