On Friday evening (3 January), the boohoo (LSE:BOO) share price came into my head. That’s because I was watching the PDC World Darts Championship final and noticed that Luke Littler, the youngest ever winner of the trophy, was wearing the boohooMAN logo on his left shoulder.

I suspect those responsible for the sponsorship deal would prefer me to buy something from the retailer’s website, rather than think about the price of the company’s shares. But it’s been a long time since I was a member of its target market of “price conscious consumers aged 16-24”. When boohoo was founded in 2006, I was part of its intended demographic. Alas, I’m now too old.

But to be honest, I’m not sure Littler will qualify for long either. With his £500,000 prize money, he probably doesn’t have to count the pennies. And he doesn’t look like the models on the company’s website. But who does?

Contrasting fortunes

It’s been well documented that the price of boohoo shares has crashed over the past five years.

The company was one of the few winners from the pandemic. It trebled its sales between 2018 and 2021. And for the year ended 28 February 2021 (FY21), it reported adjusted earnings per share of 8.67p.

But in the face of intense competition and changing tastes, the shares now change hands for 92% less than they did in June 2020. However, at their current (6 January) level of 31.3p, I wonder whether now could be a good time for me to invest?

Check this out

On the plus side, the company’s entered 2025 with a strengthened balance sheet. That’s because, in November, it raised £39.3m from shareholders. These proceeds were used to help repay £50m of a £97m term loan. And just before Christmas, it announced the sale of its London office for £49.5m.

The company’s also recently embarked on a business review intended to “unlock and maximise shareholder value”. It believes that its current stock market valuation doesn’t reflect the full potential of, in particular, its Debenhams and Karen Millen brands.

Operating costs are also falling. During the first half of FY25, these were £128m lower than for the same period two years earlier.

Some problems

But the biggest issue I have is that it’s difficult to value boohoo when it’s loss-making. Unless there’s a clear path to profitability, it’s hard to see it being worth anything.

Having said that, Ocado Group’s apparently ‘worth’ £2.7bn, despite reporting adjusted post-tax losses of £1.34bn over the past five years!

However, boohoo’s latest results — for the six months ended 31 August 2024 — revealed falling sales and increased losses, compared to the same period 12 months earlier. Of further concern, its gross profit margin was 2.7 percentage points lower.

Despite the company’s best efforts, it appears to me that it’s going to be a while before its profitable again. And I doubt it’ll ever be able to repeat its performance of FY21.

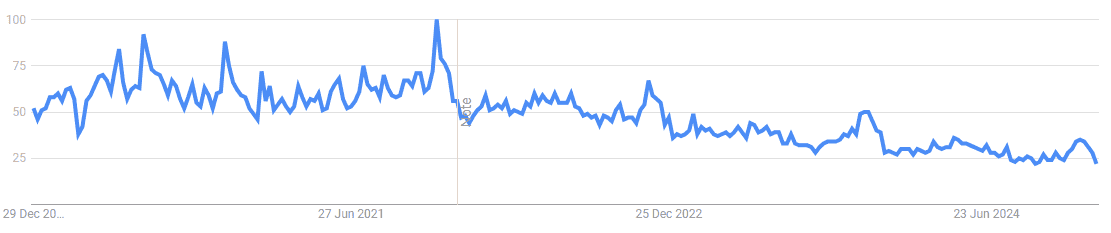

I’m also worried that interest in the company seems to be in decline. The chart below shows the number of Google searches for ‘boohoo’, since December 2019.

Therefore, in my opinion, I think Littler’s going to make more from boohoo in 2025 than its shareholders will. For this reason, I don’t want to invest.