Bargain-hunting season’s in full swing. But I’m not interested in grabbing some cut-price electricals, books, or anything else that retailers like Amazon are trying to flog me. I’m searching the stock market for the best FTSE 100 value shares to buy instead.

I’m still currently in the research phase. But here are two I’m considering adding to my portfolio soon.

Standard Chartered

FTSE 100-listed Standard Chartered‘s (LSE:STAN) share price has rocketed 45.8% in 2024. Yet the emerging market bank still looks like a steal relative to both predicted earnings and its book value.

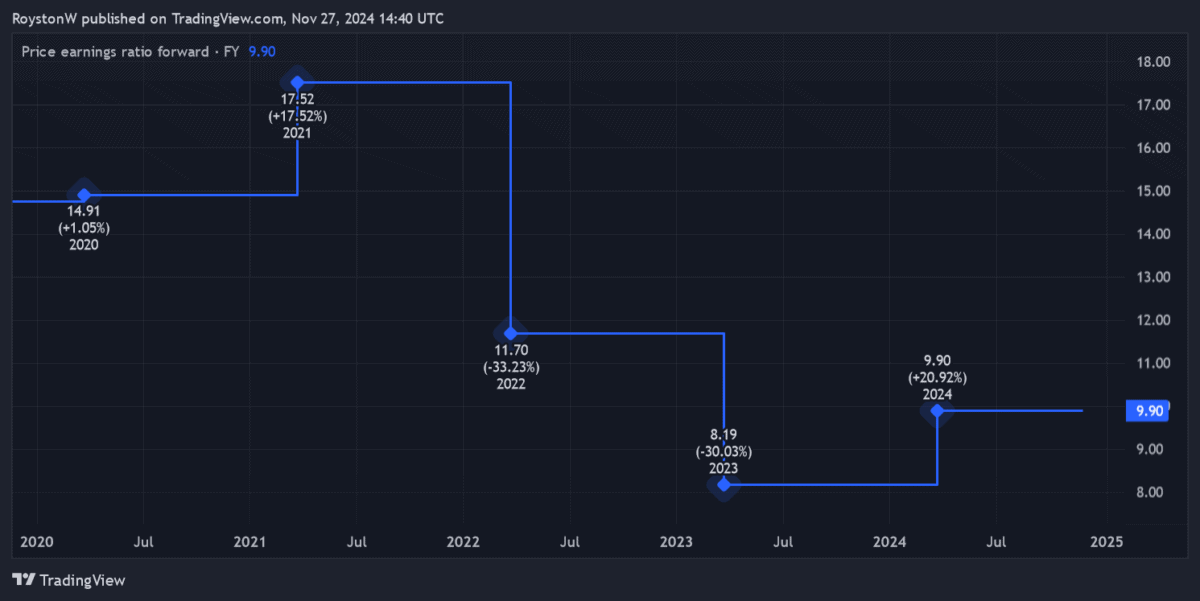

At 960.6p per share, it trades on a forward price-to-earnings (P/E) ratio of 7.6 times. This is some distance below the Footsie average of 14.3 times.

StanChart also trades on a corresponding price-to-earnings growth (PEG) reading of 0.1. Any reading below 1 suggests that a share’s undervalued.

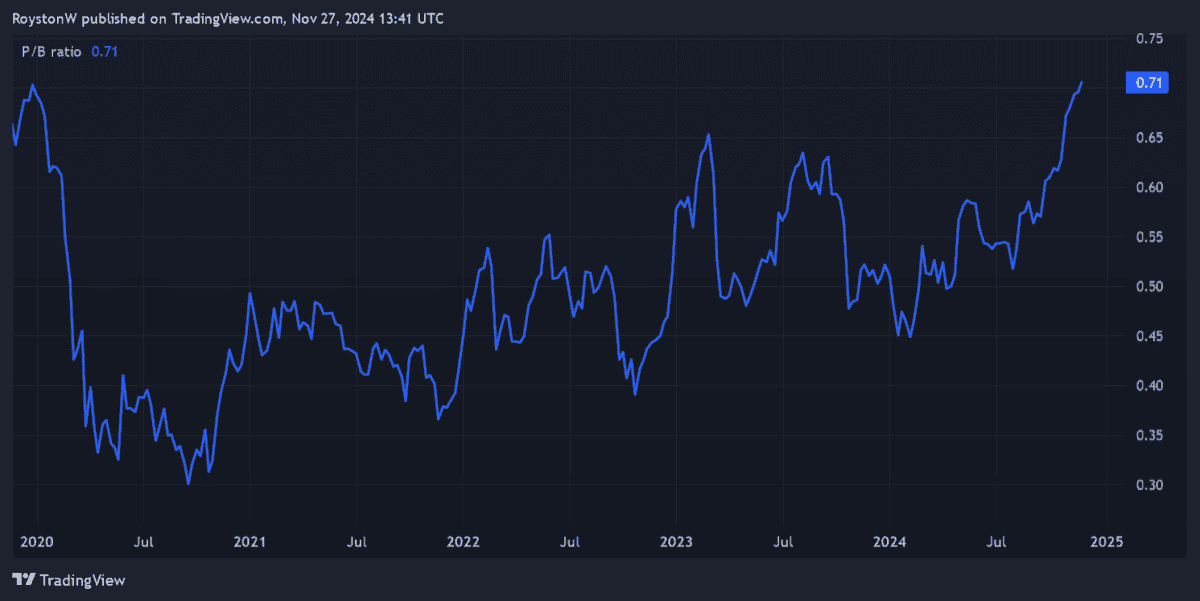

And finally, its price-to-book (P/B) ratio also sits below the value watermark of 1, at 0.7.

The bank’s cheapness reflects ongoing worries about China’s economy and the implications of current turbulence on the broader Asia Pacific region. Today, it sources more than 70% of operating income from its 21 Asian markets.

However, I think the dangers of Chinese contagion are baked into StanChart’s rock-bottom valuation. Therefore, now could be a good time for me to open a position.

I buy shares based on a long-term horizon. Over this sort of timeframe things look promising for the Footsie bank, given its huge emerging market exposure (it also has operations in Africa, the Middle East and Latin America).

Banking product penetration’s low in these regions, and as a consequence has considerable scope for growth as population sizes balloon and personal wealth levels rapidly increase. Standard Chartered’s scale gives it a great opportunity to capitalise on this opportunity.

Vodafone Group

In terms of paper-based value, telecoms firm Vodafone Group (LSE:VOD) goes even further than the aforementioned bank.

At 70.7p per share, it trades on a Footsie-beating forward P/E ratio of 9.9 times. And its P/B ratio is 0.4, showing a considerable discount to the value of its assets.

In addition to all this, the dividend yield on Vodafone shares comes in at 6.2%, even after this year’s proposed dividend cut. To put this in context, the UK blue-chip average is way back at 3.6%.

As with StanChart, Vodafone’s low valuation partly reflects current trouble in key markets. In this case, revenues are under pressure following changes to service bundling rules in Germany. Sales here make up a third of the group total.

Yet the long-term picture here remains robust, in my opinion. As a major global telecoms provider, the company could profit substantially from ongoing rapid digitalisation driving mobile data and broadband demand.

Vodafone’s investing heavily in 5G and broadband rollout to capture sales in this growing market.

I also like the company’s significant presence in developing markets. In particular, I expect — like Standard Chartered — sales to rise strongly in Africa, where Vodafone provides mobile money and data services.