The Santa Rally of early December now seems a long, long time ago. Today, stock markets are awash with a sea of red, with some predicting that a US stock market crash could be around the corner.

So what’s going on? And what action should investors like me take?

Here’s what’s happened

Hopes of swingeing interest rate cuts in 2024 and 2025 have boosted global share markets this year. Base rate reductions provide an economic stimulus and bring down borrowing costs, boosting corporate profitability.

But stickier inflation more recently suggests these extreme rate reductions may not be on the horizon after all. Such suspicions have exploded following the US Federal Reserve’s latest meeting yesterday (18 December).

As expected, the central bank cut its benchmark rate again, to 4.25% from 4.5%. But Fed chairman Jerome Powell warned that “from this point forward, it’s appropriate to move cautiously and look for progress on inflation.”

By adding that inflation could take “another year or two” to get to the bank’s 2% target, higher interest rates may last much longer than had been hoped.

What next?

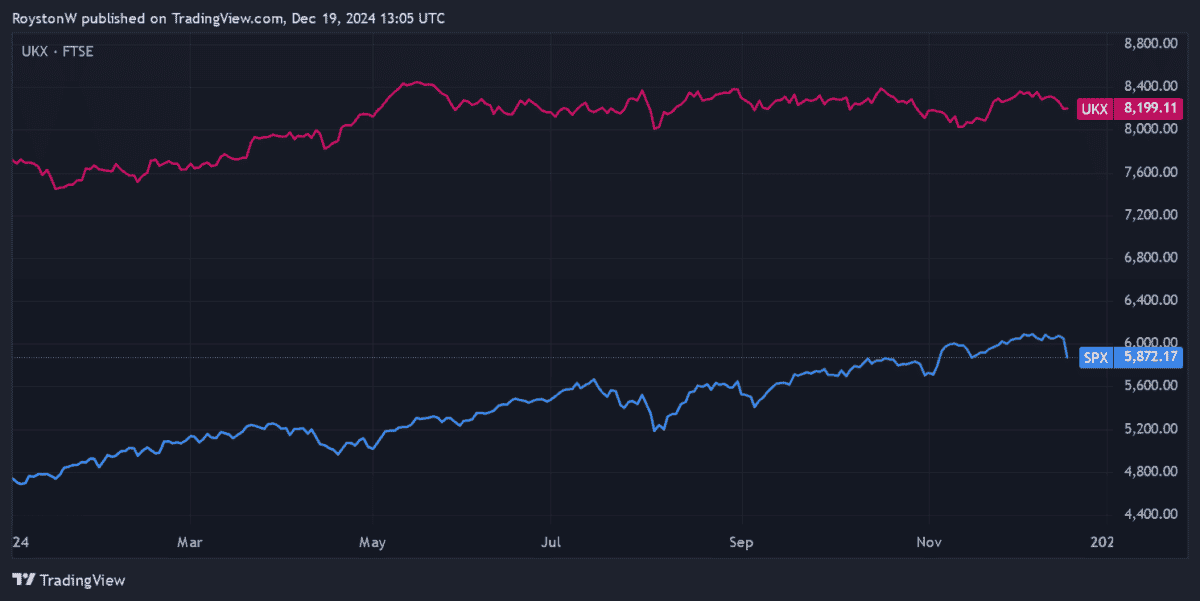

Stock markets have plunged across the globe as a result. In London, the FTSE 100 slumped to one-month lows just above 8,000 points today. Yesterday, the S&P 500 index of US shares dropped to six-week troughs.

Since earlier rallies were built on expectations of rate cuts, these retracements are not surprising. Even after the wipeout of the last 24 hours, the S&P 500 remains up 23% in the year to date.

Could this be the beginning of a bloodbath? Many analysts say global stocks are overvalued given problems like China’s struggling economy, potential new trade tariffs, and those signs of persistent inflation.

In this context, further falls could be around the corner.

This is my plan

Correctly guessing how share markets will behave in the near term is a very tough task. At any given time, stock prices are affected by a range of macroeconomic and geopolitical factors. Surprises can also spring up that shake asset values, as we’ve just seen.

My guess is that a market crash is unlikely. But as I say, I can by no means be certain.

But whether the near-term outlook is bad or good, my own investing strategy remains the same. Market turbulence is common, yet share investing still delivers impressive long-term returns. So reducing my share holdings makes little to no sense.

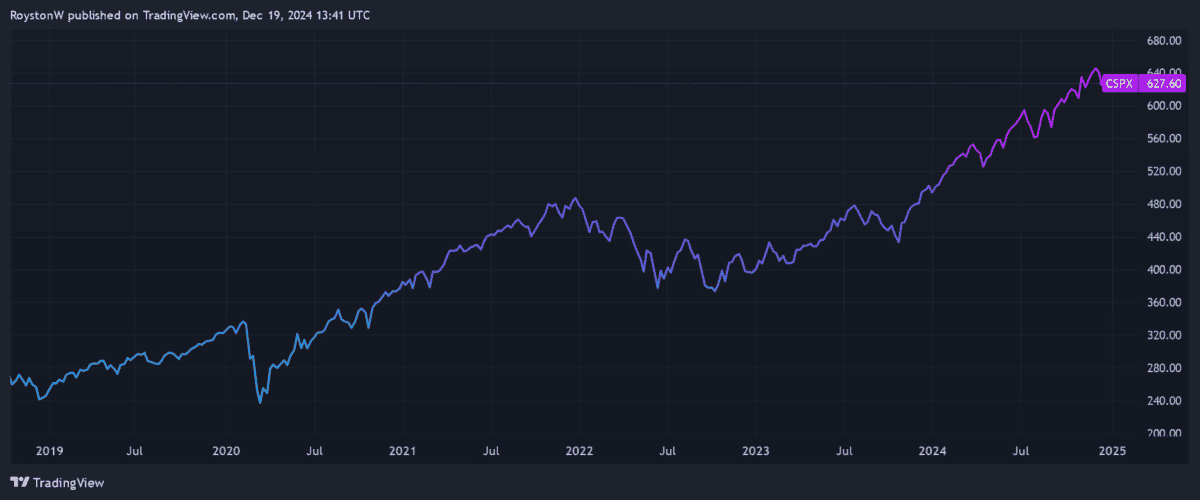

The S&P 500, for instance, has provided an average annual return of 12.7% over the past decade. It’s delivered these whopping returns despite problems like the Covid-19 pandemic, rising geopolitical tensions and higher interest rates.

At times like these, I therefore look for beaten-down shares, funds and trusts to buy. And the iShares S&P 500 ETF (LSE:CSPX) is one I’m considering buying more of following the index’s sharp drop.

As the name implies, it gives me exposure to the entire S&P 500, which helps me to spread risk. Having said that, it also has considerable growth potential due to its high weighting of tech stocks including Nvidia and Microsoft.

With an ongoing charge of 0.07%, it’s one of the most cost-effective funds tracking the US index too.

Past performance isn’t a reliable guide of future returns. But if this iShares fund’s long-term return remains unchanged, a £10k investment today would more than triple to £36,365 a decade from now.