Investing within a tax-efficient account such as a Stocks and Shares ISA or Self-Invested Personal Pension (SIPP) is one of the best ways to obtain financial security. By putting money into financial assets such as shares and funds, investors can grow their wealth significantly over time.

Looking for investment ideas for 2025? Here are three to consider.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Dividend stocks for income

Dividend stocks are popular with British investors and it’s easy to see why. These stocks pay investors cash distributions (dividends) out of company profits on a regular basis and the yields can be very attractive.

For example, within the FTSE 350 index, there are over 30 stocks that have forward-looking dividend yields of more than 7%. With these kinds of yields on offer, it isn’t hard to build a passive income portfolio.

It’s worth pointing out that not all dividend stocks are created equal. Some have fantastic long-term dividend track records while others don’t. The key with this type of investing is to seek out companies with strong financials and healthy growth prospects. These kinds of companies are less likely to cut their dividends.

Growth stocks for gains

Growth stocks have generated strong returns for investors in recent years and I believe they’ll continue to do so in 2025. The reason I say this is that there’s an incredible amount of technological innovation going on across the world today (especially in the US).

One theme I reckon will continue to do well is artificial intelligence (AI). This theme has been hot for nearly two years now but it’s showing no signs of slowing.

Another theme that could do well is cybersecurity. This industry has massive growth potential and some analysts believe that it will be bigger than AI.

Thematic funds and ETFs can be a good way to play these kinds of themes. For AI exposure, I’m invested in the Sanlam Global Artificial Intelligence fund. Top holdings here include Nvidia, Amazon, Alphabet and Tesla. So I see it as a great way to play the theme.

Quality stocks for great long-term returns

My final idea for 2025 is ‘quality’ stocks. These are the stocks of high-quality businesses that have strong competitive advantages, consistent revenues and earnings, high levels of profitability, and plenty of growth potential.

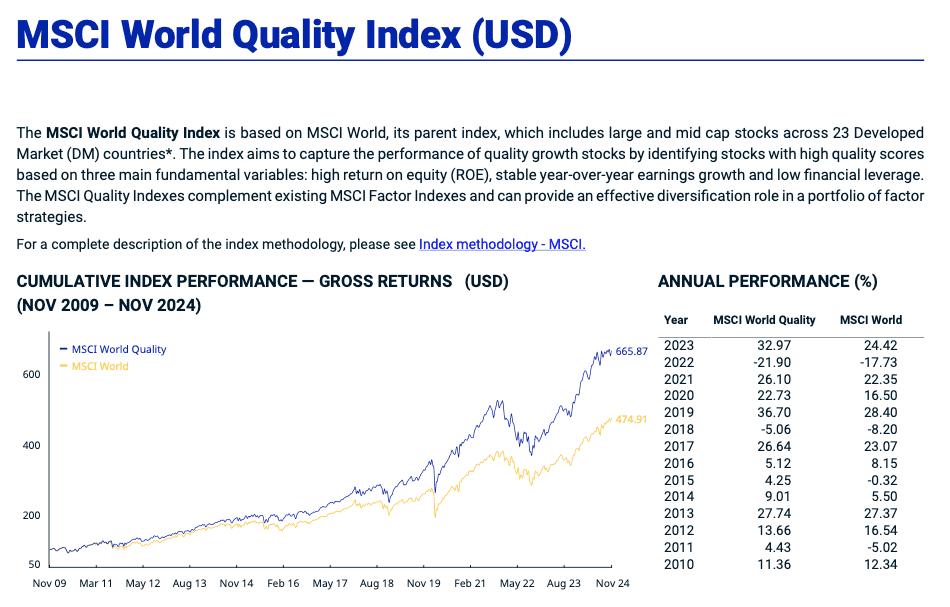

I’m a big fan of quality stocks as history shows they tend to outperform the market over the long run. For example, if we look at the MSCI World Quality Index, it’s smashed the regular MSCI World Index over the last 15 years.

Those looking for broad exposure to this area of the market may want to consider an ETF such as the iShares Edge MSCI World Quality Factor UCITS ETF (LSE: IWQU).

This ETF allows exposure to around 300 companies that screen up as high-quality. Top holdings currently include Apple, Microsoft and Nvidia.

Ongoing fees are just 0.25%. So the product’s very cost-effective.

It’s worth noting that quality stocks don’t always outperform. There will be times in the economic cycle when low-quality stocks have their moment so there are no guarantees that this ETF will do well in 2025.

In the long run though, quality stocks tend to produce great returns for investors. So I think exposure to this area of the market in 2025’s worth considering.