“Diversification is the only free lunch in investing,” according to the late economist Harry Markowitz. One way investors can diversify their portfolios is by investing an index like the FTSE All-Share.

I’m not sure whether Markowitz would or wouldn’t have put his own money in this UK share index today. But as a home to a wide spectrum of growth and income shares, it provides investors a chance to make big returns while also spreading risk.

As well as the FTSE 100 and FTSE 250, the FTSE All-Share also includes the FTSE Small Cap Index. In total, it covers around 98% of the entire market capitalisation of the London stock market.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

But how much would ISA investors have today if they had invested £20,000 in the index a decade ago?

Solid return

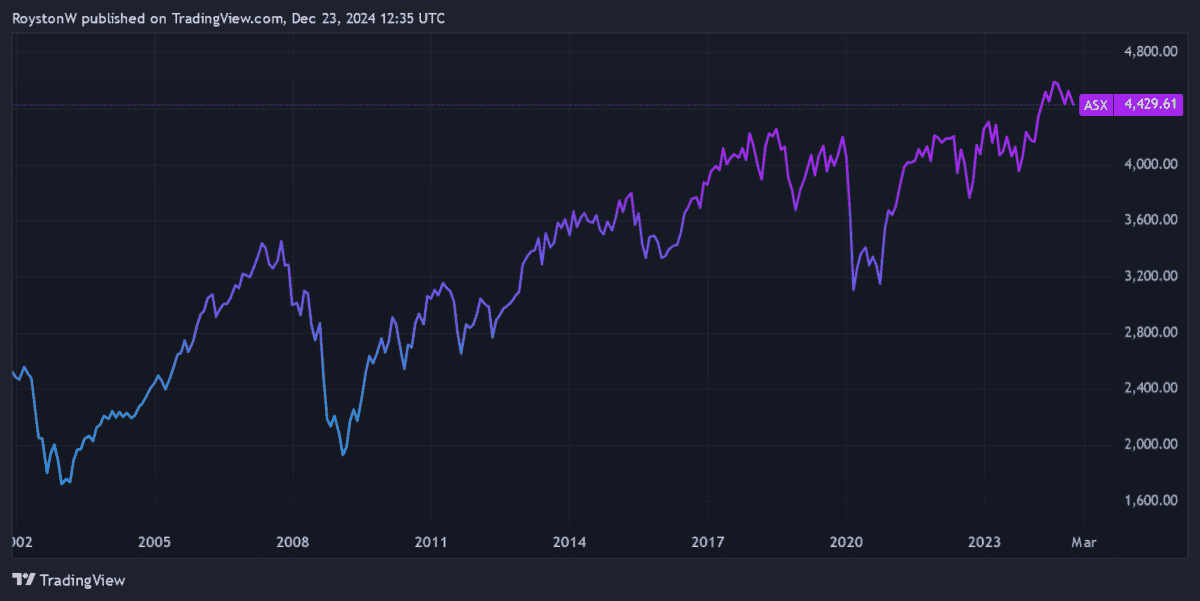

Since 23 December 2014, the FTSE All-Share has risen 24.9% in value. Combined with dividends, the average annual return for the index comes out at 6.1%.

This performance means someone who invested £20k — the maximum yearly allowance for a Stocks and Shares ISA — would now be sitting on £36,752, give or take a few pennies.

That’s not a bad result. In fact, it’s better than the 5.5% average annual return the FTSE 250 would have provided, along with the Footsie’s corresponding return of 6%.

An important caveat

That said, the FTSE All-Index’s returns are still far less than what a lump sum investment could have achieved elsewhere.

Let’s say an investor decided to park their cash in the S&P 500 instead. Based on an average annual return of 11.3% since 2014, a £20,000 lump sum in an index fund would have made them a whopping £61,587.

Past performance is no reliable guide to future returns. And following recent underperformance, some analysts believe UK equities could outperform many of their overseas peers in future, given their superior value.

However, there are also reasons to expect UK shares to keep lagging. The US stock market has a high concentration of high-growth tech stocks that could drive it higher. Furthermore, signs of revived weakness in the British economy could weigh on domestic share prices.

One top stock

So far, I haven’t been tempted to buy a UK tracker fund. Instead I’ve bought one that tracks the S&P 500, along with a couple of US-focused sector and thematic exchange-traded funds (ETFs).

However, I’ve also purchased some individual UK shares I think could outperform the market. Games Workshop (LSE:GAW), a giant in the tabletop gaming industry, is one I’ve increased my holdings in during 2024.

Over the past decade, it’s delivered an average annual return of 40.3%, driven by surging global interest in fantasy wargaming. It’s now a proud member of the FTSE 100 club following promotion this month.

The same strong performance isn’t guaranteed. But I’m confident it can continue its proud record as store numbers grow around the world, and it looks to supercharge royalty revenues through film and TV deals with Amazon.

Profits could slow during economic downturns. But on balance, I think this growth share will remain a better investment for me than a FTSE All-Share tracker fund.