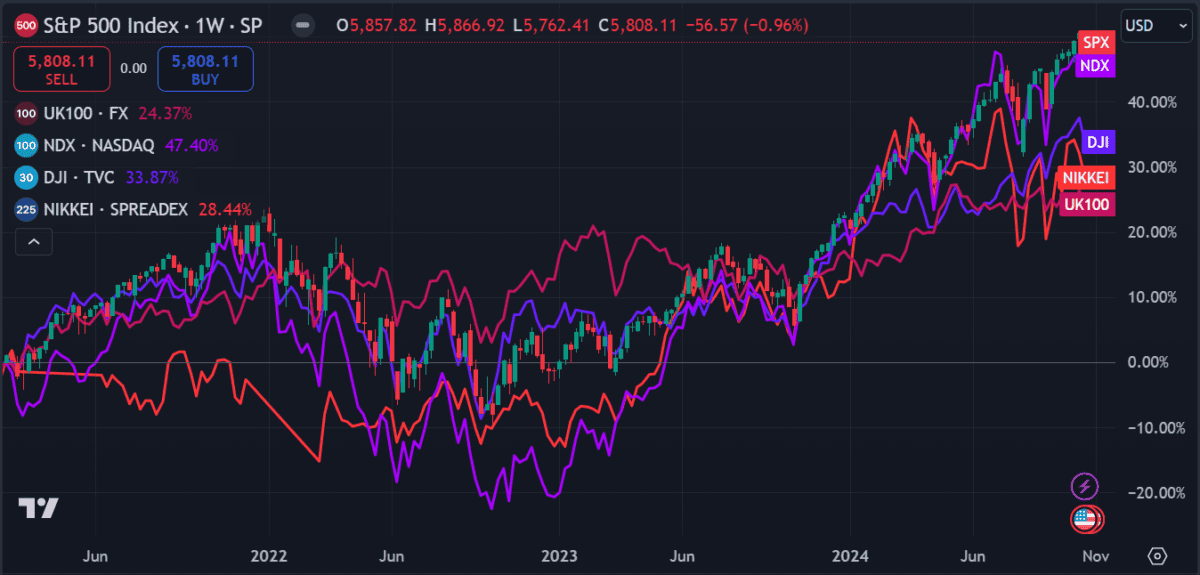

The US S&P 500 has seen highs and lows this year as global issues rock markets. After falling to 5,186 points in August, it hit a new record high of 5,866 points last week.

Throughout the year, the index has been buoyed up by strong performance from tech stocks, particularly in AI, with companies like Nvidia and Meta driving investor optimism.

The exceptional performance and rapid growth of these companies make it hard to make comparisons with the S&P 500. But I’ve identified several stocks on the FTSE 100 that consistently outperform it over multiple different time frames.

Should you invest £1,000 in Legal & General right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General made the list?

For example, in the past five years, 3i Group (LSE: III), Diploma, Ashtead, Frasers Group, BAE Systems, Rolls-Royce, Antofagasta, and Marks and Spencer have all beaten it. Four of those have also done so in the past year, including Rolls-Royce, Marks & Spencer, 3i Group and Diploma.

Rolls-Royce is undoubtedly the comeback king of recent years but when it comes to consistent growth, 3i Group remains my favourite and I feel it’s worth considering.

Here’s why

3i Group is a multinational private equity and venture capital company based in London. It’s up 67% in the past year and 200% over five years.

Return on equity (ROE) is over 20% and it has a net profit margin of 96.4%. Plus, it’s currently trading at 64% below fair value based on cash flow estimates, with earnings forecast to grow 18% a year going forward.

Despite an extensive portfolio, it’s heavily invested in European discount retailer Action, which accounted for 72% of holdings as of March. Such a concentrated stake is unusual for private equity, but considering the Action’s solid performance, it’s understandable.

Living up to its name

Action’s strong growth has been a driver of 3i’s portfolio performance, with the retailer generating impressive sales and earnings in 2023. Net sales reached €11.3bn, up 28% on the year, with a 34% increase in operating EBITDA.

This is largely due to a low-cost retail model and aggressive growth strategy that has helped the enterprise rapidly expand. By sourcing products directly and focusing on private labels, it maintains low costs and provides high value to customers.

Discount retailers like Action often perform well during economic slowdowns as consumers shift spending habits toward more affordable options. Its resilience during these times has attracted investor interest, contributing to 3i Group’s portfolio strength as it maintains profitability even in challenging economic conditions.

Questionable valuation

There’s been some debate recently in regard to Action’s valuation, which is a concern. Some critics argue that it may be exaggerated due to temporary factors like inflation. If so, that could impact 3i Group’s perceived stability if Action’s value is corrected at some point.

If the valuation process comes under scrutiny, naturally there could be some volatility in the price. It’s already drawn attention from UK regulators, which could impact market confidence and hurt the share price. Moreover, investing in private equity makes it more difficult for individuals to gauge performance as the financials are not always made public.

Still, it has a solid track record and has so far been a good earner for me. Plus, a large percentage of the stock is owned by institutional investors like BlackRock, Artemis and Fidelity. That’s an encouraging sign.