Lloyds (LSE:LLOY) shares are always in high demand among dividend investors. At first glance, it’s not difficult to see why.

High street banks offer essential services like loans, mortgages, credit cards and current accounts. As a consequence, they tend to enjoy stable cash flows they can then use to pay consistent dividends.

On top of this, the financial regulator demands that banks hold significant capital reserves, providing dividends with added stability.

Should you invest £1,000 in Bunzl Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Bunzl Plc made the list?

Finally, the dividend yield on Lloyds shares is 6% for 2024, beating the 3.5% FTSE 100 average by a large distance. The yield marches to 6.2% and 7.1% for 2025 and 2026 too.

However, I wouldn’t touch the Black Horse Bank with a bargepole right now. If I was seeking dividends, I’d much rather add support services provider Bunzl (LSE:BNZL) to my portfolio.

Dividend growth

First, let’s take a look at Bunzl’s dividend forecasts for the next three years.

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2024 | 73.89p | 8% | 2.1% |

| 2025 | 79.61p | 8% | 2.3% |

| 2026 | 84.83p | 7% | 2.5% |

As you can see, these dividend yields are substantially lower than those on Lloyds shares. But let’s look past the final column for a moment.

Instead, let’s look at annual dividend growth. If broker forecasts to 2026 are correct, Bunzl will have raised the annual payout for an astonishing 34 years on the spin.

Payout growth has been more impressive at Lloyds of late. It raised the full-year dividend 15% in 2023, far ahead of Bunzl’s near-9% rise.

But I’m not going to buy a stock just based on dividends.

Stunning returns

Income forms an important part of my investing strategy. A stock that pays a decent and growing dividend gives me money I can reinvest, a concept that — through the mathematical miracle of compounding — can allow me to grow my portfolio exponentially.

But dividends are only one part of the investing equation. The passive income a company provides can be negated by a stalling or reversing share price, resulting in an overall disappointing return.

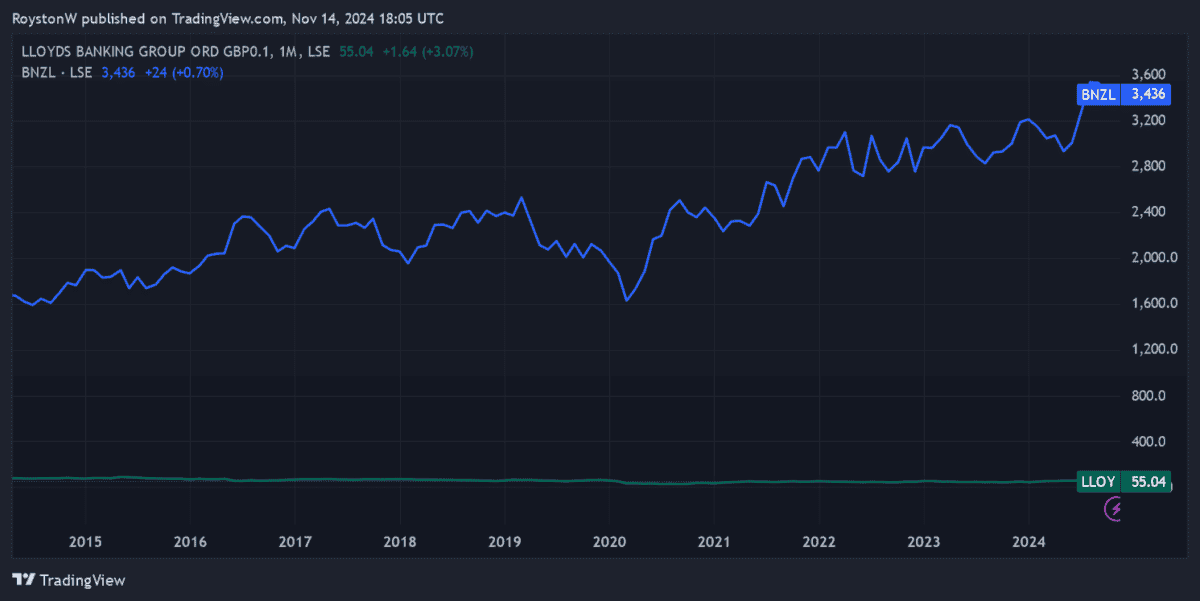

Taking into account share price movements and dividends, Lloyds has delivered a paltry total shareholder return of 2% since 2014. That’s far below the 131% that Bunzl has provided in that time.

Lloyds vs Bunzl

Past performance is not a guarantee of future returns. But I believe the contrasting performances of these FTSE 100 stocks will continue.

Sure, Lloyds is an industry giant in the UK, and has significant brand power it can leverage. But its growth potential is limited given Britain’s mature banking sector and the murky economic outlook. And Lloyds could face billions of pounds in fines if found to have mis-sold motor finance in recent years.

Both of these are likely to weigh on its share price and potentially dividends.

By contrast, Bunzl has considerable earnings possibilities as it continues its acquisition-based growth strategy. M&A strategies like this carry extra risk, but the firm’s strong track record is highly encouraging.

Bunzl also has considerable exposure to the enormous US economy, as well as operations in fast-growing emerging markets. If I had cash to invest today, I’d rather put it here than use it to buy Lloyds shares.