It has been a banner year for the London stock exchange in some ways. The FTSE 100 hit an all-time high, for example.

But a mood of gloom pervades much of the City. The UK is struggling to attract or even hang onto some companies that think they could get higher valuations in other markets.

That is reflected in valuations and, in some cases, dividend yields too. I reckon that actually offers a great opportunity for smart investors to take a lifelong approach to building wealth thanks to the relatively cheap valuations of some FTSE 100 shares.

How to build wealth over the long run in the stock market

When it comes to building wealth through share ownership, there are basically two potential drivers.

One is for shares to go up in price so that they can be sold for more than was originally paid for them. That price difference only matters when the shares are sold. So while holding them, an investor may have a paper loss or paper gain but that is all it is.

The second method of wealth creation is through receiving dividends.

Why low share prices can be good not bad news

It might seem that a falling share price is bad news.

But the price is just an indication of what an investor would pay to buy that share, or receive if they sell it.

So I reckon a falling share price can be good news if an investor has no plans to sell that share and the investment case is unchanged. It can offer an opportunity to buy more shares than previously with the same amount of money.

Plus, dividend yields are a product of dividend per share and share price. If an investor buys a share for £1 with a 5p dividend, they will earn a 5% yield. But if that share halves in price and the dividend is maintained (something that is never guaranteed), the yield on offer to buyers becomes 10%, not 5%!

Looking for bargains in the blue-chip index

That brings me to the FTSE 100 again.

One share I own and have bought more of in the past week is JD Sports (LSE: JD).

Even at its current price, the JD Sports dividend yield of 1% does not excite me – there are far higher yields available from proven FTSE 100 firms.

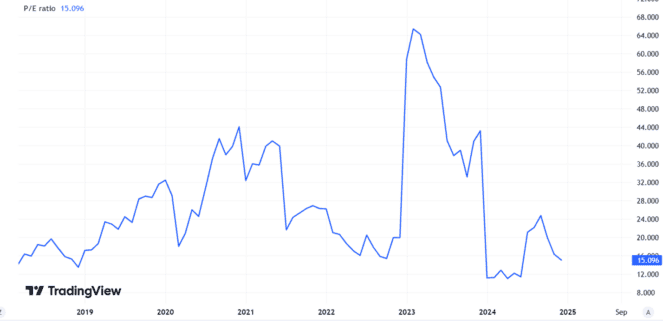

What does excite me, however, is the valuation. I think it is far below what JD Sports could be worth in future.

The retailer’s share has fallen 41% this year and trades for pennies. I think that reflects risks like weaker consumer spending hurting sales growth and profit margins. Several profit warnings this year have gone down like a lead bomb in the City.

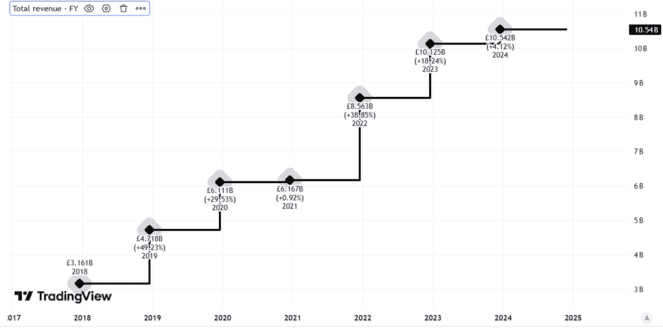

But JD Sports has a very strong brand, extensive international shop network, and large base of regular customers. Sales continue to grow.

Created using TradingView

It is spending lots of growing its shop estate further – money that if it wanted to, it could just keep as current profit rather than trying to grow future profitability.

What about the price-to-earnings ratio?

Created using TradingView

A market capitalisation of under £5bn looks like a potential bargain to me for a FTSE 100 company that – even after a profit warning last month – still expects full-year profit before tax and adjusting items to be at least £955m.