After a tough year for oil prices, Shell and BP look like interesting passive income opportunities. But I’m looking outside the FTSE 100 when it comes to energy shares.

Chord Energy’s (NASDAQ:CHRD) the largest independent oil producer in the Williston Basin. And it has a different approach to the big oil majors.

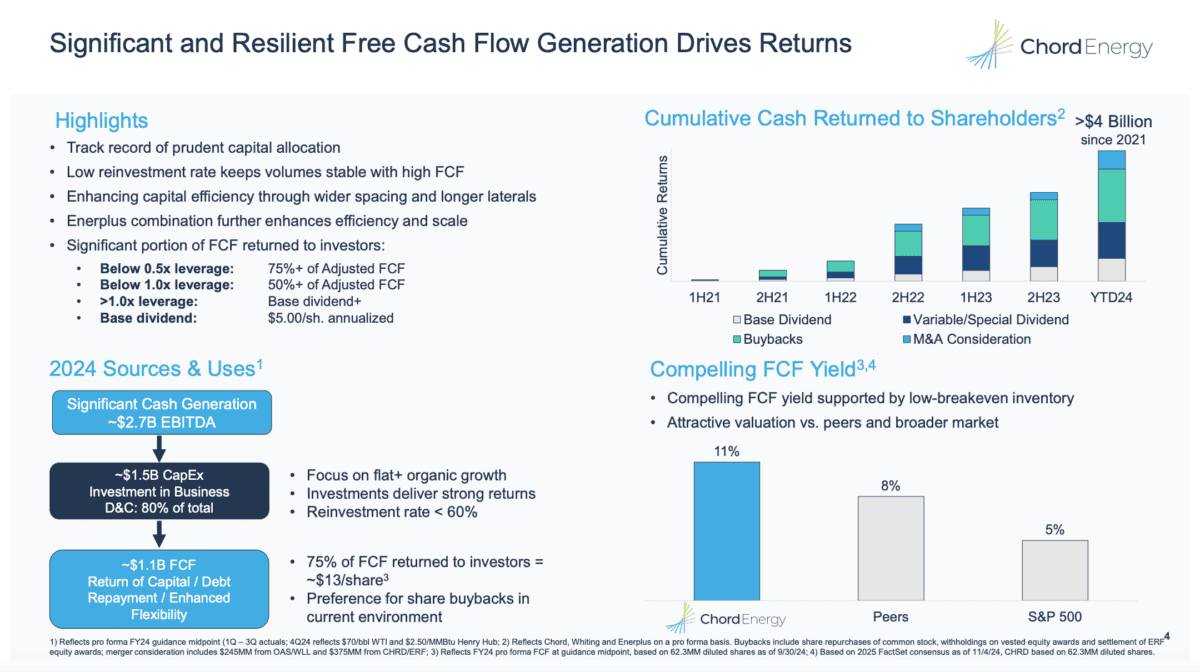

Investor returns

Based on $70 oil prices, the company anticipates returning $13 per share to investors in 2024 via dividends and share buybacks. With the share price currently at $119, that’s a return of almost 11%.

Source: Chord Energy Q3 Investor Presentation

Investors should note a couple of risks though. A similar outcome in 2025 is absolutely not guaranteed – lower taxes in the US might well increase oil supply and this could send prices lower.

On top of this, Chord doesn’t specify the break-even price of its assets in its investor materials. This makes it difficult for investors to assess what the effect of lower oil prices might be.

This makes it a riskier investment than I usually go in for. But I think the opportunity might be unique and it’s a risk I’m willing to take as part of a diversified portfolio.

What makes Chord different?

What makes Chord – potentially – unique is it doesn’t invest heavily in exploration projects. Unlike the likes of ExxonMobil and Chevron, it focuses on returning profits to shareholders.

The obvious limitation to this strategy is that oil wells don’t last forever. And when they run out, the company needs to find ways to replace them, otherwise its profits will dry up.

Rather than funding speculative projects, Chord prefers to do this by acquiring other businesses with established assets. The most recent example is its $4bn purchase of Enerplus in May.

Growing like this can put the firm’s balance sheet at risk. But the company’s actually in a very strong position, with a leverage ratio around a third of the level of its peers and a fifth of the S&P 500 average.

UK oil

Both Shell (4.5%) and BP (6.1%) have attractive dividend yields at the moment. And as a UK investor, I’m set to pay a 15% withholding tax on distributions I receive from Chord.

On top of this, I strongly suspect both the UK oil companies have lower production costs. And this gives them a clear advantage over the firm I’ve been buying shares in.

Despite this, I think the higher windfall taxes BP and Shell are going to have to deal with next year – and beyond – is likely to offset this. These got tougher in the Budget and look pretty durable to me.

By contrast, Chord’s (along with other US companies) likely to face lower taxes in 2025. And this should mean its production costs – whatever they are – come down.

I’m buying

I see Chord as one of the riskiest investments in my Stocks and Shares ISA, but I’m still buying gradually. What happens if oil prices fall is unclear.

From a passive income perspective though, I think the potential reward means the risk’s worth it. If oil prices just stay above $70, this is an investment that could turn out extremely well for me.