Cohort (LSE:CHRT) shares are up 100% over the last 12 months, but it might not be too late to consider buying the stock. Management sees more opportunities ahead for the defence business.

The stock trades on the Alternative Investment Market (AIM), which means it gets less coverage than its FTSE 100 or FTSE 250 counterparts. But this could be a hidden gem for UK investors to consider.

What does Cohort do?

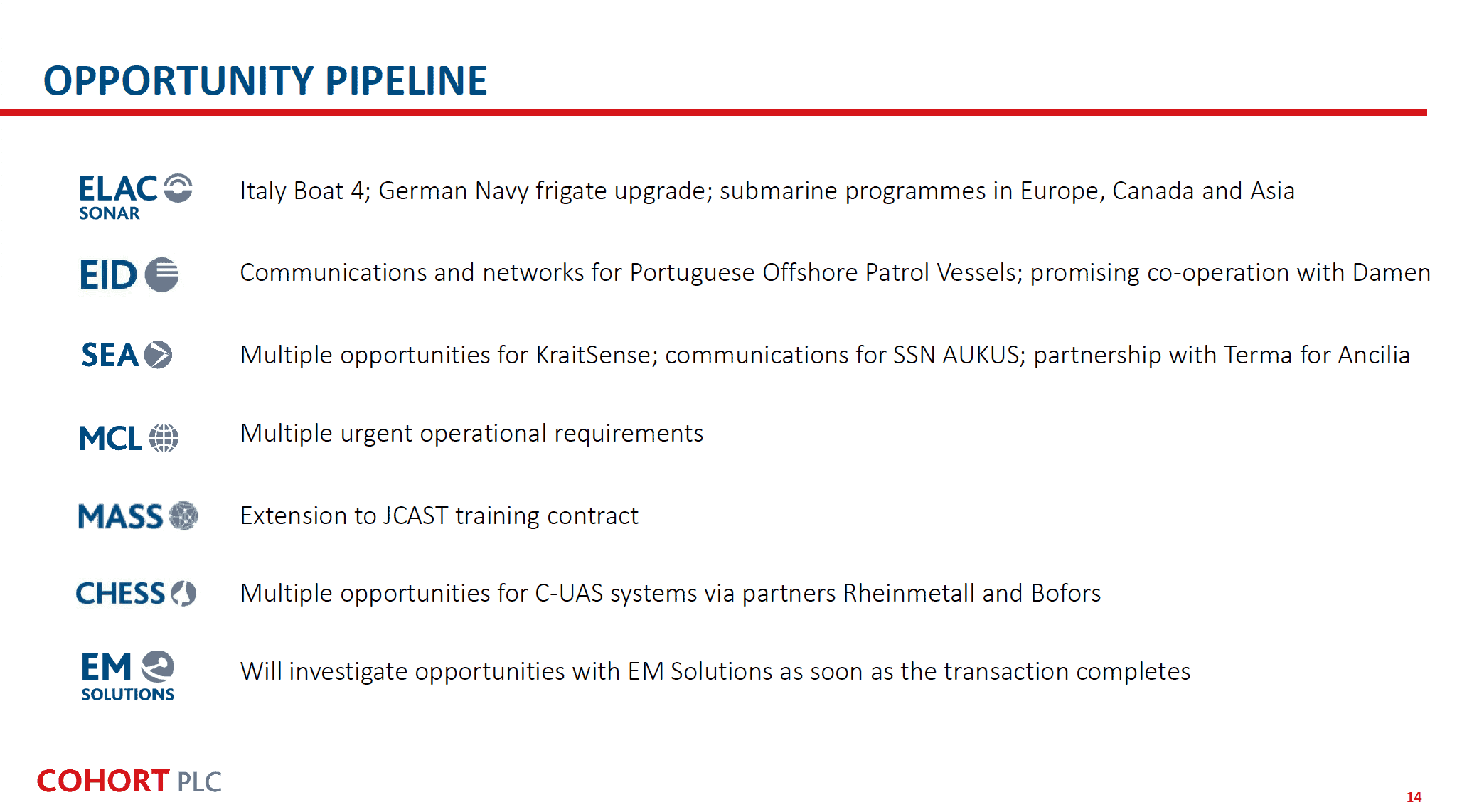

Cohort is a collection of six smaller businesses focused on defence. And with ongoing conflicts in Ukraine and the Middle East, investors might expect to see strong demand for the company’s products.

This has indeed been the case. Sales have increased 25% and widening margins mean this has translated into 90% growth in earnings per share.

Importantly, though, Cohort’s success isn’t just the product of geopolitical tensions. Management has been growing the organisation in ways that should provide durable results.

Source: Cohort Interim Results FY 24/25

The company’s growth strategy is built on acquiring other firms and improving their operations. Chess Dynamics – a surveillance and fire control business – is a good example.

Cohort acquired the outfit in 2018 for a cost of around £21m. Since then, margins have expanded from 2% to 10%, and earlier this year, it won three air defence contracts worth over £25m in total.

Importantly, it looks like there’s more to come. With improvements to its Portuguese subsidiary and the acquisition of EM Solutions this year, management expects growth to continue.

Risks and rewards

With the stock trading at a price-to-earnings (P/E) ratio of 29, the market is expecting Cohort’s earnings to grow. And acquisitions are likely to be a key part of the growth plan.

With this type of approach, there’s always a danger of paying too much to bring in a new subsidiary. And this is something investors should be especially wary of at the moment.

Cohort is benefiting from strong demand at the moment and it’s easy for a firm to overplay its hand in this situation. But as Synthomer demonstrated during the pandemic, this can be costly.

The key is going to be keeping an eye on the company’s balance sheet. If it can avoid getting too far into debt to fund its investments, I expect things to work out well over time.

The acquisition of EM Solutions is set to take the business into a net debt position this year. But if the firm keeps growing its profits, I don’t see anything to worry about on this front – yet.

If Cohort can get this right, though, the rewards could be huge. A look at the returns from the likes of Halma and Diploma shows what can happen when a company acquires well.

To buy or not to buy?

I don’t think it would be mad for me to consider buying Cohort shares at today’s prices. The business has a strategy that has powered some of the UK’s most impressive growth stocks.

The rate at which earnings increase will inevitably depend on the geopolitical situation. But I’m seriously considering adding the stock to my portfolio before the end of the year.