Prior to the government’s recent Budget, there were rumours that the annual £20k Stocks and Shares ISA allowance was under threat. This was worrying because many investors use this to generate tax-free passive income.

However, the Budget came and went and the £20,000 remains intact. Great news for everyday investors.

Here, I’ll explain how I’d aim to turn this amount into a £903 monthly second income.

Should you invest £1,000 in Berkeley Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Berkeley Group made the list?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Income vs growth investing

There are a couple of distinct approaches to building a portfolio. I might choose to invest only in high-yield dividend stocks (only those yielding, say, above 5%). These blue-chip shares are unlikely to increase too much in value, but they’d offer me solid dividend income from the off.

In the FTSE 100, the likes of high street bank Lloyds, insurer Legal & General, and tobacco firm Imperial Brands spring to mind.

Alternatively, I may try to increase my portfolio’s size through growth stocks. These businesses pay little in the way of income (if anything), and instead focus on investing to capture growing markets.

This approach will likely lead me to US stock markets, where nearly all of the world’s leading growth companies are listed. Think Amazon, Microsoft, Nvidia, Netflix, and so on.

After a few years of growing my portfolio, I’d be in a better position to generate higher passive income from dividend stocks.

Both strategies possess challenges however. Income investing comes with the risk of dividend cuts or cancelations, as investors in Vodafone found out this year when the telecoms giant cut its payout by 50%.

Meanwhile, what might seem like a great growth stock can quickly turn into a dud if the firm’s growth evaporates.

A third way

A happy medium might be found in companies that are still growing nicely but also paying a rising dividend. One example is Coca-Cola HBC (LSE: CCH), whose shares I recently bought.

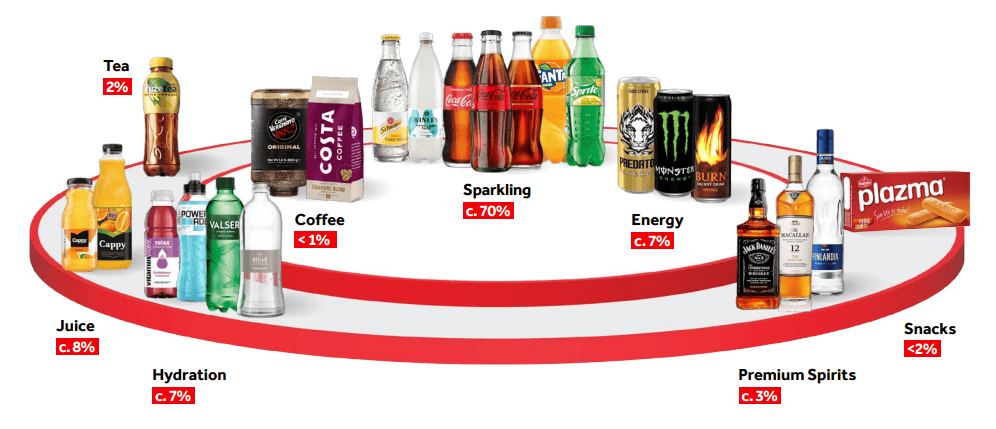

This is a strategic bottling partner for The Coca-Cola Company, which gives it a high-quality portfolio of brands. It distributes these products across 28 countries, spanning both developed and emerging markets in Europe and parts of Africa.

In the first half of 2024, the firm’s organic revenue grew 13.6% year on year to €5.18bn. And it expects full-year organic revenue to grow 11-13%.

Currency exchange risks are real here though, given the diverse geographies the company operates in. That’s worth remembering.

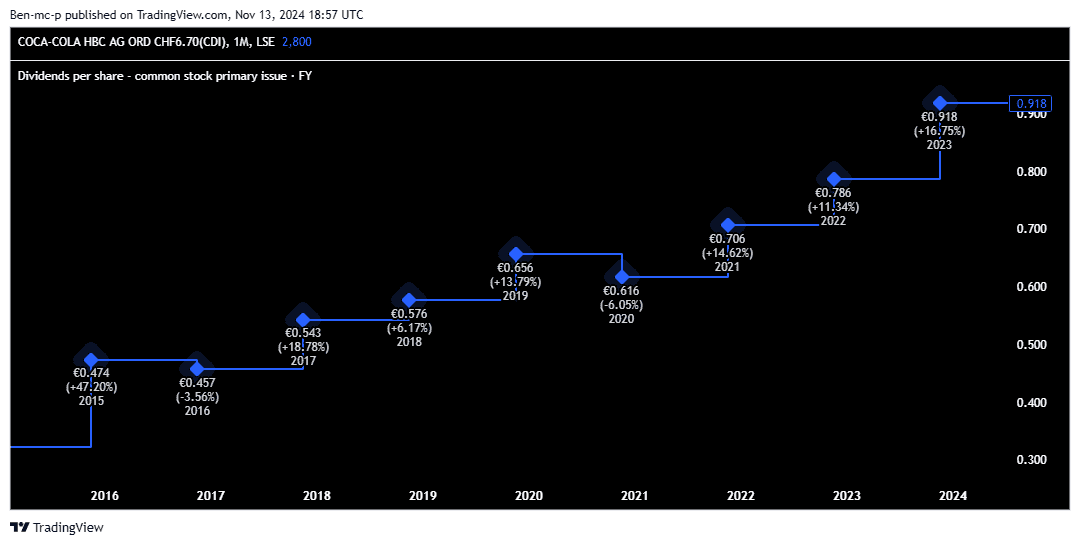

However, I like that this growing business also pays a dividend. The starting yield might seem modest at around 3%, but last year the payout increased by 19%!

In 2025, the dividend is expected to grow by around 9%. So I think this is a great example of a company that offers both share price growth potential and income.

Below, we see the firm’s solid dividend track record.

Income generation

According to AJ Bell, Coca-Cola HBC stock has returned around 10% annually in the past 10 years. There’s no guarantee that’ll continue, but an overall portfolio returning 10% on average would build a nice pot.

In this case, a £20,000 ISA would grow to £216,694 after 25 years, assuming I reinvested the dividends along the way. That’s a tremendous result.

And the passive income from that? It would be £10,835 a year — or £903 a month — if my portfolio were yielding 5%.