UK shares, as measured by the FTSE All-Share Index, have had a solid — if unspectacular — 2024. Since the start of the year, the index — which captures 98% of the UK’s market capitalisation — has increased by 7.5%, beating its five-year annual average of 5.7%.

Admittedly, other markets have performed better. For example, the S&P 500 – boosted by the Magnificent 7 — has rocketed nearly 27% this year. But ironically, I think the lack of reliance on technology stocks is one of four reasons why the FTSE will do well in 2025.

1. Back in fashion

US equities are now valued at an eye-watering 2.08 times gross domestic product (UK: 1.08).

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

According to IG, the cyclically adjusted price-to-earnings ratio (CAPE) for American stocks is currently 31.1 (UK: 18.6).

But only 1% of the movement in the FTSE All-Share Index is accounted for by tech stocks. As valuations in the sector become increasingly stretched, this could help ‘old-fashioned’ energy, mining, and banking shares that dominate, in particular, the FTSE 100.

One such stock is Lloyds Banking Group (LSE:LLOY).

It’s one of the highest-yielding on the index. In respect of its 2024 financial year, the bank looks likely to pay a dividend of 3.18p a share. This means the stock’s presently yielding 5.8%, comfortably above the Footsie average of 3.8%.

Dividends are never guaranteed. But based on the bank’s results for the first nine months of 2024, I think its payout looks reasonably secure for now. Revenue, post-tax earnings, and the return on tangible equity were all higher than analysts were expecting.

However, the ongoing investigation into the possible mis-selling of motor car finance is weighing on the bank’s shares at the moment.

In my view, even if the most pessimistic of predictions comes true, Lloyds will be largely unaffected. At 30 September 2024, its balance sheet contained over £900bn of assets, including £59bn of cash and cash equivalents.

But despite my optimism, investors are twitchy and, therefore, I’m going to wait until the picture becomes clearer before deciding whether to invest or not. I’m also concerned that so-called ‘challenger banks’ could pose a threat.

2. Dividends galore

However, Lloyds is just one of many dividend stocks out there.

The FTSE All-Share Index has yielded 4% over the past 10 years, compared to 2% for the S&P 500. When share buybacks are taken into account, the cash yield for UK equities rises to 6%.

This should help lift the domestic market in 2025. And could explain why cash is returning.

3. Loads of money

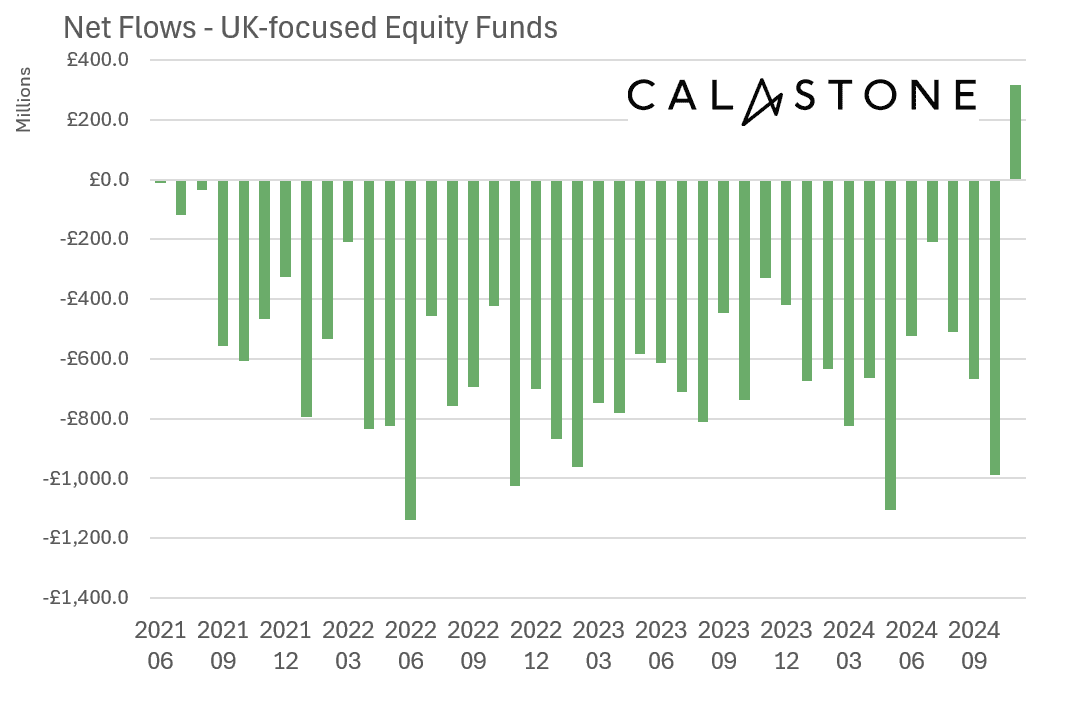

Figures from Calastone show the first net inflow of funds into UK-focused equity funds since May 2021, when the global funds specialist started monitoring these things.

In my opinion, I think this provides strong evidence that investors believe the UK stock market currently trades at a discount to its peers.

4. Return to growth

Finally, I’m encouraged by the recent upgrade to the OECD’s 2025 growth forecast for the UK (from 1.2% to 1.7%).

And with the Governor of the Bank of England hinting at four interest rate cuts next year, consumer (and investor) sentiment should pick up. Higher disposable incomes should give people more cash to invest.

With most of my investment portfolio concentrated in UK equities, I hope others share my optimism for 2025!