At first glance, Novo Nordisk (NYSE: NVO) might not look like a growth stock. After all, the Danish pharma giant is approaching its 101st birthday! Yet the figures speak for themselves.

Last year, revenue and operating profit grew 31% and 37%, respectively. This year, those figures are excepted to be 23% and 24%, which is impressive growth for any company.

The stock has surged 272% over five years. However, it’s down 29% since June, which I think has opened up an attractive long-term opportunity for my portfolio.

Should you invest £1,000 in Foxtons Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Foxtons Group Plc made the list?

From insulin to weight loss

Novo Nordisk is a leader in diabetes care. It commands a 34% share of the $50bn+ global diabetes market, including nearly half of the insulin therapy market.

In 2018, the firm launched Ozempic for type 2 diabetes. This medication contains semaglutide, which mimics the gut-produced hormone GLP-1, crucial for regulating blood sugar levels and appetite.

In 2021, Novo introduced Wegovy as a specific injectable weight-loss treatment. It contains a higher-dose version of semaglutide and can help patients lose up to 16% of their body weight.

The company now dominates the booming global GLP-1 market, with a 65% patient volume share. Both Ozempic and Wegovy are blockbuster drugs, with the latter now approved in China for weight loss.

Potential wonder drug

Today, over 2.5bn people are classed as overweight or clinically obese. By the end of this decade, that could rise above 3bn.

Yet only a small fraction of these people are medically treated (around 2% for obesity), offering an enormous potential runway of growth. Meanwhile, diabetes rates continue to rise globally.

Remarkably, GLP-1 products could also benefit patients with chronic kidney disease, heart disease, alcohol addiction, arthritis, and perhaps even Alzheimer’s.

Some analysts see the obesity treatment market alone growing to around $170bn by the early 2030s!

Risks

Of course, this gigantic opportunity isn’t a secret, and lots of potential rivals are popping up with their own potential weight-loss candidates (including oral ones). So competition is a risk, especially from Eli Lilly, the maker of rival drug Zepbound (or Mounjaro in the UK).

New entrants may well drive down prices over the long term as they all vie for market share.

Plus, Novo is due to release data for its next-generation potential treatment (CagriSema). And its set a high bar, aiming for the drug to cut weight by 25% in just over a year. That would make it best-in-class.

If CagriSema results disappoint though, the stock could sell off, and vice versa. A lot is riding on it, particularly as the drugmaker faces the eventual loss of exclusivity on Ozempic and Wegovy.

I’m bullish

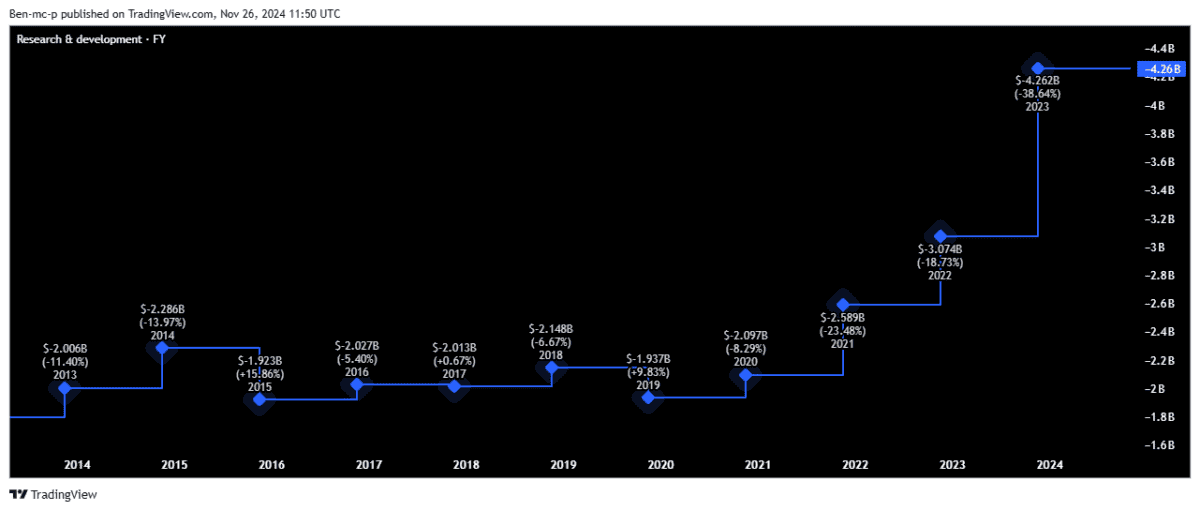

The reason I’m confident that Novo can maintain its market-leading position in the weight-loss sector is down to its massive investments in research and development (R&D).

The company is aggressively ramping up R&D spend to stay ahead of rivals, as we can see below.

Looking ahead to 2025, the firm is due to release data from a late-stage trial of semaglutide in early Alzheimer’s. That could be another massive potential market.

The stock’s trading at 27 times forward earnings, which isn’t cheap. But for an investor like myself with a long-term time horizon, I think it looks attractive. It’s top of my December buy list.