Buying penny stocks can be an excellent strategy for building stunning long-term wealth.

Small-cap stocks like these can experience spectacular earnings growth, delivering large capital gains in the process. Yet this high-reward strategy also comes with significant risks.

Penny stocks can be more vulnerable to collapse if industry or economic conditions turn sour. Share price volatility is also common.

This is why purchasing small caps with low valuations can be a good idea. Low price-to-earnings (P/E) ratios, for instance, provide a cushion that can limit price falls if news flow worsens.

These two penny stocks look cheap on paper. Which is the best one for investors to consider?

Petra Diamonds

Petra Diamonds (LSE:PDL) hasn’t had the best of it in recent years. Slumping stone prices, production issues, and balance sheet woes have caused its share price to collapse and remain in the gutter.

City analysts expect it to remain loss-making this financial year (to June 2025). But a return to growth in fiscal 2026 means the miner trades on a P/E ratio of just three times.

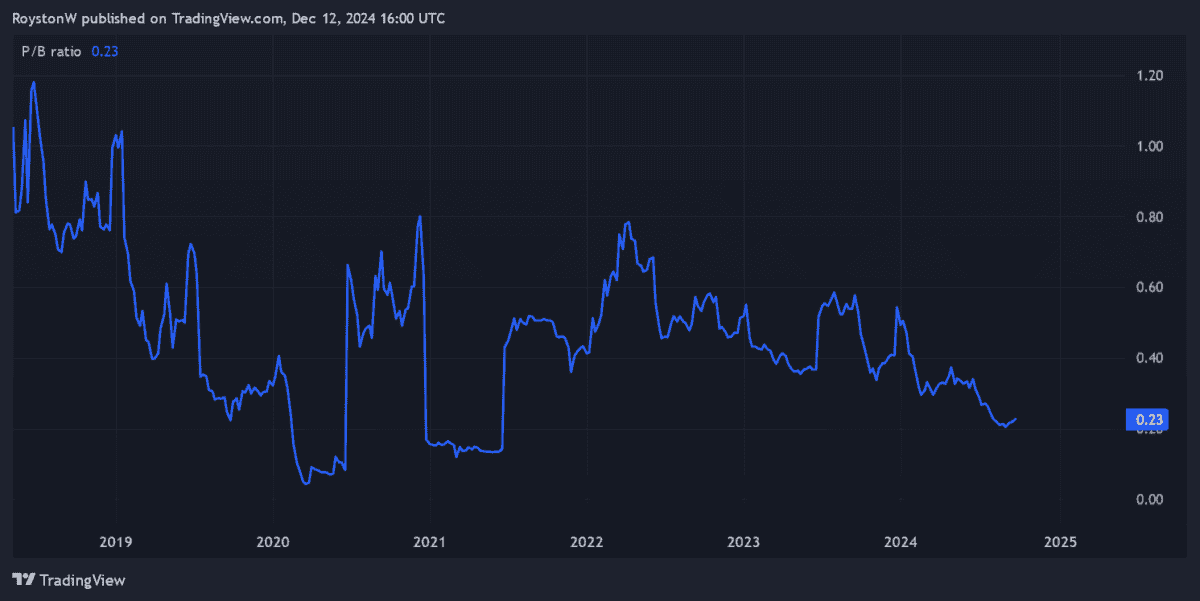

That’s dirt-cheap on paper, as is Petra’s price-to-book (P/B) ratio. At 0.2, this is some distance below the watermark of 1, indicating it trades at a big discount to the value of its assets.

Could now be the time to buy in?

The company’s planning to boost output at its Finsch and Cullinan mines in South Africa over the next several years at it plots a comeback. It’s hoping to produce between 3.4m and 3.7m carats by 2028.

But the risks to a recovery are significant, and they’re not just operational. Diamond prices may remain weak depending on economic conditions, while synthetic stones also continue growing in popularity.

Added to this, Petra still has a lot of debt on its books. Net debt was $285m as of September, in fact.

Petra’s average annual return over the past decade is a jaw-dropping -42.5%. I think investors should consider avoiding it.

Pan African Resources

Pan African Resources (LSE:PAF) also looks dirt cheap on paper. Despite the bright outlook for gold prices, and its Mogale Tailings Retreatment (MTR) project coming on stream, it continues to command a low valuation.

For this financial year (also to June 2025), the gold miner trades on a P/E ratio of 6.4 times, a reading that drops to 4.5 times for fiscal 2026.

In addition to this, the price-to-earnings growth (PEG) ratio on Pan African shares is 0.1 for both the next two financial years. A sub-1 reading indicates that a stock is undervalued.

Like Petra, revenues are highly sensitive to the commodity it produces. A sudden drop in precious metal prices could destroy current earnings projections.

But for the moment, the price picture for gold looks upbeat. Increasing economic uncertainty, falling interest rates, and rising geopolitical tension are all supporting safe-haven gold.

And new production at MTR is helping Pan African capitalise on this favourable environment.

Investing £500 today

With share price gains and dividends combined, the company’s delivered a healthy average annual return of 11.8% during the last decade.

Past performance isn’t a reliable guide to the future. But if this penny stock can continue that exceptional run, a £500 investment today — blended with a £500 monthly investment for the next 10 years — would eventually turn into £115,295.