At the start of the year, I wrote that I thought Rolls-Royce (LSE:RR) shares were undervalued heading into 2024. That was despite the stock having roughly tripled in 2023.

Since then, it has climbed another 90%. And while I’m still positive on the stock going forward, I’m more cautious heading into 2025.

Earnings growth

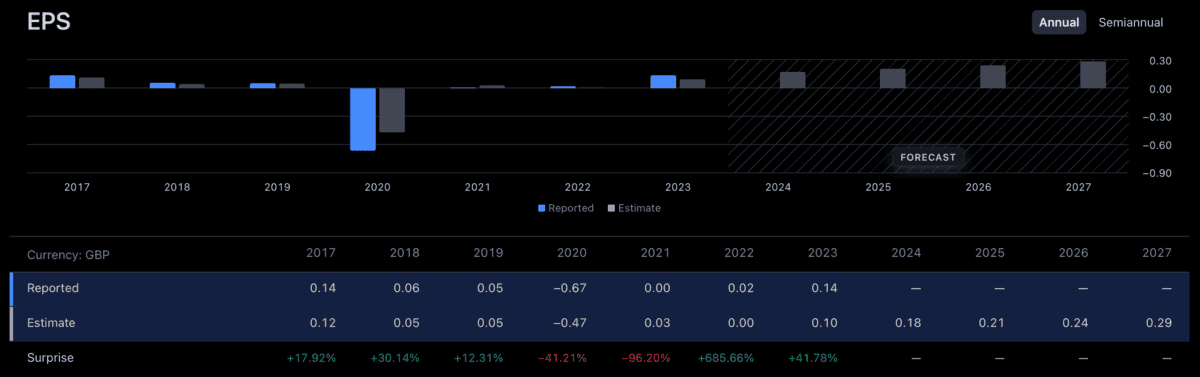

Rolls-Royce is still firmly on a growth trajectory. Earnings per share are expected to go from 14p in 2023 to 18p this year – and it’s not just about a Covid-19 recovery any longer.

Should you invest £1,000 in Rolls-Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls-Royce made the list?

There are also plenty of reasons for future optimism. An expansion into narrow-body aircraft, a shift to sustainable aviation fuels, and a rise in nuclear energy are potential opportunities.

Analysts are forecasting earnings per share to reach 21p in 2025 and 29p by 2027. I think this could well turn out to be accurate.

Rolls-Royce EPS forecasts

Source: TradingView

Despite this, some of the reasons I had for being positive on Rolls-Royce shares at the start of 2024 are gone. So it’s worth reconsidering the stock from an investment perspective.

Valuation

The biggest reason is valuation. One of the reasons I gave at the start of the year was that Rolls-Royce shares were trading at a discount to their counterparts elsewhere in Europe.

The FTSE 100 stock was trading at a price-to-earnings (P/E) ratio of 15. But that was lower than the firm’s European counterparts, which were trading at P/E multiples above 20.

In fact, that’s where a lot of the increase in the Rolls-Royce share price has come from. The stock is up 90% but earnings per share are only set to increase 28%.

As a result, the valuation gap I was seeing at the start of the year has closed. So while it’s possible the P/E multiple could expand further in 2025, I’m not expecting it to.

Growth

The other reason I’m hesitant on Rolls-Royce shares in 2025 is growth. Over the next few years, earnings per share growth is expected to go from 18% to 16% to 14%.

To some extent, this should come as no surprise to investors as the company recovers from an unusually difficult period. But I’m not expecting 16% earnings growth to push the stock up 90%.

There are also some short-term issues. Problems at both Boeing and Airbus have led to aircraft being grounded – and the effect of reduced flying hours on Rolls-Royce is well known.

That makes me cautious about the anticipated 16% earnings growth for 2025. I’m not ruling it out, but the firm wouldn’t be the only aerospace engineer to find the environment challenging.

Outperformance?

I think there are strong reasons not to expect the Rolls-Royce share price to repeat its performance over the last couple of years. But I think it could still outperform the FTSE 100.

The valuation gap to its European peers has closed up, but it isn’t extravagant. And while 16% earnings growth isn’t spectacular, it’s still pretty strong.

Rolls-Royce shares might not be the bargain they once were. But I think investors could well see the stock do well in 2025 and beyond. I believe the stock is worth considering.