It’s always fascinating to see what big-name investors in the US have been doing. Every quarter, we get to peek behind the curtain through ‘13F’ regulatory filings, which show what they were buying and selling in the previous quarter. Unsurprisingly, Warren Buffett’s Berkshire Hathaway is very closely watched.

In Q3, one big move made by Buffett — or more likely one of his investing lieutenants, Ted Weschler and Todd Combs — was the purchase of Domino’s Pizza (NYSE: DPZ).

Berkshire scooped up 1.27m shares of the pizza restaurant chain, worth roughly $550m.

The stock has been a massive long-term winner, rising 5,520% in the past 15 years (excluding dividends).

What’s so attractive about this stock?

I see a number of things that make this a classic Buffett/Berkshire buy. For starters, Domino’s is the world’s leading pizza company, with more than 20,500 locations worldwide.

Crucially, it has an instantly recognisable brand. Buffett loves strong brands, as his 36-year holding in Coca-Cola proves. Top brands normally enjoy pricing power, enabling them to raise prices without losing customers, thereby enhancing profitability.

Both companies operate a franchising model (Coca-Cola for bottling and distribution, and Domino’s for its restaurants, though it still runs a few itself here and there).

This means it generates revenue through royalties and fees paid by franchisees, as well as ingredients and equipment supplied to these store owners through its supply chain operations business (61% of revenue).

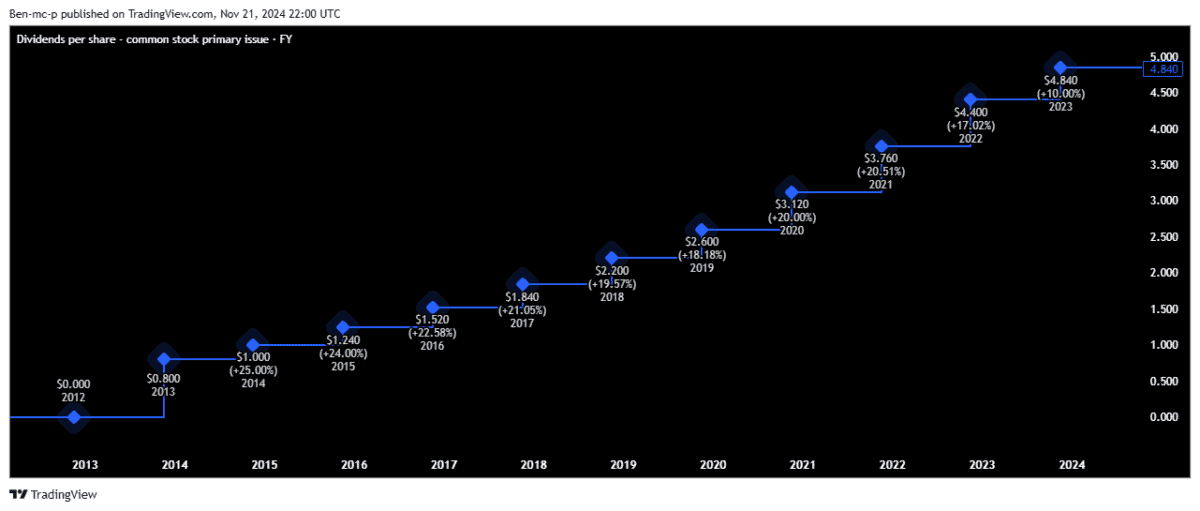

Buffett also loves dividends, and Domino’s pays one. While the yield is only 1.35%, the payout has grown at an average of about 19% per year over the past decade.

Finally, Buffett said: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price“. This simply means it’s better to invest in a business that’s both wonderful and fairly priced than a fair one trading at a premium.

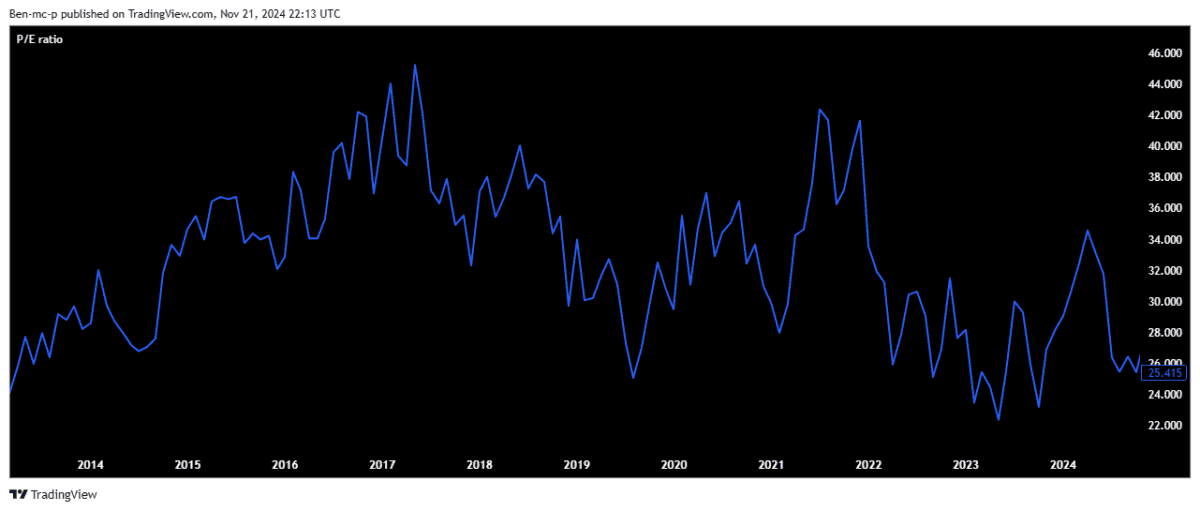

Right now, the stock’s price-to-earnings (P/E) ratio is about 25. This places it at the lower end of its 10-year historical P/E range, as illustrated in the chart below.

This suggests we’re looking at a high-quality company that’s fairly valued.

Mature and competitive market

One risk here is that the pizza market is extremely competitive. Speaking personally, I get the odd Domino’s, but I also use my local pizza shop (which is way cheaper but still tasty).

Meanwhile, Greggs does a fantastic pizza box deal, delivered almost as quickly as Domino’s. So I’m spoilt for choice, much to the detriment of my waistline.

It’s also quite a mature market, and analysts expect the pizza maestro’s revenue to grow at about 6% over the next few years. Operating profit a bit higher, at around 8%.

UK-listed alternatives

The FTSE 250 has a Domino’s Pizza, which is the master franchisee for the brand in the UK and the Republic of Ireland. That stock is a little cheaper, trading on a P/E ratio of 17.7.

Another one is DP Poland, which holds exclusive rights to the brand in Poland and Croatia. This is a loss-making penny stock, making it by far the riskiest choice here.

However, this is the one I’ve chosen over the other two. The firm is growing rapidly and moving towards a sub-franchise model. I think it has a lot of potential at 10p.