Nvidia (NASDAQ: NVDA) stock regularly appears among the top buys and sells on the UK’s largest investment platforms. It’s been like that for two years now.

Over the past week, it was the third most bought stock on AJ Bell and the second on Hargreaves Lansdown. Only MicroStrategy has seen more action, in terms of both buying and selling.

However, it looks like more UK investors are buying it than selling. Why are they so obsessed with Nvidia shares? Let’s discuss.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

Momentum

One simple reason why some will be jumping on board is due to momentum in the share price. It’s up 173% in 2024, and 2,397% over five years. That type of performance is sure to catch eyes and turn heads.

Undoubtedly, some will be motivated by FOMO (fear of missing out). But as Warren Buffett says: “The dumbest reason in the world to buy a stock is because it’s going up.”

Revenue growth

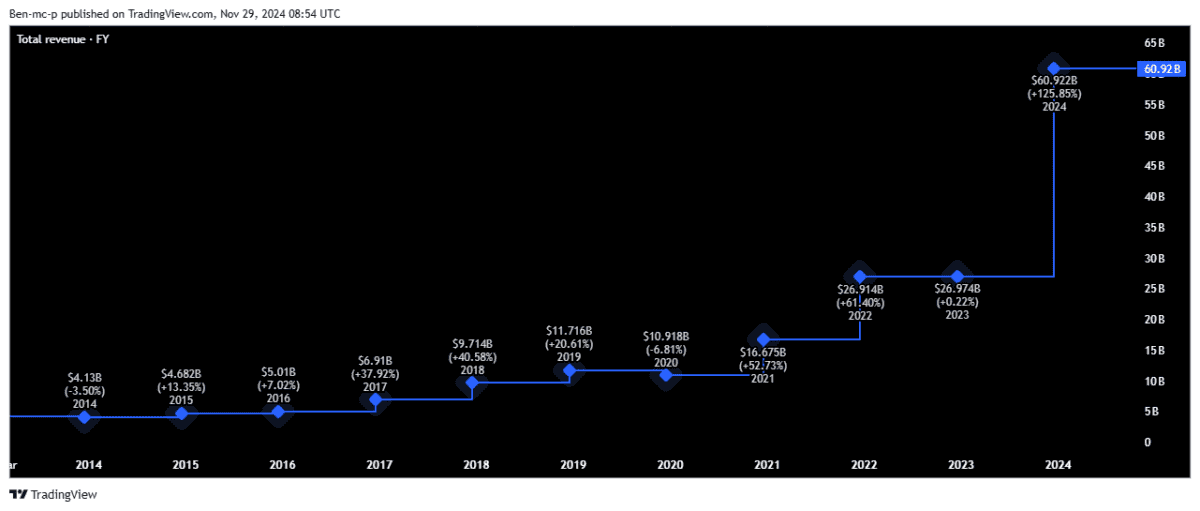

However, many savvy investors will have considered the underlying fundamentals of Nvidia as a company. The most striking thing to note about the chipmaker is how fast it’s been growing the top line.

Following the release of ChatGPT in late 2022, revenue has exploded higher. Indeed, Nvidia reported more in the last quarter ($35.1bn) than it did in every quarter combined between 2017 and 2019!

Tech companies of all sizes are greedily gobbling up Nvidia’s graphics processing units (GPUs) because they’re the best choice to train and run AI systems.

Over the long run, revenue growth is a fundamental driver of a share price. Nvidia’s is forecast to top $200bn in 2026!

Margin expansion

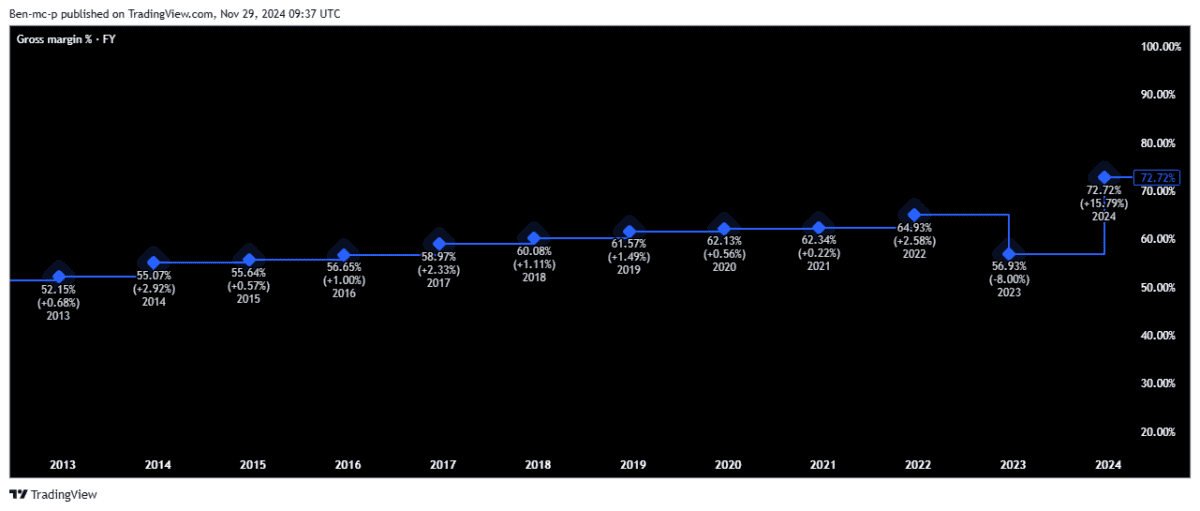

Another reason investors have been bullish on the stock is down to expanding profit margins.

The company enjoys very strong pricing power due to the incredible demand for its GPUs. And economies of scale have reduced production costs as sales volumes grow.

The gross margin is now above 70%, up from 60% in 2018.

Compelling narrative

A massively important factor for Nvidia is the overall growth story around AI. It’s certainly the most exciting tech development since the internet.

To be fair, founder and CEO Jensen Huang does a world-class job of fuelling excitement around AI. His visionary language when discussing its potential can get investors salivating.

In Q3, he wrote: “The age of AI is in full steam, propelling a global shift to Nvidia computing… AI is transforming every industry, company and country.”

This is one risk I see though. If the narrative suddenly changes, due to slowing AI equipment capital expenditure or increasing regulation, then investor sentiment could quickly sour.

Also, for large-scale AI adoption, the costs will have to come down significantly, especially when it comes to training systems. It’s possible Nvidia’s margins come under pressure in the years ahead.

Due to this uncertainty, I sold my Nvidia shares earlier this year. I’d only consider reinvesting if the stock sold off heavily.

Foolish takeaway

In conclusion, Nvidia ticks nearly every box for why a stock goes up dramatically.

We’ve got surging revenue growth, margin expansion, a higher valuation, and a captivating story centred around a once-in-a-generation technological revolution.

Given all this, it’s hardly surprising that many UK investors are obsessed with Nvidia shares!