After a two-year bull market run, many US-listed shares now look overvalued. However, there’s one growth stock that looks too good to pass up, despite it rising 80% year to date.

Here’s why I’m adding it to my ISA.

A fintech giant

The stock in question is Nu Holdings (NYSE: NU). This is a Brazilian fintech that operates Latin America’s largest digital bank (Nubank). The firm provides various financial services through its mobile-first platform, including no-fee banking, credit cards, loans, insurance, and more.

Should you invest £1,000 in Nu Holdings right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Nu Holdings made the list?

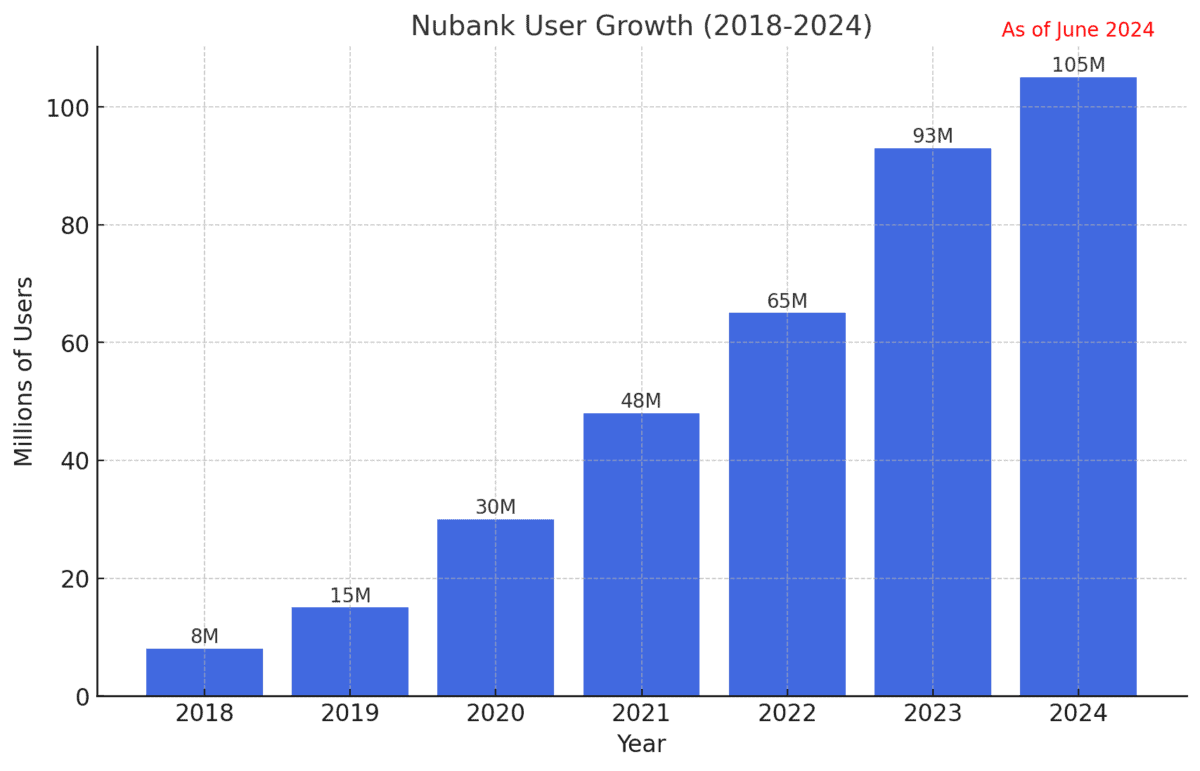

Incredibly, Nu now has 105m customers, despite only operating in three countries (Brazil, Colombia, and Mexico). While up 80% year to date, the stock, at $15, isn’t that much above the price it went public at in late 2021.

What I look for

Like many investors, I have a checklist of traits I look for in a growth company before investing a significant amount. Think of them as green flags or a set of requirements.

There are competing investing frameworks, and none serve as a magic formula for finding winning stocks. But the six traits of rule-breaker stocks set out by David Gardner, co-founder of The Motley Fool, has helped me a lot.

Here they are:

- Top dog and first mover in an important, emerging industry

- Sustainable competitive advantage

- Strong past share price appreciation

- Good management and smart backing

- Strong consumer appeal (branding)

- The stock is considered ‘overvalued’ by the financial media

Buying stocks with these traits then holding them over the long term can produce wonderful results. Famous rule-breaker stocks include Amazon, Netflix, Nvidia, and Tesla.

Competitive market

Now, I’m not saying Nu Holdings will emulate the performance of those stocks (though I hope it does). I note the firm’s market-cap is $71bn so it’s no minnow, and there are risks.

One is that the branchless bank faces stiff competition from the likes of MercadoLibre, PagSeguro, and Revolut. Whether Nubank’s competitive advantage is truly sustainable isn’t obvious to me yet.

Also, as it expands its credit portfolio across Latin America, it could face a rise in non-performing loans. That could hit profits.

Ticking boxes

However, the company possesses nearly all of the traits listed above. It’s Latin America’s leading digital bank (top dog), and is riding a smartphone/fintech boom by offering financial products to the tens of millions of underbanked and unbanked people across the region.

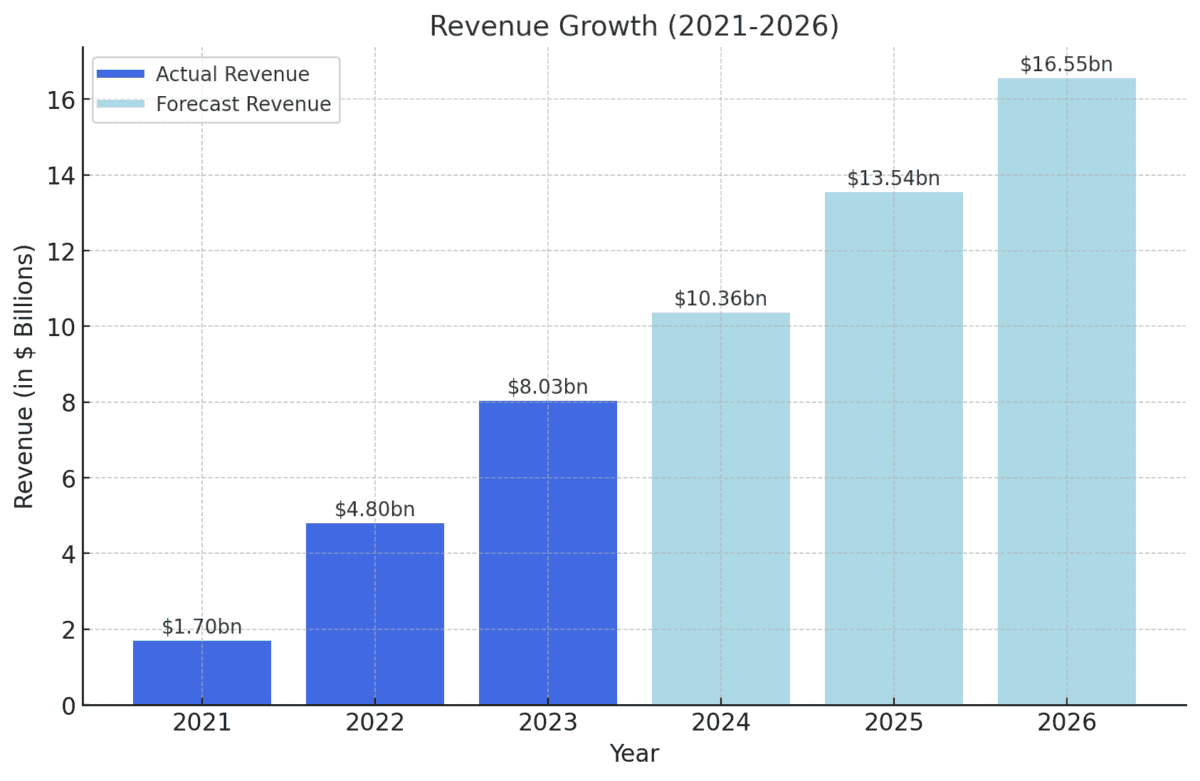

Revenue increased from $1.7bn in 2021 to $8bn last year! And it’s forecast to surge much higher.

The stock is up 269% since January 2023 (strong price appreciation), and has been held by billionaire investor Warren Buffett’s Berkshire Hathaway (smart backing) since 2021.

Nu’s co-founder is David Vélez, a former partner at venture capital firm Sequoia Capital. He has a deep understanding of Latin America’s unique financial challenges and is committed to addressing them (good management).

Meanwhile, Nubank has built a strong brand and customer loyalty in a market with historically poor banking experiences. The exponential growth in customers speaks for itself.

Finally, with a price-to-sales ratio of 10.1, the stock may seem overvalued. The forward price-to-earnings multiple is 25. But given the incredible growth rate, I reckon the stock will end up seeming cheap at $15.

Nu Holdings ticks all my boxes, so I’m buying some shares in November.