Looking for ways to generate a huge second income over time? Here are three top tips to consider for the New Year.

1. Use an ISA and/or a SIPP

The first thing to think about is opening an Individual Savings Account (ISA). Both the Stocks a Shares ISA and Lifetime ISA allow investors to buy shares, funds, and trusts.

Investors should also think about opening a Self-Invested Personal Pension (SIPP), a product that allows access to these asset classes as well.

These three products have different rules concerning withdrawals and annual allowances. But each is worth serious consideration given that users don’t pay a penny in capital gains tax or dividend tax. Over time, this can add up to serious money.

What’s more, with Lifetime ISAs and SIPPs, the government effectively gives savers and investors money through tax relief. This provides savers and investors with additional resources for compounding wealth in the long run.

2. Choose wisely

There are literally tens of thousands of assets investors can choose from today. While overwhelming, such a broad selection offers a wealth of opportunity.

Each one of us has different financial goals, investing styles, and tolerance of risk. So there’s no blueprint as to what the perfect portfolio will be.

One good idea is to observe what other successful investors have been buying and selling. I’m a keen watcher of what ‘Sage of Omaha’ Warren Buffett‘s been trading with his Berkshire Hathaway investment firm. Given his $100bn+ fortune, his trading activity’s always worth paying attention to.

But regardless of what others are doing, what stock tips you may read, or what market trends look white hot, it’s critical that you do your own research before buying and selling any asset. Even the likes of Buffett get it wrong. So pore over trading statements, balance sheets, industry reports, and other material yourself.

3. Build a diversified portfolio

While the specific assets we buy can differ markedly, building a diversified portfolio is a critical strategy every investor should consider.

Doing this can help reduce risk and provide a stable return across the economic cycle. It also means investors get exposure to a myriad of opportunities that can supercharge their portfolios.

This year I’ve bought an wide array of growth, dividend, and value shares like baker Greggs, insurer Aviva, drinks bottler Coca-Cola CCH, and building materials supplier CRH. I’ve also purchased exchange-traded funds (ETFs) like the Xtrackers MSCI World Momentum ETF (LSE:XDEM).

As its name implies, this fund invests in a range of global equities, 350 in total, with cash spread across large- and mid-cap companies. Big holdings here include tech stocks Apple and Nvidia, although other sectors like industrials, financials, and telecoms are well represented, providing decent diversification.

Its focus on momentum shares can be a risk, because these stocks are typically priced based on recent strong performance, which may not be sustainable. But its collection of established heavyweight names helps soothe any fears I have.

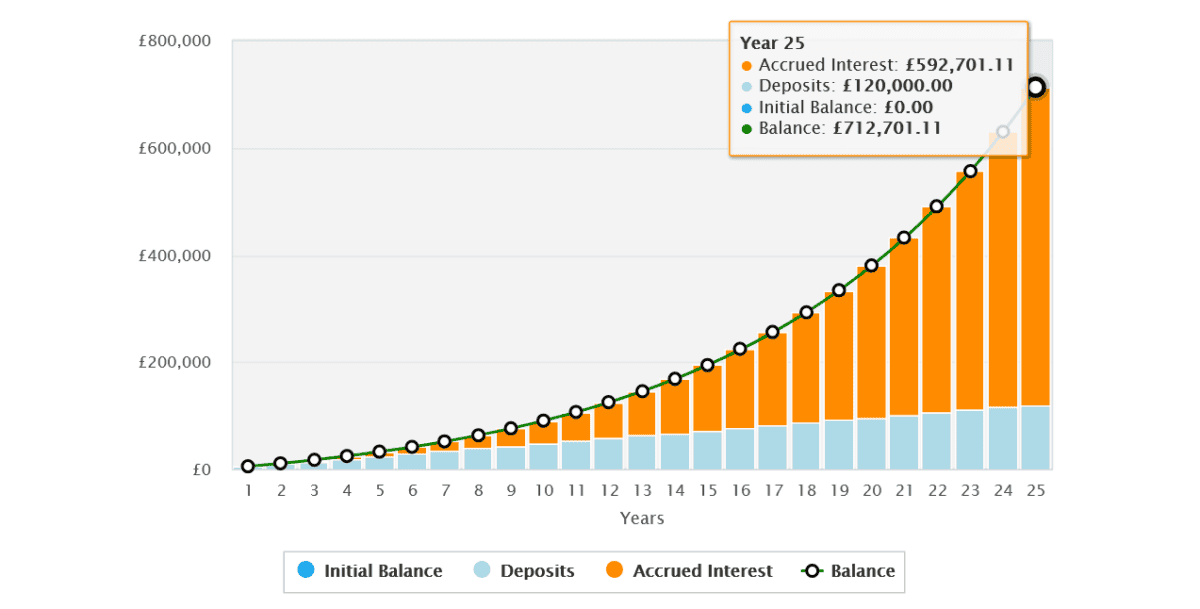

So does the fund’s robust returns, which since 2014 have averaged 11.7%. Based on this performance, a £400 monthly investment here could generate £712,701 after 25 years. This would then create an annual passive income of £28,508 based on a 4% drawdown rate.