The stock market is in a tricky place right now. Valuations have been rising and predicting what 2025 will bring in terms of geopolitics, inflation, and artificial intelligence (AI) isn’t easy.

Despite this, I don’t want to keep money in cash with interest rates continuing to fall. So I’m looking for opportunities that aren’t based on specific general forecasts for next year.

Should you invest £1,000 in BP right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BP made the list?

A confusing stock market

There are a few interesting themes in the stock market at the moment. One is a general mood of optimism in the US compared to the UK – and there are good reasons for this.

While the US looks set to lower taxes and reduce regulation, the UK seems to be going the other way (with the exception of banking). Which move is the right one remains to be seen.

There’s also geopolitical uncertainty right now. Whether it’s the conflict between Russia and Ukraine or in the Middle East, there’s a lot of potential for things to get either better or worse.

This could have a big effect on oil prices, which significantly influence costs for a lot of firms. And making predictions about how this will go seems very difficult.

Lastly, there’s AI. The big winners in terms of sales growth have been Nvidia and Palantir – companies with legitimate AI products ready to deploy, rather than just optimistic predictions.

The AI revolution looks genuinely important and I expect whatever the next business to launch a breakthrough product is to do well. But I’m not sure I can forecast exactly who that is yet.

Finding stocks to buy

At times like this, I look for the most undervalued stocks I can find. Not because they can’t go down (they definitely can) but because their value doesn’t depend on a difficult prediction.

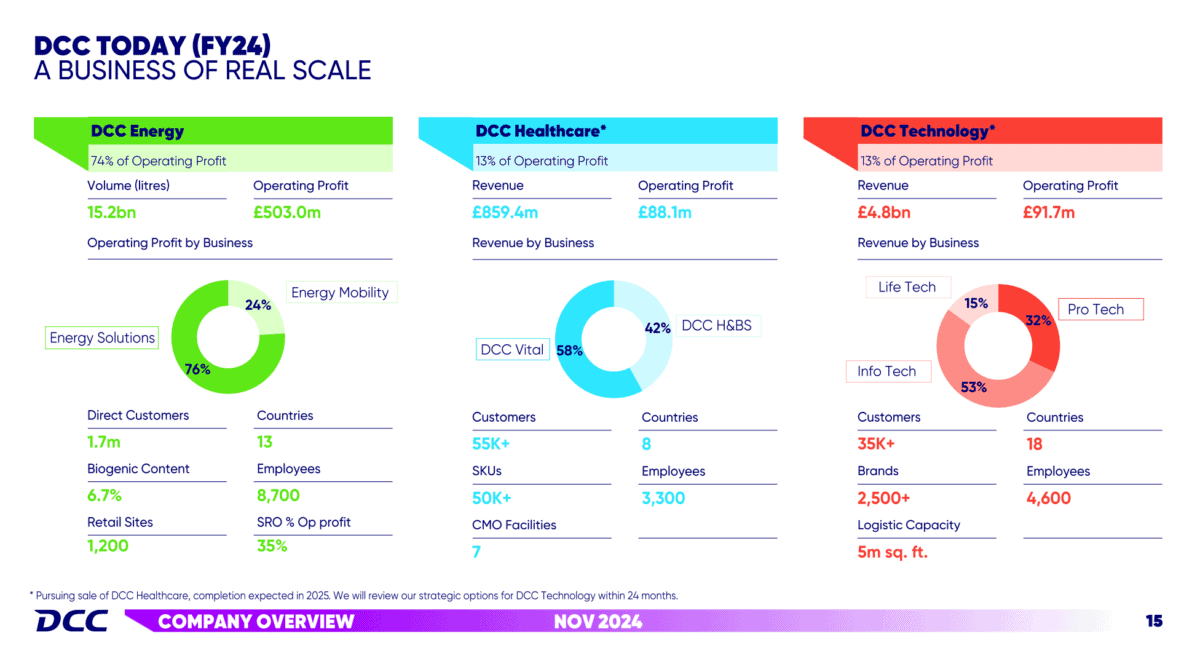

DCC (LSE:DCC) consists of an energy unit making £503m in operating profit, a healthcare arm generating £88m, and a technology division earning £92m. The firm has a market cap of £5.6bn.

Source: Company Overview November 2024

That looks cheap to me, but stocks can trade at depressed multiples for a long time. But DCC is looking to realise some of the value by divesting its healthcare and technology units.

The risk is that they might not be able to do this. Selling off those divisions depends on finding a buyer willing to offer a decent price for them, which isn’t guaranteed by any means.

I don’t think DCC needs to do much to generate a good deal though. With the energy business growing at 7% per year, it might be worth the market cap by itself.

With its balance sheet in good shape, the company is looking to return the cash raised by the divestitures to shareholders. That means there could well be a substantial dividend on the way.

Is it my best option?

Is DCC going to be the stock that generates the biggest return from this point on? Almost certainly not, but it does have one big advantage over other opportunities at the moment.

The investment thesis for DCC doesn’t depend on any complicated prediction about economics, politics, or technology. It just comes down to the firm’s assets and its plan to unlock value.

I think that makes it attractive. Once I’ve got cash together, I plan to make it the next addition to my portfolio.