Diversification doesn’t necessarily mean investors need to compromise on big returns. There are many top exchange-traded funds (ETFs) that have delivered stunning profits while also helping buyers to effectively manage risk.

Past performance is not a reliable guide to future returns. But the average annual return on the following three ETFs is a whopping 16%.

To put that into context, a £15,000 investment spread equally across them would — after 25 years — turn into £797,608 if their performance remains unchanged.

Quality street

The first fund I’m looking at is the iShares Edge MSCI USA Quality Factor ETF (LSE:IUQA). During the last five years it’s delivered an average annual return of 14.7%.

It has holdings in five of the ‘Magnificent Seven’ tech stocks, namely Alphabet, Apple, Meta, Microsoft, and Nvidia. So it’s soared in value thanks to the buzz around artificial intelligence (AI) and other advancements of the digital revolution.

But this fund is no one-trick pony. Its focus on quality — namely “US companies that have historically experienced strong and stable earnings” — provides exposure to a multitude of robust sectors. Other major holdings include Visa, Eli Lilly, and Costco.

Almost 60% of the fund is tied up in cyclical sectors like information technology, financial, and consumer discretionary. This can create turbulence during downturns. But as we’ve seen, it can also deliver substantial returns over the longer term.

Caffeine fix

Gold’s surge to record highs has dominated commodities chatter during 2024. What’s commanded less attention is the coffee price, which in December also struck all-time peaks.

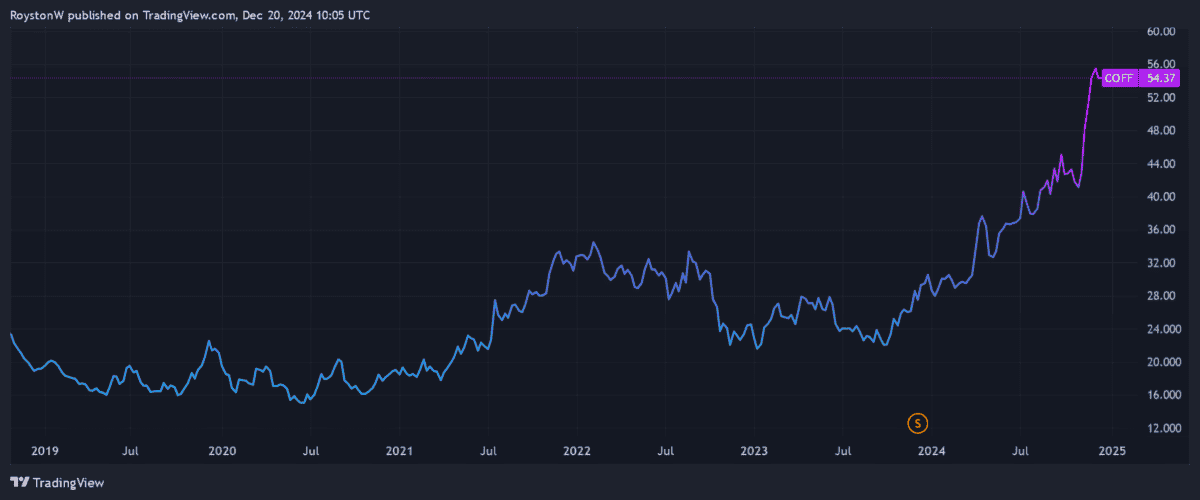

In fact, prices of coffee beans have been rising sharply over a number of years. So related ETFs like the WisdomTree Coffee (LSE:COFF) fund have subsequently rocketed in value.

Since 2019, this fund — which tracks the Bloomberg Commodity Coffee Subindex 4W Total Return Index — has provided an average yearly return of 20.7%.

A rise in extreme weather events has severely affected harvests of late. With climate change intensifying, supply shortages could become more common and push bean prices even higher.

So I think this Wisdomtree fund’s worth a close look, even though it’s denomination in US dollars, which makes returns vulnerable to exchange rate movements.

A passage to India

My final fund under the spotlight is the Franklin FTSE India ETF (LSE:FLXI). This product — which has holdings in 244 large and mid-capitalisation Indian stocks — provides excellent exposure to Asia’s fastest-growing economy.

During the last five years, it’s delivered an average yearly return of 12.7%.

Like the US iShares fund mentioned above, this Franklin Templeton ETF provides excellent diversification by sector. Major names include HDFC Bank, Infosys, Bharti Airtel, and Hindustan Unilever. So it provides a broad snapshot of Indian society.

On the downside, its focus on India makes the fund more susceptible to regional challenges compared to a globally diversified fund. However, the rate at which the local economy is tipped to grow still makes it an attractive investment to me.

Analysts at S&P, for instance, expect India’s annual GDP growth to average 6.7% between now and 2031.