I won’t keep anyone in suspense – I don’t have a positive outlook for the Nvidia (NASDAQ:NVDA) share price in 2025. After an outstanding couple of years, I think things are finally starting to change.

Over the last six months, the stock’s traded sideways as revenue growth’s started to decline. I think this is set to continue next year, which makes me pessimistic about Nvidia shares.

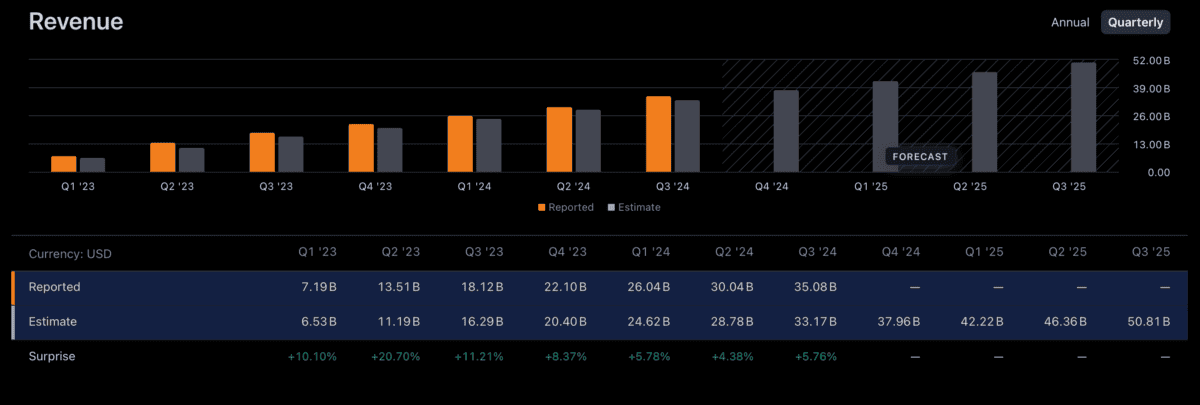

Revenue growth

Nvidia shares are up over 2,000%, but the majority of the increase has come in the last two years. And the reason for this is actually fairly straightforward.

Should you invest £1,000 in Taylor Wimpey right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Taylor Wimpey made the list?

Since the start of 2023, the company’s sales have been increasing rapidly. After modest growth between 2020 and 2022, growth’s picked up significantly and the share price has followed.

Nvidia Total Revenue 2020-24

Created at TradingView

This however, doesn’t quite tell the full story. Specifically, it doesn’t explain why the share price has stopped exploding higher over the last six months.

The reason is that while total sales have been going up, they haven’t been growing at the same rate. Over the last couple of quarters, Nvidia’s rate of sales growth has actually been declining.

Nvidia year-over-year sales growth rate 2020-24

Created at TradingView

It seems strange to think that investors might be unimpressed by 93% revenue growth. But in the context of a company that managed 206% a year ago, it’s a move in the wrong direction.

In think the above chart best explains the Nvidia share price over the last two years. So the thing investors need to figure out is what it’s going to look like in 2025.

What will 2025 bring?

At the risk of stating the bleedin’ obvious, Nvidia increasing its rate of sales growth’s going to be a big challenge. And I think this is going to be the case more and more as 2025 unfolds.

Analyst forecasts seem to bear out this view. The expectation is that sales will reach $50.81bn by Q3 2025. That’s 53% higher than in the same period of this year.

Created at TradingView

I’m not saying this is anything other than impressive from the underlying business. And I can’t think of many companies where that kind of revenue growth would be a disappointment.

What I am saying though, is that this would be lower than the growth rate the company’s currently achieving. And this makes me pessimistic about the share price in 2025 – especially as the year wears on.

Nothing’s certain and Nvidia could surprise people – including me. Its new Blackwell chip looks very impressive and the company has an extremely strong competitive position in a growing industry.

Despite this, with the firm already selling to the world’s biggest businesses (and in some cases, entire nations) I’m doubtful about a 94% growth rate in 2025. And that makes me wary about the share price.

So… short Nvidia, then?

I’m not about to bet against the Nvidia share price going into 2025. But I think investors who want to understand what the share price has been doing over the last five years don’t need to look too far.

It’s not just sales growth that has sent the stock higher – it’s the rate at which they’re growing. But this has been dropping and with analysts expecting further declines in 2025, investors need to be careful.