The Amazon (NASDAQ:AMZN) share price is rising after the company’s earnings report for the third quarter of 2024. There’s a lot going on, but I think it comes down to one thing.

Growth. For a stock like Amazon to be a viable investment, the business needs to find ways of continuing to increase its earnings and free cash flows – and it has been doing exactly this.

Revenues

Amazon reported revenue growth of 11% for the quarter. By itself, that’s not spectacular – over the last 10 years, the company has consistently managed to grow its sales at a higher rate.

Should you invest £1,000 in Amazon right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Amazon made the list?

Amazon annual revenue growth 2014-24

Created at TradingView

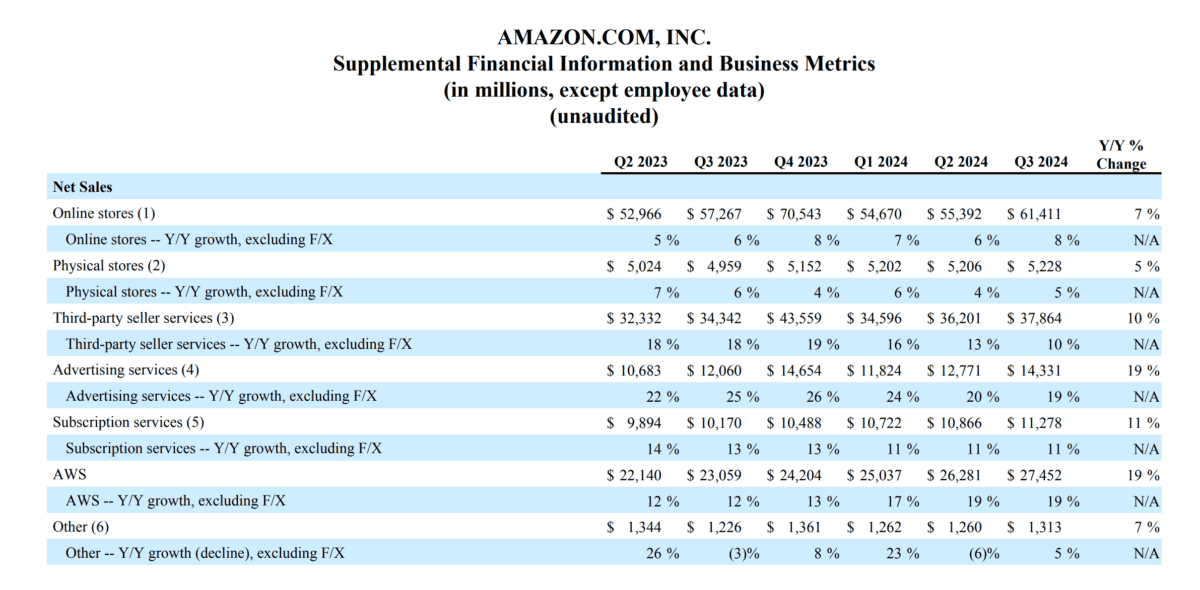

Not all sales are the same though. Especially when it comes to a business like Amazon, it’s worth taking a closer look at where that growth’s coming from.

Importantly, the most impressive gains came from AWS and the firm’s advertising services division. By contrast, growth in the online and physical retail operation was more modest.

Source: Amazon Q3 2024 Earnings Release

That’s important, because the retail parts of the business have lower margins. So rapid growth in the other operations means profits increase even faster.

Profits and free cash flow

So it transpired – that 11% revenue growth took Amazon’s earnings per share to $1.43, up from $0.94 in the third quarter of 2023. That’s an increase of 52%.

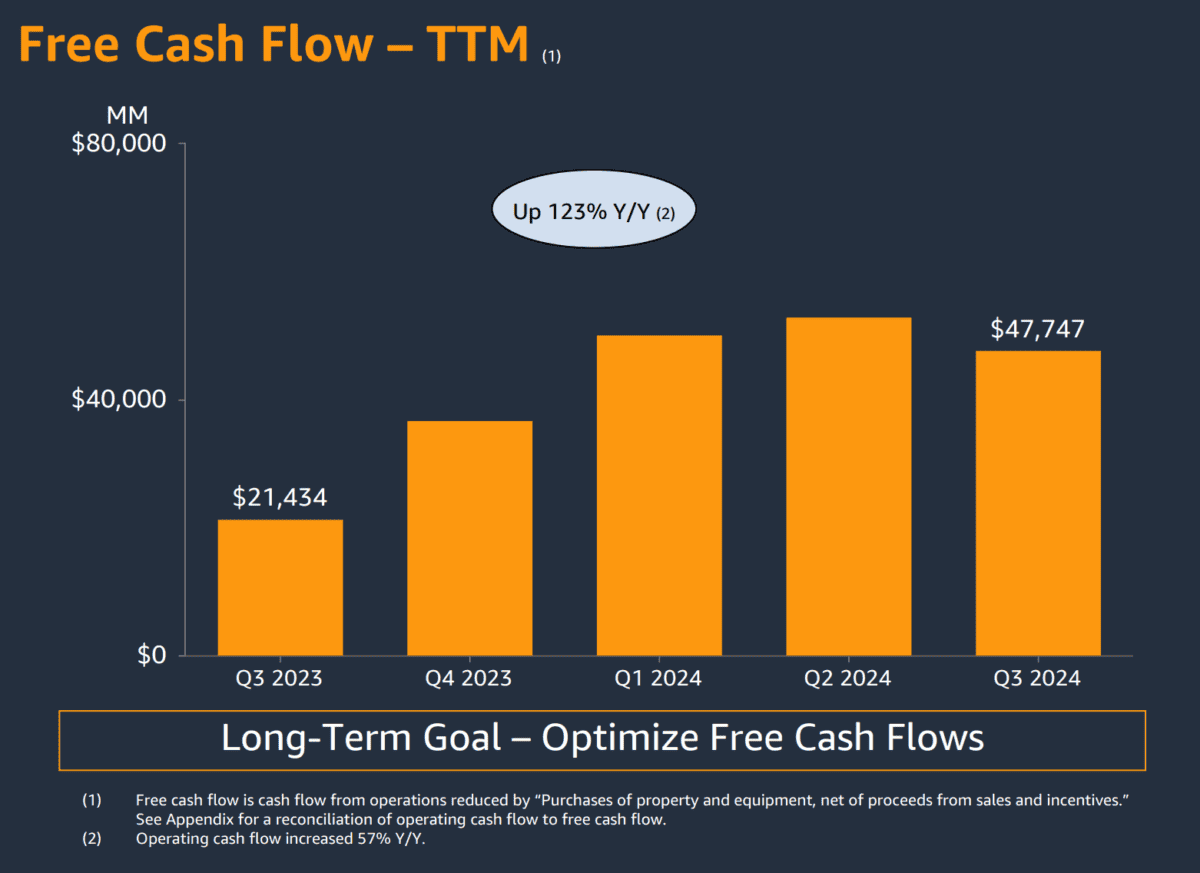

The company’s free cash flows however were more complicated. Amazon prefers to state its cash flows each quarter based on the previous 12 months.

That’s fine, but investors need to keep in mind what they’re seeing. For example, the firm reported 123% growth in free cash flows – which is accurate on a 12-month basis.

Source: Amazon Q3 2024 Webcast Slides

Most of that wasn’t from Q3 though. In the most recent quarter, Amazon’s operating cash flows grew slower than its capital expenditures, so the 12-month figure was down from Q2.

Stock-based compensation

I’m not particularly worried about this. Amazon’s looking to optimise for free cash flows over the long term, so the 12-month comparison is still interesting – and encouraging.

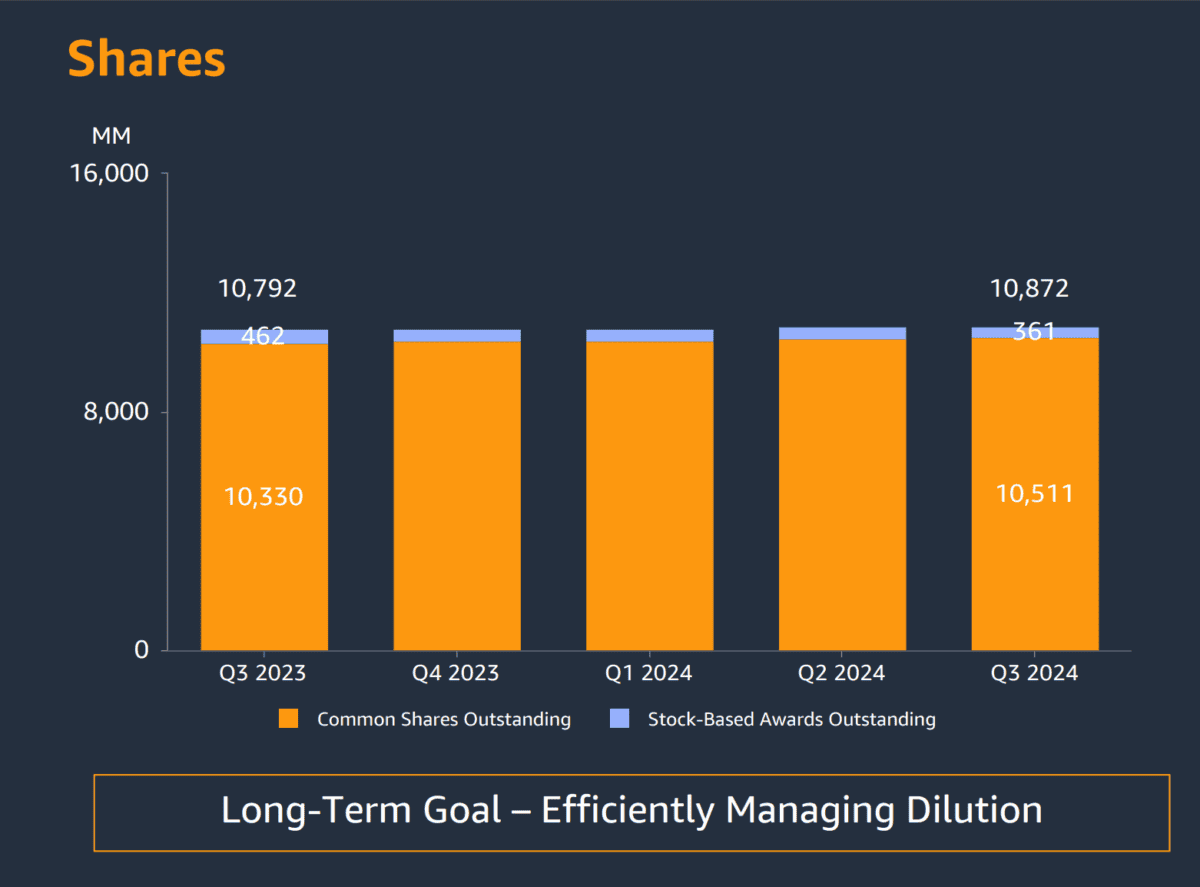

As an Amazon shareholder, the thing I was most interested in was stock-based compensation. This is the amount the company pays its employees using equity.

Doing this has the effect of boosting the outstanding share count, diluting my stake in the business (unless I buy more shares). The news on this however was encouraging.

Source: Amazon Q3 2024 Webcast Slides

Amazon’s made a point of trying to bring its share count under control. And I was pleased to see the increase in the number of shares outstanding was low compared to previous years.

Growth

I think there’s an important lesson here for investors. It’s that earnings growth doesn’t have to come from increasing revenues.

Higher sales can be a route to rising profits, but widening margins can be just as effective. Since I think there’s more to come from Amazon on both fronts, it’s staying on my buy list.