Smith & Nephew (LSE: SN.) shareholders got a Halloween fright today (31 October), as the FTSE 100 stock plunged by as much as 13.7%. Does this sharp drop make the medical equipment maker a value stock? And if so, is now the time for me to swoop in and buy?

What happened

Smith & Nephew makes hip and knee replacements, surgical instruments for sports injuries, and wound care solutions. It’s a truly global business, as highlighted in today’s third-quarter trading update, where China emerged as the chief culprit behind the stock’s decline.

The company saw weaker-than-expected demand for its surgical products in the world’s second-largest economy. This meant third-quarter revenue increased by 4% year on year to $1.4bn, but missed analysts’ expectations for 5.2% growth.

Should you invest £1,000 in Asml right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Asml made the list?

Excluding China, revenue growth was 5.9% on both an underlying and reported basis. However, managements says “China headwinds will continue into 2025“.

Consequently, the firm expects annual underlying revenue growth of 4.5%, down from an earlier forecast of 5%-6%. For 2025 though, it expects to expand its “trading profit margin significantly to between 19% and 20%“.

CEO Deepak Nath added: “We remain convinced that our transformation to a higher growth company, with the ability to drive operating leverage through to the bottom line, is on the right course“.

Bargain stock?

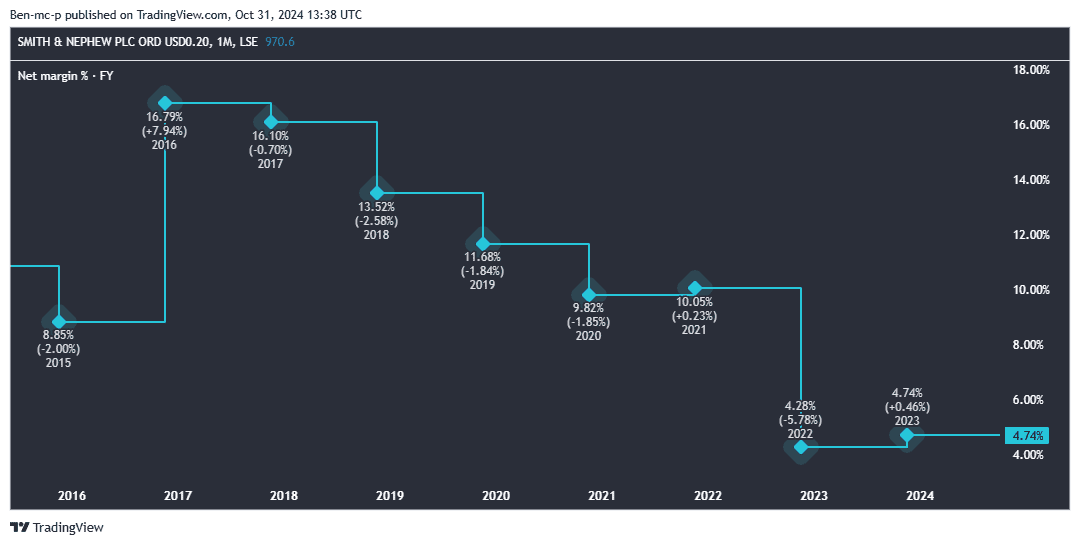

While the share price is down by more than 40% over the past five years, that doesn’t make the stock any cheaper. Profits and margins took a big hit from the pandemic and high inflation, as we can see below.

The firm’s only just starting to get back on track, so this news is a setback.

Earnings forecasts might be pegged down a bit now with the weakness in China expected to continue into 2025. But according to the latest figures I can see, we’re looking at a price-to-earnings (P/E) ratio of around 13 for 2025.

If the company eventually manages to kickstart revenue growth and boost margins, as management has set about doing, then the stock could well prove to be a top value stock at today’s price.

The longer term

Of course, China is the wildcard here. We’re seeing multiple firms reporting extreme weakness there. And trading conditions could always worsen over the next couple of years, despite Beijing’s best attempts.

Global inflation could also start creeping back up, putting pressure on margins. Therefore, I wouldn’t call this a ‘no-brainer’ stock.

Taking a longer view, however, there’s a lot to like still. According to the United Nations, the number of people aged 65 years or older worldwide is projected to more than double, rising from 761m in 2021 to 1.6bn in 2050. The number of people aged 80 years or older is growing even faster.

Surely there will be many more hip, knee, and other joint replacements needed in future. And that should eventually benefit Smith & Nephew, whose largest division is orthopaedics (40% of revenue last year).

Would I invest?

In my own portfolio, I’ve chosen robotic surgery pioneer Intuitive Surgical to get direct exposure to this global ageing trend. But this is about as far from a value stock as it gets.

If I wanted a cheaper way to play this theme, I’d consider Smith & Nephew stock after the big fall today.