The FTSE 100 and FTSE 250 have risen around 7% since the start of 2024. This has allowed many Stocks and Shares ISA investors like me to enjoy some strong returns in that time.

Right now, I’m looking for some undervalued shares that haven’t enjoyed robust gains.

Investing guru Warren Buffett‘s maxim is “to be fearful when others are greedy and to be greedy only when others are fearful.” Like him, I aim to buy quality stocks when they are trading at rock-bottom prices, which over the long haul can lead to significant capital gains.

Buffett’s $144bn fortune illustrates the massive potential of this stock buying strategy.

Bank of Georgia

Of my list of best bargains to consider for my Stocks and Shares ISA, Bank of Georgia (LSE:BGEO) is perhaps near the top.

This FTSE 250 share has toppled 30% in value during the past six months. Along with regional rival TBC Bank, it’s slumped in value as Georgia’s political system has endured fresh upheaval.

Both have plunged after last month’s general election, an event plagued by accusations of vote rigging and violence. It’s driven a fresh wedge between the country’s prime minister and president, and casts potential doubt on Georgia’s economic trajectory (and its potential membership of the European Union).

I’d argue, however, that this troubling backdrop is baked into the cheapness of Bank of Georgia’s shares.

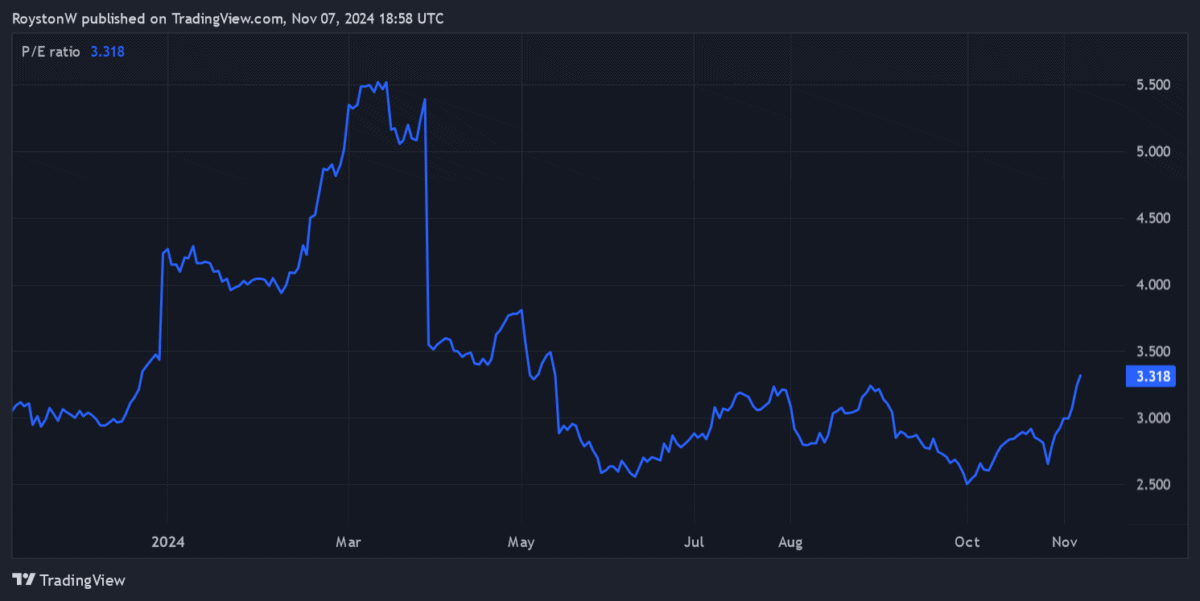

The emerging market bank trades on a forward price-to-earnings (P/E) ratio of 3.3 times

The bank also carries a big 6.2% dividend yield for this year.

At these levels, I find the FTSE 250 share very attractive, even accounting for the uncertain political backdrop. Profits here leapt 16% in the first half of 2024, as Georgia’s strong economy drove further growth in the country’s booming banking sector.

Vodafone

Telecommunications is generally not considered to be a highly cyclical industry. In fact, revenues tend to be even more stable nowadays as our lives become more digitalised, which in turn protects demand for broadband services and mobile data.

Such companies aren’t completely immune to recessions, however. And with President-elect Trump threatening Europe with thumping trade tariffs, local businesses like Vodafone (LSE:VOD) face a potential regional downturn.

This scenario could significantly hamper the firm’s turnaround plans in key market Germany. Yet at current prices, I still find the telecoms titan an attractive stock to possibly buy.

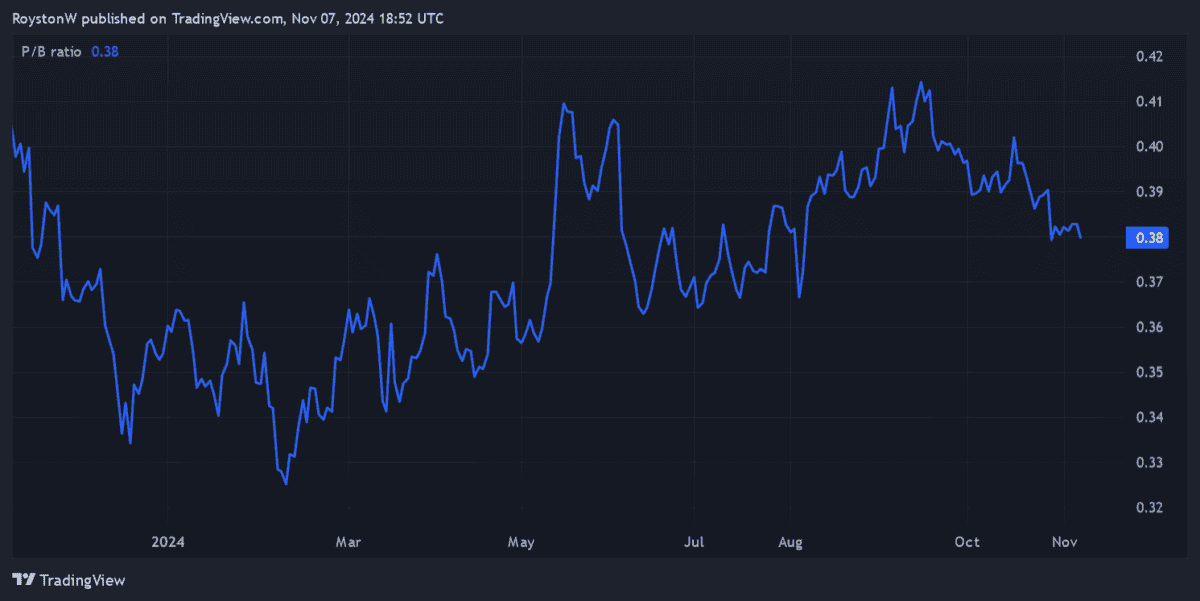

Its price-to-book (P/B) value of 0.4 is below the value threshold of 1. This indicates that Vodafone shares trade at a huge discount to the value of its assets.

The business also offers excellent value from an income perspective, its forward dividend yield standing at 5.2%.

Vodafone faces challenges in the near term. But I remain optimistic looking further out as the digitalisation trend rolls on. I’m also optimistic for the company’s fast-growing African territories where it offers telecoms and mobile money services.

If I buy Vodafone shares today, they could deliver significant long-term returns.