In general, the stock market’s done pretty well in 2024. The FTSE 100 is up almost 7% and the S&P 500 has gained around 23%.

With share prices though, the sharpest falls often follow periods of the greatest returns. So could investors be in for a fright in the near future?

Scary signs

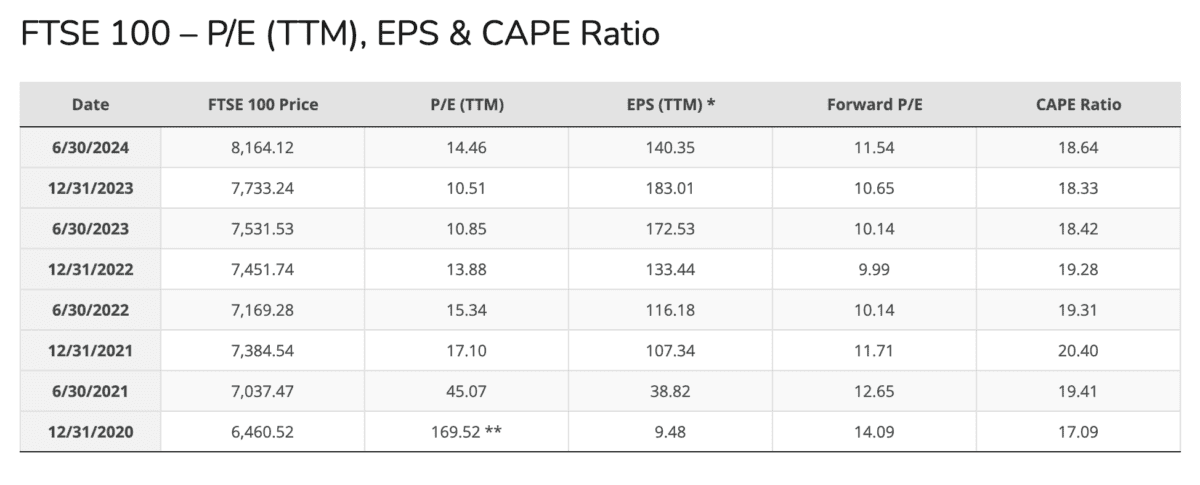

There are two main reasons the stock market might crash. The first is that stocks look expensive – and not just US ones.

Source: Siblis Research

At the end of June, the FTSE 100 was trading at a forward price-to-earnings (P/E) multiple of 11.5. That’s the highest it’s been since 2022 and the index has gone up since then.

On top of this, the macroeconomic environment isn’t looking particularly friendly to stocks. After cutting interest rates in August, the Bank of England decided to hold steady in September.

If the US Federal Reserve does the same, then investors who were expecting rates to fall might have to rethink their buying decisions. And that could be bad for share prices.

This is a very real possibility – falling bond prices indicate investors are concerned about the spectre of inflation. If that makes an appearance, the central bank might have to change course.

Nothing’s guaranteed, but investors looking at buying stocks this Halloween might be in for a fright. Fortunately, as with the witches and the ghosts, there’s probably nothing to be scared of.

Don’t run away

Stock market crashes can be scary. But the rewards for investors who avoid running away when things get frightening can be terrific.

For example, Warren Buffett finished buying shares in Coca-Cola (NYSE:KO) in 1994. Since then, the stock market’s crashed three times – in 2001, 2008 and 2020.

Despite this, the investment that Berkshire Hathaway paid $1.3bn for has a market value of almost $27bn today. And that isn’t including the dividends, which have increased each year.

Buffett hasn’t needed to predict what the stock market will do to generate that spectacular result. The only thing necessary has been to find an outstanding company and hold on.

Coca-Cola absolutely fits the bill in this regard. At today’s prices, I think there are better opportunities around, but the quality of the underlying business is undeniable.

Selling the Coke investment in anticipation of a market crash at any point in the last 30 years would probably have been a big mistake. And I think that’s a lesson investors can take note of.

Happy Halloween

Halloween’s a great reminder that it can be fun to feel scared. But a stock market crash is almost never enjoyable for investors who see their stocks falling.

As with Halloween though, the frightening part doesn’t last forever. And being scared off by the prospect of a short-term scare could cause investors to miss out on some long-term treats.