Four years ago, a well-known UK share was selling for pennies. Since then though, it has risen in price by 332%. I was not expecting such a performance.

Here I explain why not – and whether I have changed my mind on adding the company to my Stocks and Shares ISA.

Tasty but reaching its best-before date?

The share in question is Marks and Spencer (LSE: MKS).

For most Britons, the investment case here almost writes itself. M&S is a well-known brand, it has a large presence across the country (helped in recent years by its partnership with Ocado) and historically had a large, loyal customer base.

The problem I saw is that I think it has frittered away a lot of that advantage. I used to buy Marks’ quality British-made clothes but stopped shopping there once it shifted garment production overseas.

As for the food business, I saw more of a sustainable advantage there as I think the quality is good. But grocery retailing in the UK is a brutally competitive market, with profit margins that reflect this.

Impressive share price performance

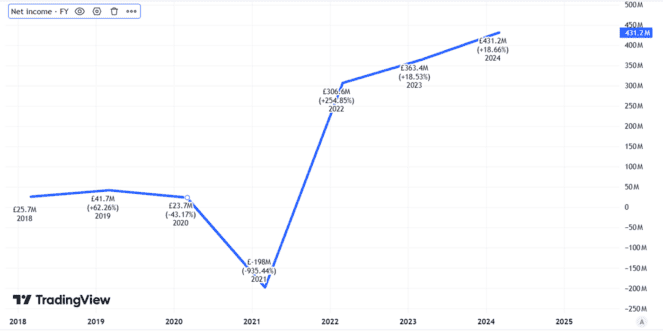

So what did I miss when considering the shares a few years back? One was that the company would be able to improve its profitability markedly. This month, the retailer’s interim results showed profit before tax of £392m. That compares to an £88m loss in the same period four years ago.

The long-term profit trend is positive, in my view.

Created using TradingView

Back then, net debt was £3.9bn. It is now £2.1bn, still substantial but much smaller than four years ago.

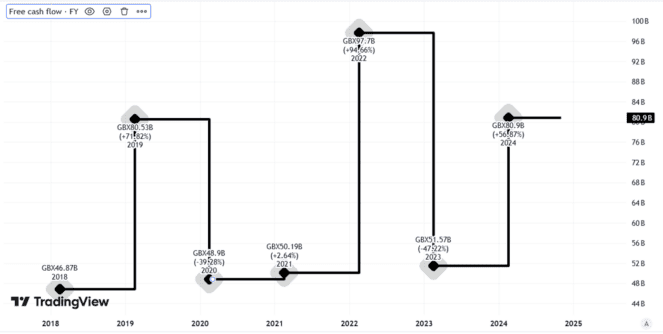

This month’s results were not all bright news though. Four years ago, free cash flow for the first half was £78m. This time around, free cash flow from operations was a slender £16m. In recent years, free cash flow has moved around a lot.

Created using TradingView

Still, overall, the company’s financial performance has improved significantly.

So despite the higher valuation for the well-known UK share, its price-to-earnings ratio is now 16. That is not cheap, but I do not think it is expensive for a strong operator with decent prospects.

Not adding this one to my basket

Still, as I do not think it is cheap, I have no plans to add Marks and Spencer shares to my shopping list.

Not only that, but I see some risks with the shares. I may have been wrong four years ago, but I continue to harbour doubts about the long-term strategy for the company. Its share of the joint venture with Ocado continues to rack up losses. But my bigger concern is about how Marks can compete effectively over the long term in both food and clothing.

Its traditional customer base is ageing and I think closing stores has hurt not helped its ability to find new ones. It can seek to do that online, but selling clothes online is every bit as competitive as flogging food on the high street.

M&S has proved me wrong in recent years and maybe it can continue to play to its strengths. But, for now at least, I am not sufficiently excited to add the UK share to my portfolio.