When it comes to dividends, investors often like the long-term income generation potential of utilities. It is no surprise that billionaire investor Warren Buffett has invested so heavily in utilities over decades. His company Berkshire Hathaway owns multiple utilities, including Northern Powergrid on this side of the pond. Meanwhile, FTSE 100 share National Grid (LSE: NG) has long been a favourite of many investors for its dividend yield, currently standing at 5.9%.

But that is not enough to tempt me to add the shares to my portfolio. This is why.

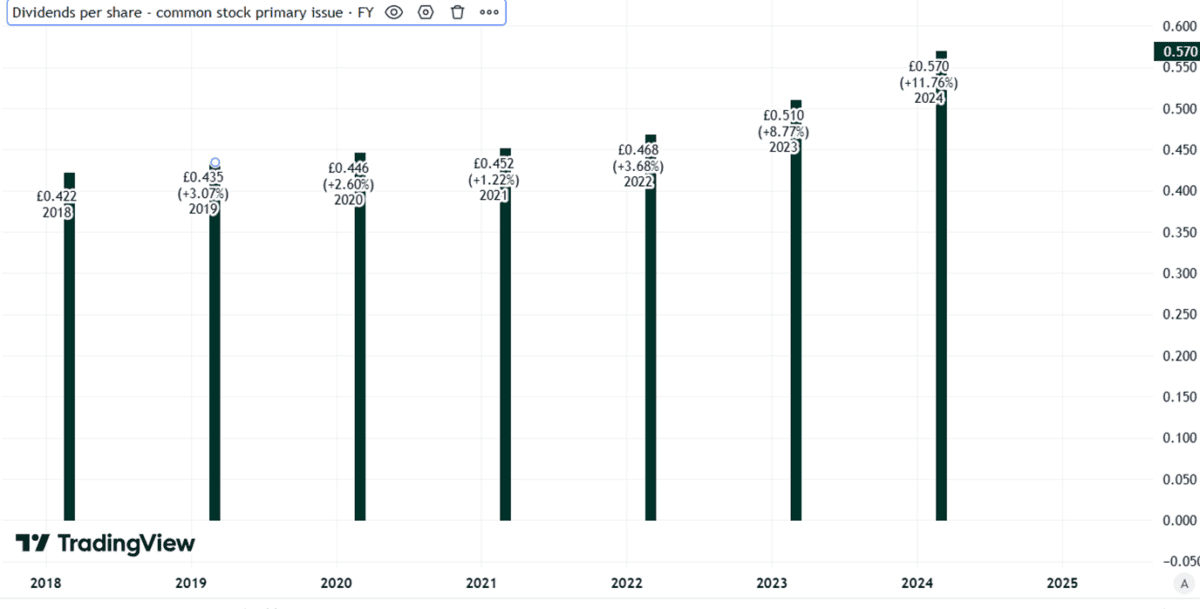

History of dividend growth

By aiming to raise its dividend each year in line with inflation, National Grid does something few companies explicitly do. It aims to keep its payout worth the same from one year to the next in terms of real value.

Over recent years, National Grid has grown its payout per share annually.

Created using TradingView

With its effective monopoly on an area that I expect to benefit from resilient long-term demand, I expect the National Grid dividend could keep growing each year. Even with regulatory price constraints, this may be a profitable business over the long run.

Still, I have no plans to invest – for two reasons.

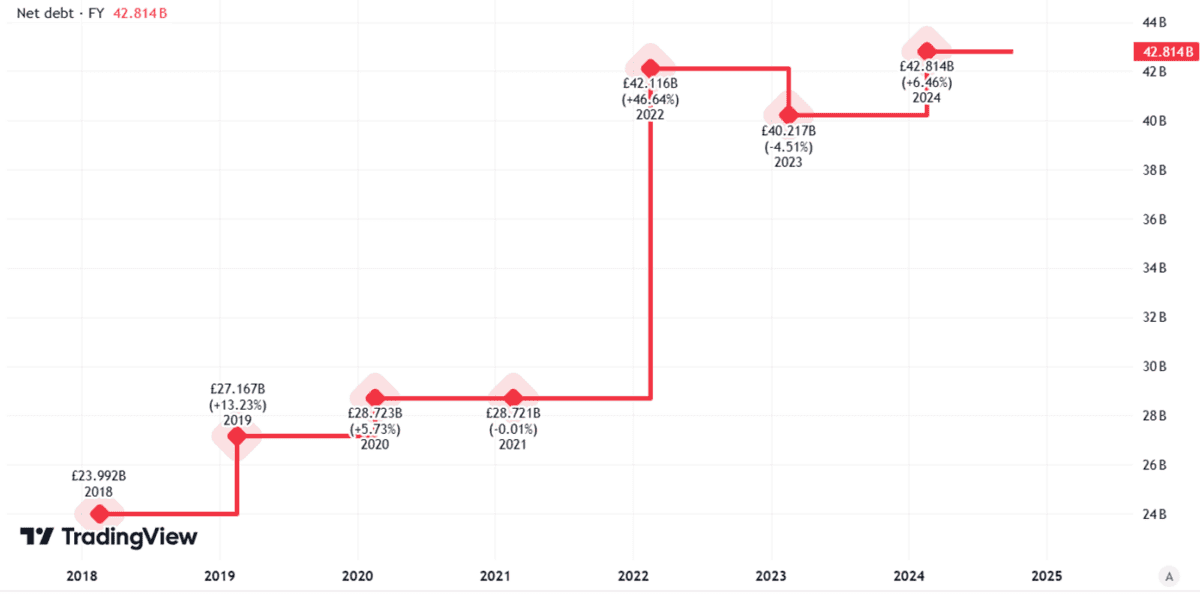

Question over long-term funding

While demand for power distribution may be resilient, delivering on that demand is not easy.

Where people use power can change, as for example with a big shift in work done in residential not commercial areas over recent years.

Where power is generated has also changed. That will likely continue to be the case. Connecting multiple rural windfarms to the grid is a different proposition to a single large power station just outside a city, for example. It is also a costly thing to do.

Meanwhile, the existing infrastructure needs to be maintained.

Taken together, that means that National Grid faces sizeable capital expenditure costs. That explains why its net debt has been growing over the past few years.

Created using TradingView

That matters because it puts increasing pressure on the company when it comes to affording annual dividend rises (or simply paying a dividend at all).

That became apparent this year when the company diluted existing shareholders by issuing new shares to raise billions of pounds.

That rights issue helped solve the question of dividend affordability for now. But it does not resolve the longer-term question satisfactorily in my view.

Shares do not look cheap

The long-term affordability of the National Grid dividend is not the only reason I am avoiding the shares, though.

I am also nervous of buying now only to find that my shares are worth less in future than I paid for them.

After an 18% increase in the share price over the past five years, that risk may not be top of all investors’ minds.

But that rise means the share now trades on a price-to-earnings ratio of 18. I do not see that as good value for a heavily regulated, deeply indebted business in a mature industry.