One UK stock that continues to impress me is Coca-Cola HBC (LSE: CCH). Today (31 October), the consumer packaged goods firm reported a solid third quarter and increased its full-year outlook.

In response, the stock rose 2.1% to 2,724p, leading the FTSE 100 on an otherwise quiet day. This brings the year-to-date return to 18%.

Strong execution

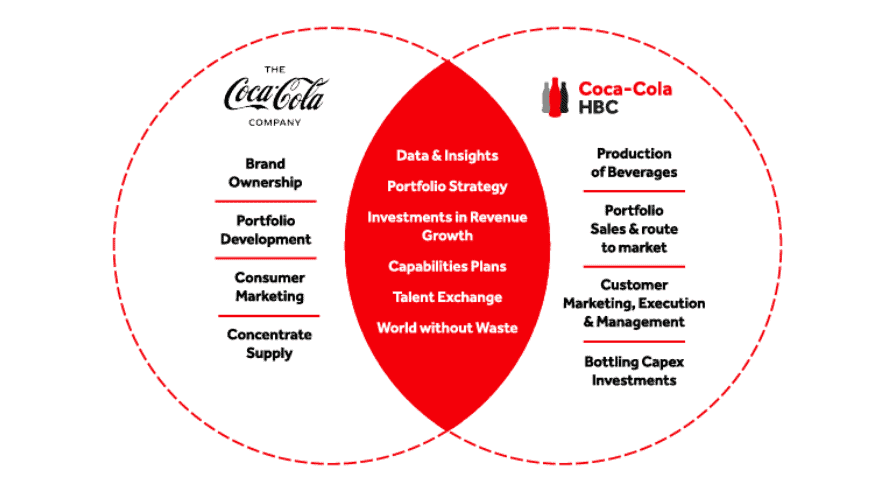

Coca-Cola HBC is a strategic bottling partner for The Coca-Cola Company, which holds a 20%+ stake in the firm while overseeing branding and beverage formulas. For its part, Coca-Cola HBC manages the bottling, distribution, and sales across 28 markets throughout Europe and parts of Africa.

Should you invest £1,000 in BP right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BP made the list?

In the three months to 27 September, the bottler’s organic revenue grew 13.9%, easily beating the 10.8% growth expected by analysts. Organic volume growth of 4% also beat expectations, supported by strong demand for its energy and coffee drinks.

Monster Green Zero fuelled the energy growth, alongside strong sales of Predator and Fury in Nigeria and Egypt. Costa Coffee and Caffè Vergnano (in which Coca-Cola HBC holds a 30% stake) helped drive strong coffee sales.

With established brands like Schweppes, Coke Zero, Fanta, and Sprite also in the line-up, Coca-Cola HBC’s portfolio offers a strong blend of brands and geographic reach.

Reported revenue growth was 8.9%, with organic gains partially offset by the depreciation of the Nigerian naira and Egyptian pound. Strategic price increases helped counter inflation and currency challenges, demonstrating the firm’s pricing power.

After this strong quarter, management upgraded the full-year guidance (the second time this year). It now expects organic revenue growth in the 11%-13% range, compared with a previous forecast of 8%-12%. And organic operating profit growth of 10%-12%, rather than 7%-12%.

Coca-Cola boycott

One issue worth mentioning is the consumer boycott of US brands in Muslim-majority countries, driven by the escalating Middle East conflict and Israel’s role as a key US ally.

The company has said that the conflict is hurting its business in countries such as Egypt and Bosnia. This is a risk worth monitoring, although the diverse portfolio is an advantage in this situation.

In a statement to Reuters, Coca-Cola HBC said: “Like many other international brands, we have seen an impact from the boycott in Q3 in Egypt. Volumes of Coca-Cola are most affected, however, many of our other brands are less affected or not at all.”

Timeless brand power

I intended to invest in this stock in August following the company’s half-year results. Instead, I went with ride-hailing giant Uber, as its profits are soaring and there’s the potential for it to become much larger.

But there’s still room for Coca-Cola HBC, especially after this cracking quarter. The stock is trading at just 13 times next year’s forecast earnings per share. That looks tremendous value to me.

A fast-growing dividend, with a current yield of 2.9%, should also come in handy.

From what I gather, the iconic red Coca-Cola trucks will be making a return to UK streets this Christmas. I’m still amazed that the ‘Holidays Are Coming‘ ad campaign managed to make a cold beverage feel like a natural part of Christmas. But that’s brand power for you!

The holidays are indeed coming, and I plan to add Coca-Cola HBC to my portfolio before they arrive.