The FTSE 100 has some outstanding passive income stocks. And one of the most obvious is National Grid (LSE:NG).

At today’s prices, £10,000 would buy 1,019 shares in the electricity transmission business. And that could turn into a meaningful second income over time.

Competition

From an investment perspective, the most attractive thing about National Grid might be its competitive status. It essentially operates as a monopoly in the UK.

The risk of disruption from another company is close to zero. The prohibitive cost and regulatory difficulties make building competing infrastructure nearly impossible.

This gives National Grid a high degree of predictability in its revenues. And that in turn allows it to operate with higher levels of debt than other businesses might be able to.

Investors should note, however, that the regulation that provides this protection comes with a couple of costs. The most obvious is that it limits the firm’s ability to raise prices.

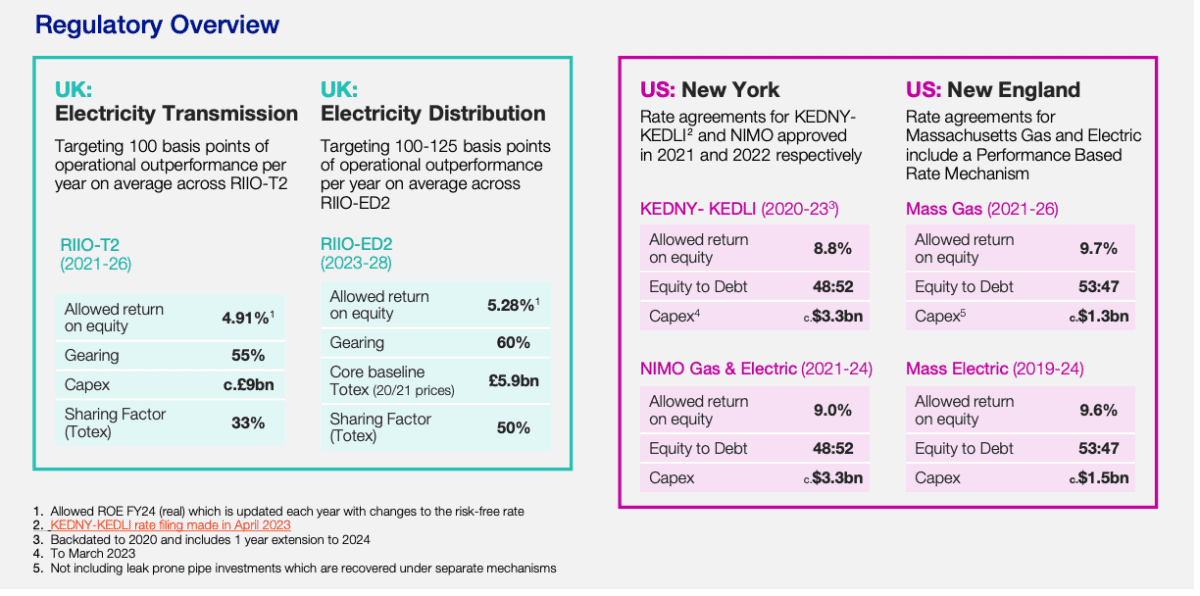

National Grid is allowed to earn a certain return on equity for the services it provides. That’s around 5% for its UK operations and between 9% and 10% in the US.

Source: National Grid Investment Proposition November 2023

This is reviewed periodically, but the company ultimately has to stick to its allowed return. So while the threat of competitive disruption is limited, there’s a different risk to consider.

Dividends

Despite this, National Grid operates in one of the most stable industries around. And that has made it an attractive source of dividend income for investors.

For 2025, the company is expected to distribute around 45.3p per share. At today’s prices, that’s a dividend yield of 4.6%, meaning a £10,000 investment today would generate £460 next year.

That’s not much by itself, but reinvesting that income over time could help build something quite substantial. The question is whether it’s substantial enough.

Over the last 10 years, National Grid’s dividend yield has typically been slightly higher than it is at the moment. Despite interest rates generally being lower, the average has been around 5%.

National Grid dividend yield 2015-24

Created at TradingView

On top of that, analysts are expecting the dividend to grow in the future. It has been cut recently to fund investments, but the general trajectory has been around 2% annual growth.

National Grid dividends per share 2015-24

Created at TradingView

Assuming a 5% average dividend yield that grows at 2% per year, a £10,000 investment could be generating £2,284 per year after 30 years. That’s not bad at all, but I think investors can do better.

Total returns

Ultimately, I think investors need to look at the big picture here. On a total return (dividends plus change in share price) basis, National Grid has underperformed the FTSE 100 recently.

The question is whether or not the firm’s stability is enough to offset this. It might be for some, but I think it’s easy to overestimate the significance of its monopoly status.

The company doesn’t have competition from other businesses, but it does have regulators to deal with. And as investors have seen recently, a dividend cut absolutely cannot be ruled out.

I understand the attraction of National Grid from an investment perspective. But I prefer other opportunities when it comes to looking for passive income.