One of Warren Buffett‘s most famous quotes is: “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years“. Here’s a growth stock I’d be happy to keep holding in this situation.

A recurring-revenue powerhouse

The share is Axon Enterprise (NASDAQ: AXON). This firm has come a long way from its early days selling just Tasers. Nowadays, software makes up around 37% of total revenue, with the rest coming from Tasers and body-worn cameras.

Axon’s annual recurring revenue has increased more than 500% in five years. Consequently, the stock has skyrocketed 764% over this period!

Should you invest £1,000 in Anglo American right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Anglo American made the list?

In some specific ways, the company reminds me of Apple and Amazon.

Like Apple, it has successfully built an ecosystem where its hardware (Tasers and bodycams) and software (via its digital evidence management platform) are deeply integrated. This encourages customer loyalty and drives long-term growth through recurring revenue streams.

All digital video evidence from bodycams, drones, dashcams, and other sources is stored in its giant cloud-based platform. This houses 30 times the amount of video as Netflix‘s library!

Like Amazon, whose mission is to be “Earth’s most customer-centric company“, Axon is relentlessly focused on its customers. Indeed, founder and CEO Rick Smith spends most of his time with the firm’s customers and its product teams, figuring out how products can be improved and what needs inventing.

I spend the majority of my time…ensuring that we are inventing and focused on the right things and aligning our efforts where our customers need us and where they need us to be for their future.

Axon Enterprise CEO Rick Smith

A need to deliver

It’s natural that when a stock’s been on a massive winning streak it ends up more richly valued. And that’s what we see here, with Axon trading at 18 times 2025’s forecast sales.

This doesn’t leave much margin of safety if sales unexpectedly slow down. The valuation tells us that the market is pricing in a lot of future growth.

If Axon can’t deliver on this, then the stock could be grossly overvalued today, even when taking a 10-year view.

Massive TAM

However, I’m optimistic about what lies ahead. Axon’s future contracted revenue now sits at $7.7bn. And while today it primarily serves law enforcement agencies, it’s rapidly moving into adjacent markets like the military, prisons, hospitals, justice (where legal professionals need to access stored evidence), private security, and more.

Recently, Walmart began piloting body cams for employees to try and deter rising levels of shopper violence. No confirmation yet, but shared photos online show staff with yellow-and-black devices (Axon’s trademark colours).

Walmart operates more than US 5,000 stores, with around 1.6m employees. This could be another massive new market.

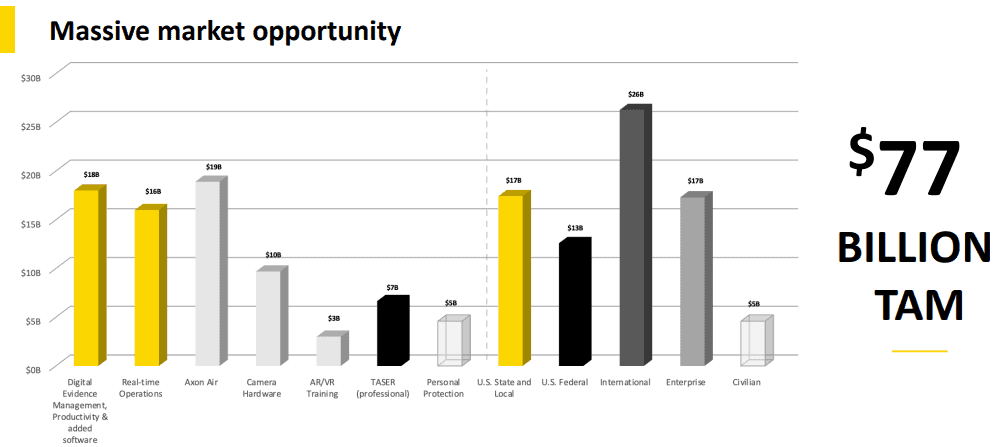

Where could Axon be in 10 years? Well, it puts the total addressable market (TAM) at $77bn, set against an expected $2.1bn in revenue this year.

It’s building up multiple new businesses, including drones as first responders to incidents, virtual reality training, and an artificial intelligence (AI) product subscription service.

The Taser 10 is the latest model, but future iterations might bring the company closer to its founding mission to “obsolete the bullet“. Either way, I expect this to be a much larger company in 10 years.