From an investment perspective, the S&P 500 looks risky right now. A heavy concentration in some expensive names has more than one analyst forecasting weak returns for the next 10 years.

That might cause investors to turn away from the US when looking for opportunities. But I think that’s a mistake – outside of the index, there are some stocks I like the look of very much.

An oil company

One example is Chord Energy (NASDAQ:CHRD). Earlier this year, the company merged with Enerplus to form the largest oil producer in the Williston Basin.

My thesis here is relatively straightforward. Management reports its assets will allow it to extract oil for 10 years at low prices and I think this is going to make for strong investor returns.

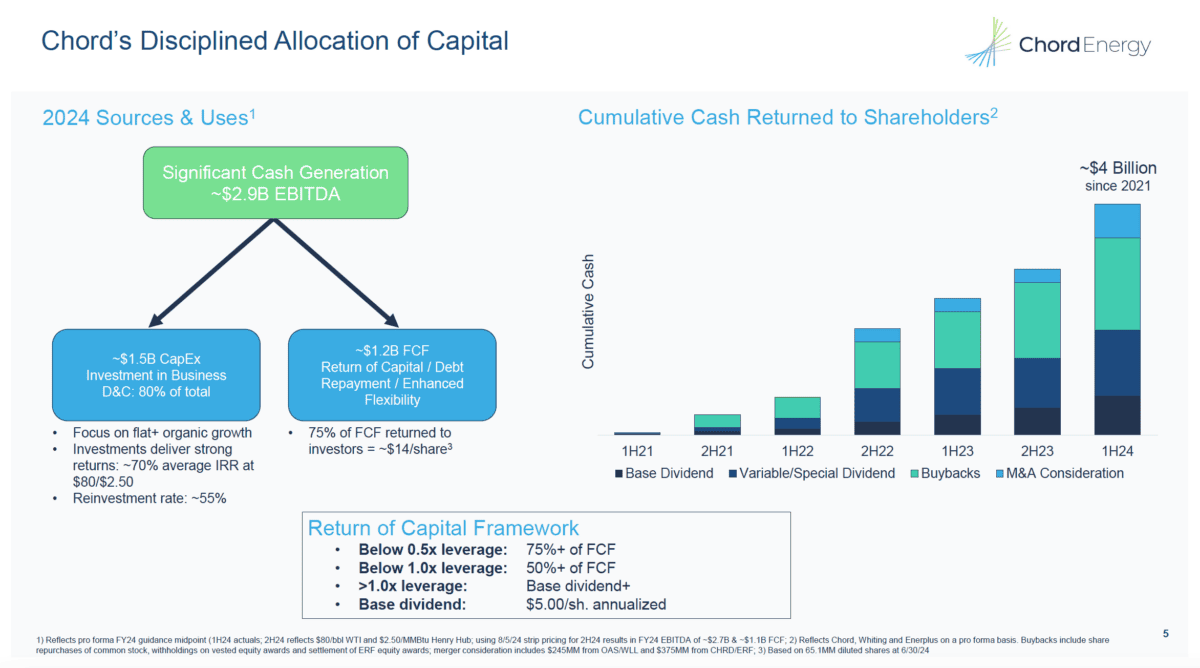

Chord’s balance sheet is extremely strong. And that allows the company to return significant amounts of the cash it generates to investors through dividends and share buybacks.

This sets it apart from other oil stocks and makes it very attractive from my perspective. I think it looks like a bargain even when US stocks as a whole are at historically expensive levels.

Production

Chord’s position in the Williston means its costs are higher than its counterparts that are based in the Permian. But I think there’s still plenty for investors to be excited about.

Back in August, the firm anticipated generating around $700m in free cash this year based on a $70 oil price. And from next year, that should be boosted by synergies from the Enerplus transaction.

Since then, West Texas Intermediate (WTI) has dropped to around $67 per barrel. But Chord’s market cap is currently under $8bn, which I think makes things very interesting.

At that level, there could well still be a very good free cash flow return available to investors even if oil prices have further to fall. But there’s more to the story than this.

Dividends

Instead of exploration, Chord looks to return its free cash to shareholders. The firm aims to keep its leverage ratio below 1 and sets its dividend policy based on how well it achieves this.

Source: Chord Investor Presentation August 2024

Right now, the company has a net debt-to-EBITDA ratio of 0.3. At that level, 75% of the free cash the company generates gets returned to investors as dividends.

A positive view on the outlook for WTI is a necessary condition of investing in oil stocks at all. But if the oil price stays above $70 for the next 10 years, things could be very interesting.

If I invested £1,000 today, I think there’s a chance I could get 100% of that back in dividends in the next 10 years. And with interest rates falling, there aren’t many opportunities like that.

A stock to consider?

There are plenty of reasons to be uncertain about the outlook for oil prices. Right now, the biggest threat is probably increased production from OPEC at a time when demand is weak.

Investors with a positive outlook for oil might want to take a look at Chord Energy, though. US stocks in general might be expensive, but I think there’s still excellent value on offer here.