As the year rapidly draws to a close, I’m checking the dividend forecasts of high-yield stocks for 2025 and beyond.

I already hold shares in the following two companies and explain here why other investors may want to consider them for passive income.

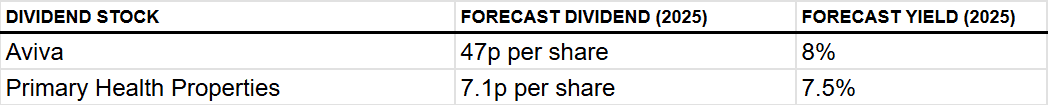

For comparison, the average yield in the UK is currently around 3.5%. That makes the potential returns on these shares well above average.

Should you invest £1,000 in British American Tobacco right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if British American Tobacco made the list?

But the yield alone is not the only factor to consider. Since dividends are never guaranteed, it’s important to assess how well-positioned the business is and if it can continue paying dividends.

Aviva

Aviva (LSE: AV.) has a long track record of consistent dividends, forecast to continue through 2025. The 7% yield is set to reach 8% by the end of next year, with the dividends rising from 33.4p per share to 42p by 2026.

Earnings per share (EPS) are forecast to rise faster than dividends, from 42p to 53p per share by 2026. As earnings improve, the company’s price-to-earnings (P/E) ratio is forecast to decrease from 11.6 to 9.1. This is comfortably below the UK insurance industry average of around 16, suggesting the current price represents good value.

Keep in mind that the economy is fickle and the insurance industry is at its whim. Interest rate fluctuations present an ever-present risk. While lower rates threaten investment income, higher rates can lead to fewer contributions and a decrease in business.

If one (or more) of Aviva’s many competitors can afford to undercut the market, it could steal away customers, threatening the company’s profits. It’s currently attempting to buy out smaller rival Direct Line, although its bids have so far been rejected.

It has long been one of the most consistent dividend-payers on the Footsie. Forecasts seem to indicate that will continue and I think recent performance supports that theory. I don’t have the cash to buy more shares today but I would if I could!

Primary Health Properties

Primary Health Properties (LSE: PHP) has long been a favourite real estate investment trust (REIT) of mine, paying consistent dividends. Due to a rule that enforces a 90% return of profits as dividends, REITs can be a great option for passive income.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Sadly, the rules can’t ensure share price growth and Primary Health has fallen 7% since July, negating a big chunk of the dividend returns. The promise of falling interest rates gave the property market a boost this year but the October budget threw a spanner in the works. While interest rates remain high, it’ll be a tough market to crack.

However, since I have a long-term view of my passive income goals, the dividend forecast is more my concern.

And that looks good.

Dividends are forecast to rise to 7.1p per share next year, up from 6.9p. The growth is not spectacular but reliable, with dividends rising 4% yearly for almost a decade. Strong cash flows ensure dividends remain well-covered even when the share price struggles.

Coincidentally, the current 43% price decline is equivalent to that experienced during the 2008 financial crisis. In the decade following, it recovered at an annualised rate of 9.29% per year. If it can do that again, the returns would be significant.

As such, I plan to drip feed my cash into this one as time goes by.