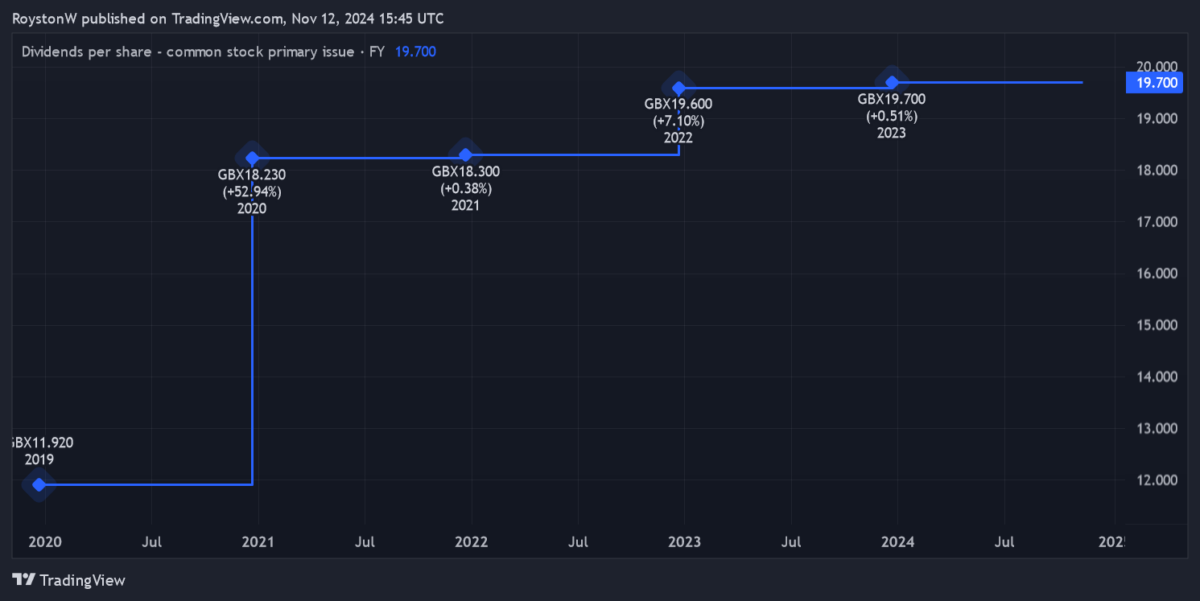

M&G‘s (LSE:MNG) been one of the FTSE 100‘s greatest dividend shares to buy in recent times. Not only have dividend yields smashed the market average since 2019. Shareholder payouts have risen steadily since the company was spun out of Prudential five years ago.

What makes M&G such an attractive share to me today is its double-digit dividend yield. For 2024, only Phoenix Group carries a larger yield on the Footsie today.

And as the chart below shows, City analysts expect cash rewards to keep rising to 2026 at least, pushing the yield even further above 10%.

Should you invest £1,000 in M&G right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if M&G made the list?

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2024 | 20.07p | 2% | 10.2% |

| 2025 | 20.63p | 3% | 10.5% |

| 2026 | 21.26p | 3% | 10.8% |

However, before buying any dividend share, I need to think about how realistic current forecasts are. I also need to consider whether M&G’s share price will keep sinking, which could offset any large dividends.

Here’s my verdict.

Financial foundations

On first look, those predicted dividends on M&G shares appear somewhat fragile. This assessment’s based on the easy-to-calculate dividend cover ratio. As an investor, I’m looking for a wide margin of safety, namely a reading of 2 times and above.

Unfortunately, the predicted dividend for this year’s actually higher than estimated earnings. And while profits are tipped to surge in 2025 and 2026, dividend cover’s still weak, at 1.2 times and 1.3 times respectively.

In theory, this leaves dividend forecasts in danger if earnings disappoint. However, M&G has a cash-rich balance sheet to fall back on if profits underwhelm.

Its Solvency II capital ratio — a key signal of liquidity — was 210% as of June, double the regulatory requirement and up 7% year on year.

Encouragingly for future dividends, M&G’s also recently upgraded its three-year cash generation target, to £2.7bn from £2.5bn previously.

Robust outlook

On balance then, I think there’s a great chance that M&G will meet brokers’ dividend forecasts. Poor dividend cover in recent years has been frequent. Yet it hasn’t stopped the distribution of large and growing cash payouts.

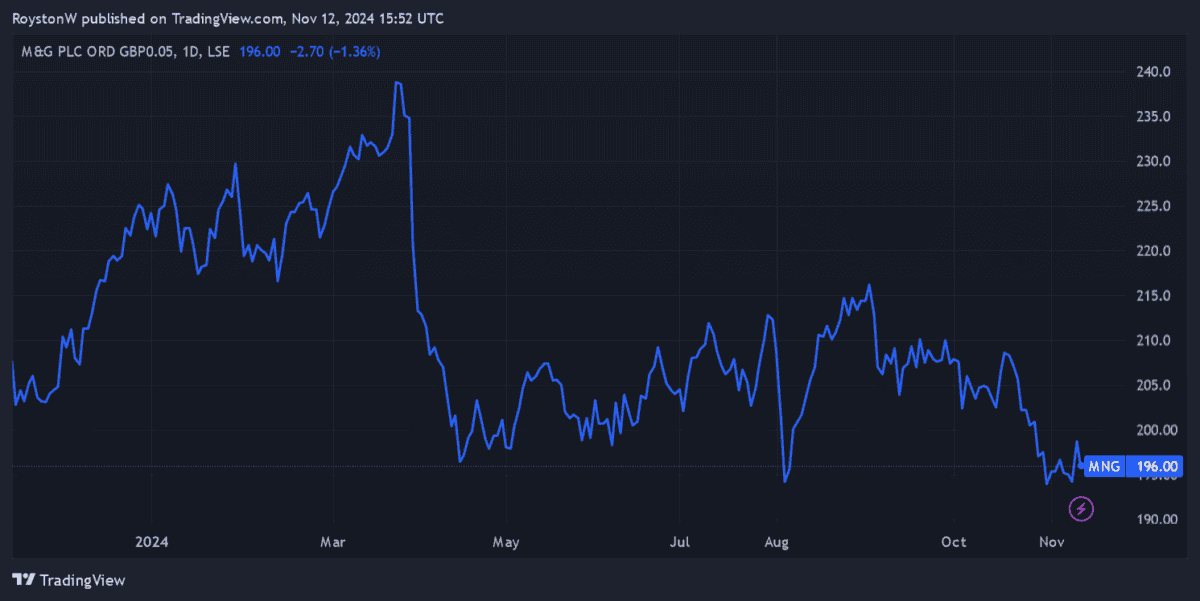

But does this make the business a potential buy? As I say, its share price slumped from late March after the company went ex-dividend. And it’s continued to struggle since then as worries over the UK economy persist.

However, I expect M&G’s shares to recover strongly over time. As a leading provider of pensions and other investment products, I expect profits to steadily rise as an ageing population drives demand for retirement services.

Though it faces high competition, I feel the FTSE firm has the expertise and the brand recognition to capitalise on this opportunity.

The verdict

At 196p per share, M&G shares offer those huge 10%-plus dividend yields. But that’s not all for value chasers to get excited about. Its price-to-earnings growth (PEG) ratio for this year is just 0.4. Any reading below 1 suggests a share’s undervalued, based on expected earnings.

It’s not without risk. But, on balance, I think M&G’s a top dividend share to consider. And especially at today’s price.