The price of Legal & General (LSE: LGEN) shares is now even lower than it was last November. After a great start to the year, it flipped-flopped around the 250p level before deciding that anything above 220p is too ambitious.

That’s okay, I’m not even angry.

In the long run, my shares continue to deliver excellent returns via dividends. Now at 9.5%, Legal & General has the third-highest yield on the FTSE 100.

What’s more, it has a solid track record of increasing payments. They’ve risen at an average rate of 13.3% per year for the past 15 years.

But lest we forget, past performance is no indication of future results! So will the dividend giant continue to deliver as it has in the past?

To answer that question, I’m taking a look at the stock’s dividend forecast.

Earnings and dividend forecast

First, I should highlight that dividend estimates have declined since June, when the company announced a major overhaul. This included the sale of its housebuilding business and the departure of its asset management chief. It also introduced a new shareholder strategy, including a £200m share buyback programme.

The share price slipped 5% on the news and has struggled to recover since. However, the forecast is still relatively positive looking ahead.

The yield has increased from 6% in 2019 to almost 10% this year, largely driven by a falling price. Analysts expect it to continue climbing to above 10% next year and 10.29% in 2026.

| Financial year | Dividend per share | Dividend yield |

|---|---|---|

| 2024 | 21.3p | 9.8% |

| 2025 | 21.8p | 10.04% |

| 2026 | 22.3p | 10.29% |

But a rising yield is not worth much if the share price keeps falling.

The growth forecast gives some hope that it won’t. Sales are expected to rise 5.15% next year and a further 5% in 2026. Net income is expected to follow suit, forecast to rise 33% next year and 8.29% in 2026.

Meanwhile, the annual dividend is forecast to increase by less than half a penny each year. The final dividend for 2024 is set at 21.3p, expected to reach 21.8p in 2025 and 22.3p in 2026.

What’s most interesting is that earnings per share (EPS) is expected to outperform dividends, rising to 24p per share next year and 26p by 2026.

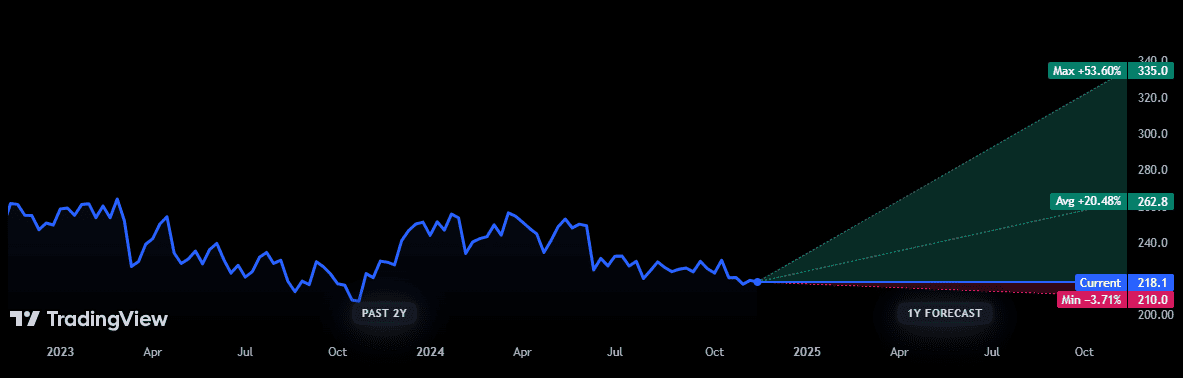

Analysts are moderately positive about the share price, with an average 12-month target of 262p — up 20.5% from today’s price.

Considerations

There are a few factors that threaten Legal & General’s performance, such as the recent hikes in National Insurance and minimum wage. These are likely to eat into profits during the next earnings round.

As it stands, earnings don’t quite cover the current dividend so a further drop could become an issue. If EPS doesn’t increase as forecast, the company may have to cut dividends. Both these situations could threaten the share price.

Overall, I think the current price is good value and things look likely to improve from here. Of course, that’s on the assumption that present conditions will be maintained. Right now, a lot is going on in the world, so any short-term predictions should be taken with a pinch of salt.

But long-term? I plan to be holding my Legal & General shares well into retirement.