While short-term gains are attractive, I believe that investing in dividend shares for the long term is the smart way to go. It’s often appealing to withdraw those dividends when they get paid but reinvesting them will compound the gains exponentially.

However, predicting how a company will perform over a longer time frame becomes increasingly difficult. So when aiming for long-term wealth, it’s best to pick stocks that look likely to continue performing well for decades to come.

Additionally, UK investors may want to consider using a Stocks and Shares ISA. This can help to minimise tax obligations with the £20k annual tax-free contribution limit.

Should you invest £1,000 in National Grid right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if National Grid made the list?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Planning

It’s best practice to develop an investment strategy from the start. This covers how much to invest, the frequency of contributions (monthly, yearly), the number of stocks to include and how long to hold the investment.

When I started, I invested a £5k lump sum and then made further contributions of £200 each month. Naturally, these amounts would depend on an individual’s financial situation.

I then identified at least 10 shares spread across various industries, including a mix of defensive, growth and dividend shares plus a fund or two.

I then plan to hold the investment until retirement, or approximately 30 years.

Picking stocks

There are three key things I look for in a company:

- Well-established companies: it should have a long history of solid management and stable growth (50 years+)

- In-demand industry: it should operate in an industry that promises consistent demand for the indefinite future (think retail, pharmaceuticals)

- Dividend track record: it should have a long and proven track record of increasing dividends (20 years plus)

A dividend powerhouse

One stock I picked that matches the above criteria is British utility firm National Grid (LSE: NG.). The company began operating in its current form in 1990 and was listed on the London Stock Exchange in 1995.

However, the business of managing the UK’s electricity and gas grid has been around since the 1950s, so I’d say it’s well-established.

In the same breath, I’d also say electricity and gas are likely to remain in high demand for the indefinite future. With a monopoly in the sector and regulated earnings, it’s a steady and reliable performer.

Which takes me to the dividend track record.

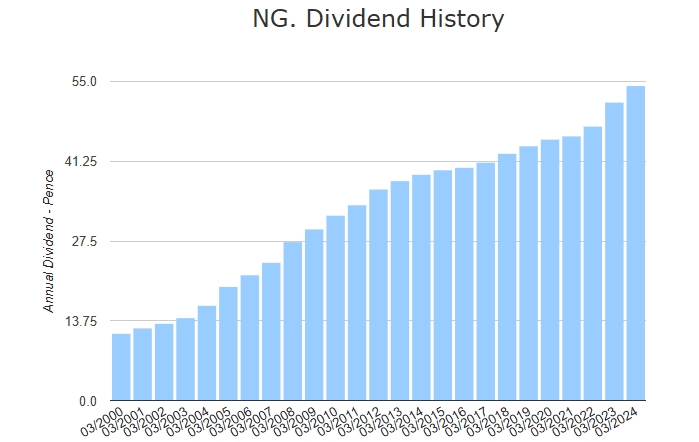

While the increases aren’t spectacular (3.6% a year, on average) they are consistent. For over 20 years there hasn’t been a single break or reduction in dividends, rising from 16.3p per share to 54.1p.

The share price is equally stable, increasing at an annualised rate of 4.39% for the past 20 years.

But it’s not immune to risk. Infrastructure upgrades, in particular, to meet renewable energy goals, threaten the company’s profits. In May, the price crashed 18% after it announced a 7 for 24 rights issue to raise £7bn in support of renewable energy.

While these investments are necessary they can result in short-term price dips. The ongoing need to support renewable energy initiatives may present further challenges to the company going forward.

Overall, I think it should be a staple in any dividend portfolio aimed at securing long-term wealth. I plan to continue investing in the company for the indefinite future.