One of the most interesting stocks in Warren Buffett’s portfolio at Berkshire Hathaway is Nu Holdings (NYSE: NU). Founded less than 12 years ago in Brazil, it’s now Latin America’s largest digital bank.

And despite the Oracle of Omaha’s company selling just over 19% of its position in Q3, it still owns around 1.8% of Nu’s outstanding shares.

I opened a smallish position in my Stocks and Shares ISA back in October. Since then, the share price has dropped 27% to just over $10. Fortunately, I look to build up my position over time, often with three purchases.

Therefore, I’ll add to this stock at a lower price in January. Then I plan to hold my shares for a decade — here’s why.

Hyper growth

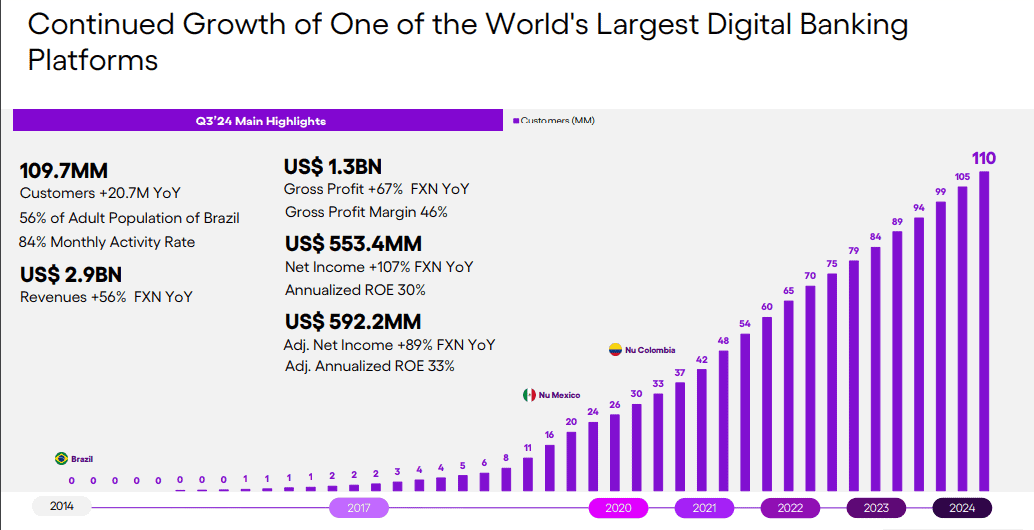

Nu Holdings, which is commonly known as Nubank, claims to be the world’s largest digital banking platform outside of China. Considering its customer count reached 109.7m in Q3, that looks likely.

Nubank’s app offers a range of financial products and services, including bank accounts, credit cards, loans, investing options, and more. Unlike physical banks that rely on a network of branches, this digital-first approach has enabled it to rapidly grow its user base, particularly among lower-income individuals.

Indeed, its app is now used by around 56% of adults in Brazil (the seventh most populous country in the world). Nubank’s signature purple debit and credit cards are also growing quickly in Mexico and Colombia.

In Q3, revenue jumped 56% year on year to $2.9bn on a currency-neutral basis, while net income surged 107% to just over $553m. That’s a net margin of 19%, which is very impressive for a fintech firm still in hyper-growth mode.

Looking ahead, Wall Street sees earnings per share (EPS) rising from $0.23 in 2023 to $1.23 by 2027. That’s a compound annual growth rate (CAGR) of approximately 52%.

So why is the stock down?

As we know, Latin America is no stranger to economic volatility, particularly when it comes to inflation and currency fluctuations. And this seems to be the chief culprit for the recent sell-off in Nu shares, with Brazil (the bank’s key market) facing a challenging macroeconomic environment.

Some economists fear that tax changes in the country could stoke inflation. If this happens, Nu could be exposed to rising bad loans, especially as it now serves the most active credit customers in Brazil.

Extremely attractive valuation

Despite these risks, I reckon the company offers a compelling growth story for long-term investors to consider. The opportunities to cross-sell its current massive customer base appear substantial.

Meanwhile, 70% of the region’s population is still either unbanked or underbanked, according to Latin America Reports. So Nu has plenty of runway to grow beyond the three markets it’s operating in today.

Plus, the company recently invested $150m in start-up Tyme Group, a Singapore-based digital bank that has attracted 15m customers in South Africa and the Philippines. International growth seems likely in the medium term.

At $10, the stock’s forward price-to-earnings (P/E) multiple for 2025 is just 17.5, falling to 12.6 by 2026. And the shares trade on a price-to-earnings-to-growth (PEG) ratio of 0.5.

Traditionally, a good value for a PEG ratio would be 1, which highlights just how cheap this high-growth stock is right now.